Understanding how much is renters insurance is a fundamental question for millions of tenants across the country. This comprehensive cost guide breaks down national averages and provides specific pricing for different living situations. We start with the broad picture: how much is renters insurance in the US on average, and what is the most common premium range that tenants actually pay? The article then explores costs for specific scenarios, including apartments, studio apartments, rented houses, college students, and even coverage for business property or items in storage. We identify what typically constitutes the cheapest renters insurance and explain the key factors—from location and coverage limits to your deductible and discounts—that determine your final premium. Whether you’re looking for annual or monthly costs, or wondering about specific coverage amounts like $100,000 in personal property protection, this guide delivers clear, actionable data to help you budget for this essential and affordable protection.

National Averages and Common Premium Ranges

Before looking at specific situations, it’s helpful to understand the overall cost landscape for renters insurance in the United States.

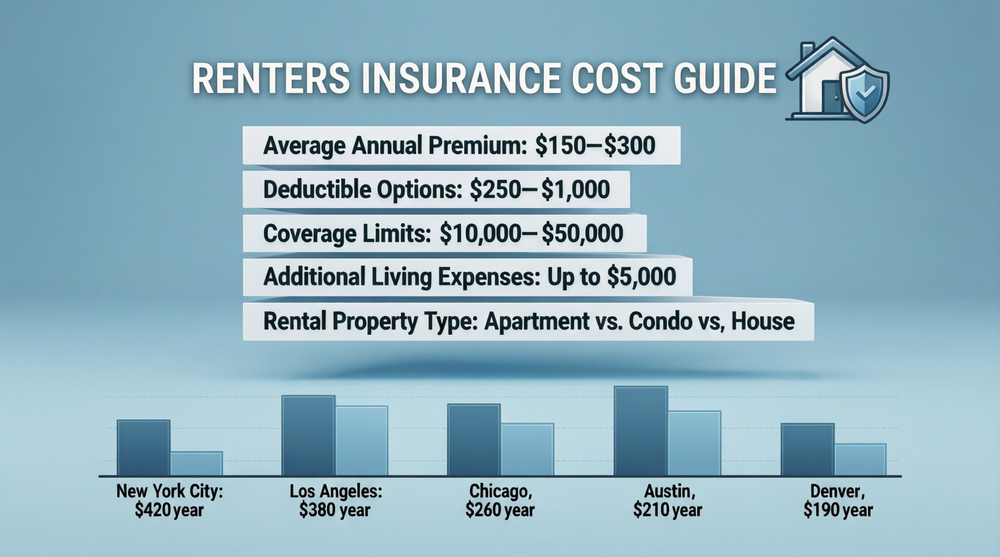

The National Average and Most Common Cost

So, how much is renters insurance in the US? According to the latest industry data from sources like the Insurance Information Institute (III) and National Association of Insurance Commissioners (NAIC), the average cost of renters insurance nationwide is between **$15 and $30 per month**, which translates to roughly **$180 to $360 per year**. This leads to the next logical question: What is the most common amount for renters insurance? While averages are helpful, the mode—or most frequently quoted price—tends to cluster around **$20 to $25 per month** ($240-$300 annually) for a standard policy with $20,000-$30,000 in personal property coverage and $100,000 in liability protection. This is the sweet spot where the majority of tenant policies are priced, making renters insurance one of the most affordable types of insurance available.

Understanding Annual vs. Monthly Costs

When budgeting, you might ask specifically, how much is renters insurance for a year? As noted, the typical annual premium falls in the $180-$360 range. Many insurers offer a discount (often 5-10%) if you pay the entire annual premium upfront rather than in monthly installments. Paying monthly is convenient but may include a small service fee. Regardless of payment frequency, the annual cost is what you should compare when shopping for the best value. The low annual cost underscores why experts consider renters insurance a high-value financial safety net, providing substantial protection for a minimal yearly investment.

Cost Breakdown by Type of Rental and Occupant

The type of dwelling you rent and your personal profile significantly influence your premium. Here’s a detailed look at various common scenarios.

Apartments, Studios, and Houses

One of the most frequent queries is: How much is renters insurance for an apartment? For a standard one or two-bedroom apartment, expect to pay within the national average of $15-$30/month. For smaller spaces, how much is renters insurance for a studio apartment? often costs slightly less, typically $12-$25/month, due to the lower value of belongings that can fit in a smaller space. Conversely, how much is renters insurance for a house? that you’re renting can be slightly higher, often $20-$40/month. This increase is because rented houses are typically larger, may contain more or higher-value belongings, and sometimes present different liability risks (like a backyard with a pool or trampoline) compared to an apartment unit.

Special Cases: College Students and High-Value Coverage

For students and those with significant assets, costs adjust accordingly. How much is renters insurance for a college student? living off-campus can be very affordable, often $12-$20/month. Many students may also be covered under their parents’ homeowners policy while living in a dorm, but a separate policy is needed for an off-campus apartment. If you have expensive belongings, you might ask, How much is renters insurance for $100,000? in personal property coverage? This is a high coverage limit. While liability is often standard at $100,000, insuring $100,000 worth of *personal property* will increase your premium substantially, potentially to $40-$70/month or more, depending on your location and other risk factors.

Costs for Business Use and Specialized Coverage

Standard renters insurance has limits for business property and doesn’t cover commercial operations. Understanding these specialized needs is crucial.

Business Property and Commercial Activities

A standard renters insurance coverage policy includes only minimal protection for business property (often $2,500 or less) and no liability for business activities conducted from the home. Therefore, how much is renters insurance for a business? isn’t quite the right question. You typically need a separate business insurance policy or a specific endorsement (add-on) to your renters policy. A Business Owners Policy (BOP) or a Home-Based Business endorsement can cost anywhere from an additional $15-$50/month to several hundred dollars annually, depending on the size and nature of your business.

