The Critical Gap: Why Standard Renters Insurance Excludes Floods

Understanding the fundamental difference between water damage and flood damage is the first step in recognizing your vulnerability. Insurance companies define these terms with precise, legal language that dictates coverage.

The Strict Definition of a “Flood”

For insurance purposes, a flood is defined as an excess of water on normally dry land, affecting two or more properties or spanning two or more acres. More commonly, it refers to water entering your home from outside, such as from overflowing rivers, storm surge, heavy rainfall that overwhelms drainage, or rapid snowmelt. Crucially, it is a general condition affecting a wider area, not an isolated incident within your dwelling.

What Your Flood Renters Insurance Does Cover: Water Damage

In contrast, standard renters insurance covers internal, accidental water discharge. This includes scenarios like a burst pipe, an overflowing washing machine, a leaking water heater, or a toilet overflow. The source of the water is inside your unit and is sudden and accidental. This distinction is absolute; if water comes from the outside ground up, it is a flood and is excluded. Resources like the Insurance Information Institute’s flood insurance guide emphasize this critical separation.

The Financial Risk of Being Uninsured

Without separate flood insurance, you are 100% responsible for replacing every flood-damaged item you own—furniture, electronics, clothing, appliances. Furthermore, you will bear the full cost of temporary housing if you must evacuate. Given that floods are the most common and costly natural disaster in the U.S., and that over 20% of flood claims come from moderate-to-low-risk areas, relying on federal disaster assistance (which are often loans you must repay) is a risky financial strategy.

What Does Flood Renters Insurance Actually Cover?

A flood insurance policy for renters is specifically designed to protect your interests as a tenant. It consists of two main coverage parts, similar in structure to a standard policy but exclusively for flood perils.

| Coverage Type | What It Protects | NFIP Coverage Limit (Dwelling & Contents Policy) | Key Details for Renters |

|---|---|---|---|

| Personal Property (Contents) | Your belongings: furniture, electronics, clothing, area rugs, portable appliances. | Up to $100,000 | This is the core coverage for tenants. You can purchase this coverage on its own. |

| Additional Living Expenses (ALE) | Extra costs incurred if flood makes your rental uninhabitable (hotel, meals, etc.). | Not included in standard NFIP policy. | Available as an added endorsement or through select private flood insurers. Must be specifically added. |

| Building Property (Dwelling) | The physical structure: walls, floors, built-in appliances, electrical systems. | Up to $250,000 | This is the landlord’s responsibility. Tenants do not need or purchase this portion. |

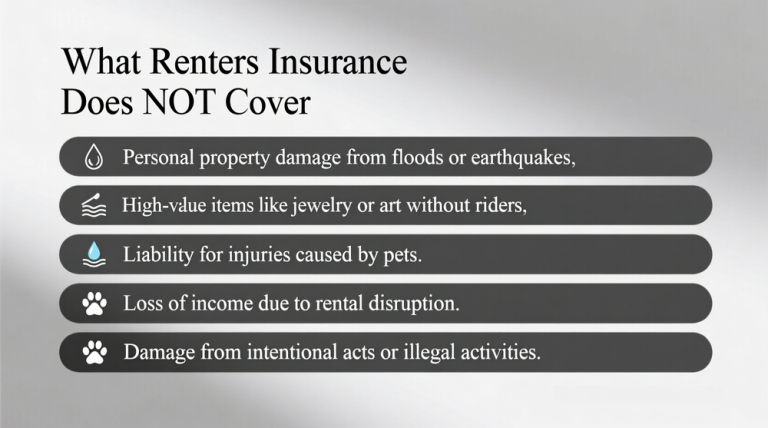

What’s Not Covered by Flood Renters Insurance

Even a flood policy has exclusions. It typically does not cover currency, precious metals, valuable papers, outdoor property (patio furniture, plants), cars (covered by auto insurance), or damage from moisture/mold that could have been prevented. It also does not cover living expenses unless you’ve added that endorsement. Understanding these limits ensures you have realistic expectations about the recovery process.

Actual Cash Value vs. Replacement Cost in Flood Policies

For personal property under an NFIP policy, coverage is based on Actual Cash Value (ACV)—the item’s value minus depreciation. This is a significant difference from the Replacement Cost Value (RCV) option available in standard renters insurance. A 5-year-old flooded sofa will be reimbursed at its current used market value, which may not be enough to buy a new one. Some private flood insurers may offer RCV contents coverage, which is a major advantage to explore when shopping.

Who Needs Flood Renters Insurance and How Much Does It Cost?

The biggest misconception is that only homes in high-risk flood zones (Special Flood Hazard Areas or SFHAs) need coverage. The reality is that flooding can happen anywhere it rains, and risk is increasing due to changing weather patterns and urban development.

