The auto and renters insurance bundle is one of the most popular and effective strategies for saving money on insurance premiums. This comprehensive guide answers the central question: Is it worth bundling renters and auto insurance? by breaking down the substantial advantages, from significant multi-policy discounts to simplified billing and enhanced coverage management. We explore which major insurance companies offer the best bundling discounts and overall value, helping you identify the best auto and renters insurance provider for a combined policy. The article provides a clear comparison of standalone versus bundled policies, giving you the data to decide if it is better to bundle renters and auto insurance for your specific situation. Furthermore, we discuss strategic add-ons that complement a bundled approach, ensuring you get comprehensive protection while maximizing your savings. Whether you’re a new renter or reevaluating your current policies, this guide delivers the insights needed to make an informed decision about this powerful money-saving tactic.

Evaluating the Value of Bundling Auto and Renters Insurance

Combining two essential policies seems logical, but it’s important to understand the tangible benefits and potential trade-offs to determine its true worth.

Is Bundling Worth It? The Core Financial Advantage

The fundamental question for most consumers is: Is it worth bundling renters and auto insurance? The answer, in the vast majority of cases, is a resounding yes. The primary driver is cost savings. Insurers reward customer loyalty and reduced administrative overhead by offering a “multi-policy” or “multi-line” discount. This discount typically ranges from **10% to 25% off the total premium for both policies**. For example, if you pay $1,200 annually for auto insurance and $300 for renters insurance, a 20% bundle discount would save you $300 per year. This makes the combined cost significantly lower than purchasing two separate policies from different companies. Therefore, when asking Is it better to bundle renters and auto insurance? from a purely financial perspective, bundling almost always provides superior value.

Beyond Savings: The Holistic Advantages of Bundling

The financial discount is compelling, but the advantages of bundling insurance extend beyond just lower monthly bills:

- Simplified Management: You have one insurance company, one point of contact (agent or app), one renewal date, and one monthly bill. This reduces administrative hassle and makes it easier to track your coverage.

- Enhanced Customer Service: Being a multi-policy holder often elevates your status with the insurer, potentially leading to prioritized service, easier claims handling, and fee waivers.

- Potential for Higher Coverage Limits: Some companies offer unique benefits or higher liability umbrella options more readily to customers who bundle their core policies.

- Reduced Risk of Lapse: With combined billing, you’re less likely to accidentally let one policy lapse due to a missed payment, ensuring continuous protection.

These non-financial benefits contribute to a smoother, more integrated insurance experience.

Identifying the Best Companies for Bundling

Not all insurers offer the same bundle discount or service quality. Choosing the right company is key to maximizing value.

Top Contenders for the Best Bundle

When searching for the best auto and renters insurance bundle, a few national carriers consistently rank highly due to their strong discounts and comprehensive coverage options. State Farm and Allstate are renowned for their substantial multi-policy discounts (often 15-25%) and their extensive networks of local agents, which is ideal for those who prefer in-person service. Liberty Mutual and Travelers also offer very competitive bundling savings and robust online tools. For a more digital-first experience, Progressive and Geico (which often partners with other companies for renters insurance) provide easy online bundling with clear discount structures.

Which Insurance Company is Best for Bundling?

The answer to which insurance company is best for bundling is not universal—it depends on your profile. The “best” company is the one that offers you the lowest total combined premium for the coverage you need, paired with service you trust. To find it, you must get personalized quotes. A company known for high auto rates might still offer you the best bundle price if their renters insurance is exceptionally cheap and their discount is large. Start by getting auto quotes from 3-4 major insurers, then ask for a bundled quote that includes renters insurance. Compare the *bundled total* against the cost of your best standalone auto policy plus your best standalone renters policy from different companies.

Strategic Coverage: Essential Add-Ons for Your Bundle

Bundling saves money on the base policies, but ensuring you have the right add-ons is crucial for complete protection.

Critical Add-Ons for Comprehensive Car Insurance

While bundling saves on the base policy, you should also consider enhancing your coverage. When asking which addon is best for car insurance?, focus on protection against significant financial risk. The most valuable add-ons are often:

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This is arguably the most critical add-on. It protects you if you’re hit by a driver with no insurance or insufficient coverage. Given the high number of uninsured drivers, this coverage is essential.

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after a covered claim, ensuring you’re not left without transportation.

- Roadside Assistance: Provides help for breakdowns, lockouts, flat tires, and towing. It’s a relatively low-cost add-on that offers significant convenience and peace of mind.

- Glass Coverage (Full Windshield Replacement): Waives the deductible for windshield repair or replacement, which is a common claim.

When you bundle, you can often afford to add these valuable protections while still paying less overall.

Enhancing Your Renters Insurance in a Bundle

Similarly, your renters insurance coverage can be improved with key endorsements. Consider adding **Replacement Cost Value** for your personal property (instead of Actual Cash Value, which deducts for depreciation) and **Scheduled Personal Property** to fully cover high-value items like jewelry, art, or electronics that exceed standard sub-limits. Another useful add-on is **Water Backup Coverage**, which protects against damage from sewer or drain backups—a common exclusion in standard policies.

Potential Drawbacks and How to Bundle Successfully

While bundling is highly advantageous, it’s not without potential pitfalls. A strategic approach ensures you get the best deal.