Coverage for Storage Units

Good news for renters: a standard policy usually extends a percentage (often 10%) of your personal property coverage to items in a storage unit off-premises. So, how much is renters insurance for a storage unit? There is typically no *additional* premium for this basic extension of coverage. However, if you are storing a very high value of property (e.g., antique furniture, a valuable collection) that exceeds the off-premises limit, you may need to schedule those items or purchase additional coverage, which would increase your premium.

Finding the Cheapest Renters Insurance and Key Cost Factors

While price is important, the cheapest option isn’t always the best value. Understanding what drives costs helps you find optimal coverage at a fair price.

What Constitutes the Cheapest Renters Insurance?

When asking, What is the cheapest renters insurance? you’ll typically find the lowest base premiums from digital-first, direct-to-consumer insurers like Lemonade or companies that sell primarily online without a large agent network. These companies have lower operational overhead. However, “cheapest” can be misleading. A major national carrier like State Farm or Allstate might offer you a much lower final renters insurance cost if you qualify for their bundling discount by also having your auto insurance with them. The *cheapest effective premium* is often found by combining a multi-policy (bundle) discount with other discounts for safety devices, being claim-free, or paying annually.

Primary Factors That Determine Your Premium

Your final quote is personalized based on several key variables:

- Location (ZIP Code): The single biggest factor. Premiums are higher in areas with greater risk of theft, vandalism, and severe weather claims.

- Coverage Limits & Deductible: Higher coverage limits = higher premium. A higher deductible (e.g., $1,000 vs. $500) = lower monthly payment.

- Type of Coverage: “Replacement Cost” coverage (pays to buy new items) costs 10-25% more than “Actual Cash Value” (pays depreciated value).

- Credit-Based Insurance Score: In most states, insurers use this as a rating factor. Better credit often leads to lower premiums.

- Claims History: A history of filing multiple insurance claims can increase your rate.

- Discounts: Bundling, safety devices (smoke alarms, burglar alarms), auto-pay, and paperless billing can all reduce your cost.

To get the best price, you must shop around and compare quotes from at least 3-4 different companies.

Final Recommendations for Affordable Coverage

While focusing on how much is renters insurance, remember that adequate protection is more important than the absolute lowest price. A policy that’s $5 cheaper but lacks sufficient liability coverage or has a very high deductible may be poor value if you ever need to file a claim. Start by creating a home inventory to determine a realistic personal property limit. Aim for at least $100,000 in personal liability coverage—this is a critical component that costs very little to increase. Choose a deductible you can comfortably afford to pay out-of-pocket. Then, gather quotes online and from local agents. Be sure to ask every insurer about all available discounts. Ultimately, renters insurance provides exceptional value, with robust financial protection typically available for less than a dollar a day. By understanding the cost factors and shopping strategically, you can secure comprehensive renters insurance that fits both your needs and your budget.

Frequently Asked Questions About Renters Insurance Cost

How much is renters insurance in the US?

The average cost of renters insurance in the United States is between $15 and $30 per month, or approximately $180 to $360 per year. This is for a standard policy with $20,000-$30,000 in personal property coverage and $100,000 in liability protection.

What is the most common amount for renters insurance?

The most common monthly premium for renters insurance falls in the $20 to $25 range ($240-$300 per year). This price point represents the typical policy purchased by tenants across the country for average coverage limits.

What is the cheapest renters insurance?

The cheapest base premiums are often from digital insurers like Lemonade or those without agent networks. However, the most affordable final price is usually achieved by bundling renters with auto insurance from a major carrier, which can offer discounts of 15% or more on both policies.

How much is renters insurance for a house?

Renters insurance for a house you are renting typically costs $20 to $40 per month. This is slightly higher than for an apartment due to the larger space (often containing more belongings) and potentially different liability exposures (like a yard or swimming pool).

How much is renters insurance for an apartment?

For a standard one or two-bedroom apartment, renters insurance usually costs $15 to $30 per month, aligning with the national average. The exact price depends on the apartment’s location, size, and your chosen coverage details.

How much is renters insurance for a business?

Standard renters insurance offers minimal business property coverage. For proper business protection, you need a separate policy or endorsement. A Home-Based Business endorsement can cost an additional $15-$50/month, while a full Business Owners Policy (BOP) can cost several hundred dollars annually.

How much is renters insurance for a storage unit?

Standard renters insurance typically extends 10% of your personal property coverage to items in a storage unit at no extra cost. If you need higher limits for high-value stored items, you may pay an additional $2-$10 per month to schedule those specific items on your policy.

How much is renters insurance for a studio apartment?

Renters insurance for a studio apartment is often slightly cheaper, averaging $12 to $25 per month. The lower cost reflects the smaller space and typically lower total value of personal belongings compared to larger apartments.

How much is renters insurance for a year?

The average annual cost of renters insurance is $180 to $360. Paying your premium annually instead of monthly often qualifies for a discount, potentially lowering your total yearly cost.

How much is renters insurance for a college student?

For a college student living in an off-campus apartment, renters insurance is very affordable, typically $12 to $20 per month. Some insurers also offer specific discounts for students.

How much is renters insurance for $100,000?

If you mean $100,000 in personal property coverage (a high limit), expect to pay $40 to $70+ per month, depending heavily on location and other factors. If you mean $100,000 in liability coverage (a standard limit), that is included in the typical $15-$30/month premium.

External Reference: For the latest national data and statistics on insurance premiums, the Insurance Information Institute (III) Fact Sheet is an authoritative, non-profit source.