You Are at Risk More Than You Think

Consider flood insurance if you: live near any body of water (creek, river, coast), in an area with poor drainage, at the bottom of a hill, in a region with heavy rainfall or snowmelt, or in any urban area where pavement increases runoff. FEMA’s flood maps change, and a “low-risk” zone (X zone) is not a “no-risk” zone. Nearly 25% of all flood insurance claims are filed outside of high-risk areas, proving that renters insurance cost considerations must include this separate policy for true peace of mind.

Factors Determining Flood Renters Insurance Premiums

For an NFIP policy, your premium is primarily based on: 1) Your flood zone (risk level from FEMA maps), 2) The coverage amount you choose for your contents (up to $100k), 3) Your deductible (typically $1,000-$10,000), and 4) The age and type of building (for the landlord’s dwelling coverage, which affects the contents premium). In low-to-moderate risk zones, a contents-only policy can be very affordable, often ranging from $150 to $400 per year.

The 30-Day Waiting Period: A Crucial Rule

You cannot buy flood insurance at the last minute. NFIP policies have a standard 30-day waiting period from the date of purchase before coverage goes into effect (with few exceptions, like for a new mortgage). This rule prevents people from buying a policy as a storm approaches. It means the time to buy flood insurance is now, during clear skies, not when flood warnings are issued.

How to Get Flood Insurance as a Renter: A Step-by-Step Guide

Securing flood insurance is a straightforward process, but it requires action on your part. Follow these steps to ensure you have the right coverage before disaster strikes.

Step 1: Assess Your Risk and Needs

Start by visiting FEMA’s Flood Map Service Center (msc.fema.gov) and entering your rental address to see its official flood zone designation. Conduct a home inventory to estimate the total value of your personal belongings. This will determine how much contents coverage you need, up to the $100,000 NFIP limit.

Step 2: Shop and Compare Quotes

Contact your existing renters insurance agent or company first—they often sell NFIP policies as “Write-Your-Own” companies. You can also contact the NFIP directly at 1-800-427-4661 or visit FloodSmart.gov for a referral. Crucially, also get quotes from private flood insurance companies. The private market has grown, sometimes offering higher limits, RCV coverage, and lower premiums, especially in lower-risk areas.

Step 3: Purchase and Document Your Policy

Once you select a provider, complete the application, choose your deductible, and pay the premium. Remember the 30-day waiting period. Store your policy documents digitally and share a copy with your emergency contacts. Make sure you understand your policy’s specific claims procedure so you’re ready to act quickly if needed.

Conclusion: Don’t Let a Flood Wash Away Your Financial Security

Flood insurance for renters is not an optional add-on; it is a fundamental component of a responsible financial plan for anyone leasing a home. The exclusion in standard policies is absolute, and the devastation from even a few inches of water can be financially crippling. By understanding the distinct coverage it provides, accurately assessing your true risk beyond official maps, and proactively securing a policy, you transform a potentially catastrophic loss into a manageable recovery. Don’t wait for the forecast to turn dire. Invest in flood renters insurance today and secure the peace of mind that comes with knowing your belongings and your future are protected from one of nature’s most common and destructive forces.

FAQs About Flood Insurance for Renters

Does my renters insurance cover any type of flood?

No. Standard renters insurance policies categorically exclude damage from flooding, which is defined as water coming from outside the home (groundwater, overflowing bodies of water, storm surge). You must have a separate, specific flood insurance policy.

Can I get flood Insurance for Renters if I rent an apartment on a high floor?

Yes, and you likely still need it. While upper floors are less likely to have contents damaged by rising water, flood damage to the building can still displace you, triggering a need for Additional Living Expenses coverage. Also, floods can damage garage/storage areas, lobbies, and mechanical systems, affecting all residents.

How much does flood insurance cost for a renter?

For a contents-only NFIP policy in a moderate-to-low risk zone (B, C, or X), premiums can be as low as $150-$400 per year. In high-risk zones (A or V), costs are higher but federally subsidized. Private market policies may offer competitive or lower rates depending on location.

What is the difference between NFIP and private flood insurance?

The NFIP is a federal program with set limits ($100k for contents) and ACV-only payouts. Private insurers may offer higher coverage limits, Replacement Cost Value for belongings, lower deductibles, and may include Additional Living Expenses. It’s essential to compare both options.

Is flood insurance required for renters?

It is not legally required by state law for renters. However, if you live in a high-risk flood zone and your building has a mortgage from a federally regulated or insured lender, the landlord is required to have flood insurance on the structure. They cannot force you to buy contents coverage, but it is strongly advised.

What should I do if a flood damages my rental?

1) Ensure safety and evacuate if told. 2) Contact your flood insurer to start a claim. 3) Document all damage with photos/video before cleaning. 4) Move damaged items to a safe, dry place if possible. 5) Keep records of all expenses and communications. File the claim quickly.

Does flood insurance cover a leaking roof during heavy rain?

No. Water entering through a compromised roof is generally considered windstorm or rain damage, which may be covered by the landlord’s property insurance. It is not considered flood damage unless there is a general condition of surface water accumulation on the ground outside.