When Bundling Might Not Be the Best Choice

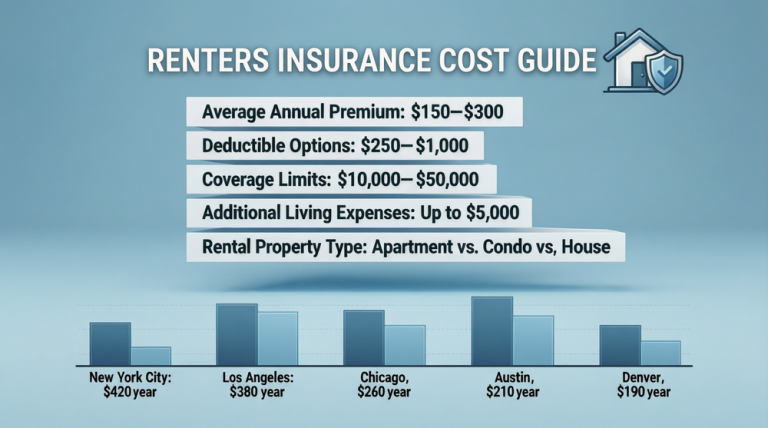

Bundling is generally the best financial move, but there are rare exceptions. If one company offers you an outstanding price on auto insurance but a very poor price on renters insurance cost, the bundled discount might not overcome the overpriced renters policy. Always run the numbers. Also, if you have a specialized need that a particular “best-in-class” insurer handles (e.g., you need a non-standard auto policy due to a poor driving record), it might be better to use that specialized auto insurer and a separate renters policy elsewhere.

Step-by-Step Guide to Securing the Best Bundle

To successfully secure the optimal auto and renters insurance bundle, follow these steps:

1. Gather Standalone Quotes: Get separate quotes for auto and renters insurance from different providers to establish a baseline.

2. Request Bundle Quotes: Contact the companies that gave you good standalone auto quotes and ask for a bundled quote including renters insurance.

3. Compare Apples to Apples: Ensure the coverage limits, deductibles, and add-ons are identical in every quote you compare.

4. Inquire About All Discounts: Beyond the bundle discount, ask about discounts for safe driving, safety features, paperless billing, auto-pay, and payment in full.

5. Review Annually: Your insurance needs and market rates change. Shop your bundle every 1-2 years at renewal to ensure you’re still getting the best value.

Final Verdict on Bundling Auto and Renters Insurance

For the overwhelming majority of drivers who rent their homes, an auto and renters insurance bundle represents the smartest financial and practical choice. The multi-policy discount provides immediate and substantial savings, often making the combined cost of two robust policies cheaper than one standalone auto policy. The added benefits of streamlined management, potential service perks, and reduced risk of a coverage lapse make it a compelling package. While it’s essential to shop around to find which major carrier—be it State Farm, Allstate, Liberty Mutual, or another—offers you the best total price and service fit, the act of bundling itself is a proven wealth-preservation strategy. By combining this approach with strategic, value-focused add-ons like Uninsured Motorist and Replacement Cost coverage, you achieve comprehensive protection at a minimized cost. Ultimately, bundling is a win-win: insurers gain a loyal customer, and you gain significant savings and simplified peace of mind.

Frequently Asked Questions About Insurance Bundling

Is it worth bundling renters and auto insurance?

Yes, bundling renters and auto insurance is almost always worth it. It typically results in a multi-policy discount of 10% to 25% on your total premium, leading to significant annual savings. The simplified billing, single point of contact, and potential service benefits provide additional value beyond just the lower price.

What are the advantages of bundling insurance?

The primary advantages are substantial cost savings through a multi-policy discount, simplified management (one bill, one renewal date), potentially better customer service as a valued multi-policy holder, and a reduced chance of letting one policy lapse accidentally. It creates a more integrated and often more affordable insurance portfolio.

What is the best auto and renters insurance?

The “best” company varies by individual. However, State Farm, Allstate, Liberty Mutual, and Travelers are consistently top contenders for bundled auto and renters insurance due to their strong multi-policy discounts, financial stability, and nationwide availability. The best way to find your best fit is to compare personalized bundled quotes from several of these major carriers.

Is it better to bundle renters and auto insurance?

Financially and administratively, it is almost always better to bundle renters and auto insurance. The combined cost after the discount is usually lower than purchasing two separate policies from different companies. The only exception would be if one company offers you an exceptionally poor rate on one of the two policies that the bundle discount cannot overcome.

Which insurance company is best for bundling?

Companies known for excellent bundling discounts and service include State Farm, Allstate, Liberty Mutual, and Travelers. The best company for *you* depends on your specific driving record, location, coverage needs, and the personalized quote they provide. You must shop around to discover which insurer offers you the lowest total premium for the bundle.

Which addon is best for car insurance?

The best and most critical add-on for car insurance is Uninsured/Underinsured Motorist (UM/UIM) Coverage. It protects you financially if you’re in an accident caused by a driver with little or no insurance. Other highly valuable add-ons include Rental Reimbursement coverage and Roadside Assistance, which provide practical support after a breakdown or claim.

External Reference: For independent analysis of consumer savings and insurance buying strategies, the Consumer Reports guide on bundling provides authoritative, unbiased advice.