Securing an Allstate renters insurance quote is the first strategic step toward achieving that crucial peace of mind. In today’s dynamic rental market, protecting your personal belongings and financial well-being is not just a good idea—it is a smart necessity. For many renters. Unlike your landlord’s policy, which typically covers only the building itself, renters insurance is designed specifically to safeguard your personal property, provide liability protection, and offer additional living expenses if your rental becomes uninhabitable. Allstate, a well-established name in the insurance industry, offers customizable policies that can be tailored to fit your unique lifestyle and budget. This comprehensive guide will walk you through everything you need to know about obtaining, understanding, and optimizing your Allstate renters insurance quote, ensuring you get the right protection at the best possible value.

Understanding Your Allstate Renters Insurance Quote

When you receive an Allstate renters insurance quote, it represents a snapshot of your potential coverage and its cost. It is vital to look beyond the final premium number and understand what is included. A quote from Allstate will detail the types of coverage offered, the limits for each category, your chosen deductible, and any applicable discounts. The core of any renters insurance policy, including those from Allstate, revolves around three fundamental areas: personal property coverage, liability protection, and loss of use or additional living expenses. Personal property coverage reimburses you for the loss of your belongings—like furniture, electronics, and clothing—due to covered events such as theft, fire, or vandalism. It is important to know whether your Allstate renters insurance quote is for actual cash value (which accounts for depreciation) or replacement cost (which pays to buy a new item), as this significantly affects your potential payout. Understanding these components is the first step to ensuring your quote aligns with your actual needs.

What is Renters Insurance and Why Do You Need It?

Many tenants mistakenly believe their landlord’s insurance will cover their personal possessions in a disaster; this is almost never the case. Landlord insurance protects the physical structure of the building, not the contents inside your individual unit. This critical gap is precisely what renters insurance fills. An Allstate renters insurance quote provides a plan to protect you from financial ruin if your belongings are stolen, damaged, or destroyed. Beyond property, it offers robust liability coverage. If a guest is injured in your apartment or you accidentally cause damage to another unit, you could be held legally responsible. Liability coverage helps pay for associated medical bills or legal fees, protecting your savings and future earnings. Furthermore, if a covered peril like a fire forces you to temporarily live elsewhere, renters insurance can cover hotel bills and extra food costs. For a deeper dive into the fundamentals, you can learn more about what renters insurance is and its essential role for every tenant.

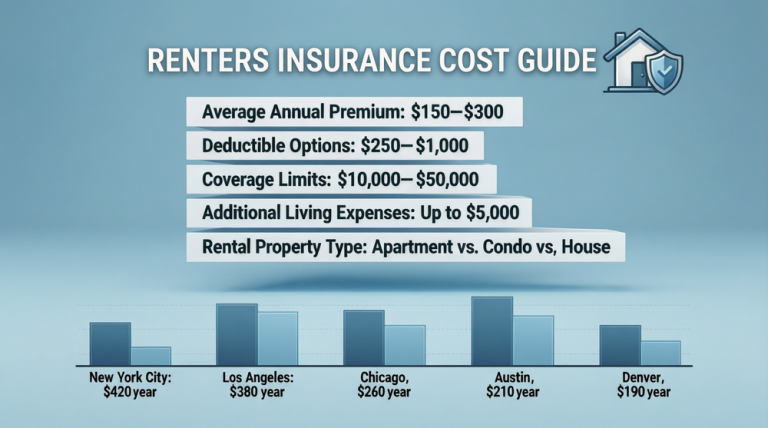

Key Factors That Influence Your Premium

The final number on your Allstate renters insurance quote is not random; it is calculated based on a personalized risk assessment. Several key factors directly influence your premium. Your location is a primary driver—renting in an area with a high frequency of theft, vandalism, or severe weather events will typically lead to a higher quote. The amount of personal property coverage you select is another obvious factor; opting for a $30,000 limit will cost more than a $15,000 limit. Your deductible, which is the amount you pay out-of-pocket before insurance kicks in, also plays a major role. Choosing a higher deductible (e.g., $1,000 instead of $500) will lower your monthly premium. Other personal details, such as your claims history, credit-based insurance score in states where permitted, and the presence of safety features like smoke alarms or a security system in your rental, can all affect the cost of your Allstate renters insurance quote.

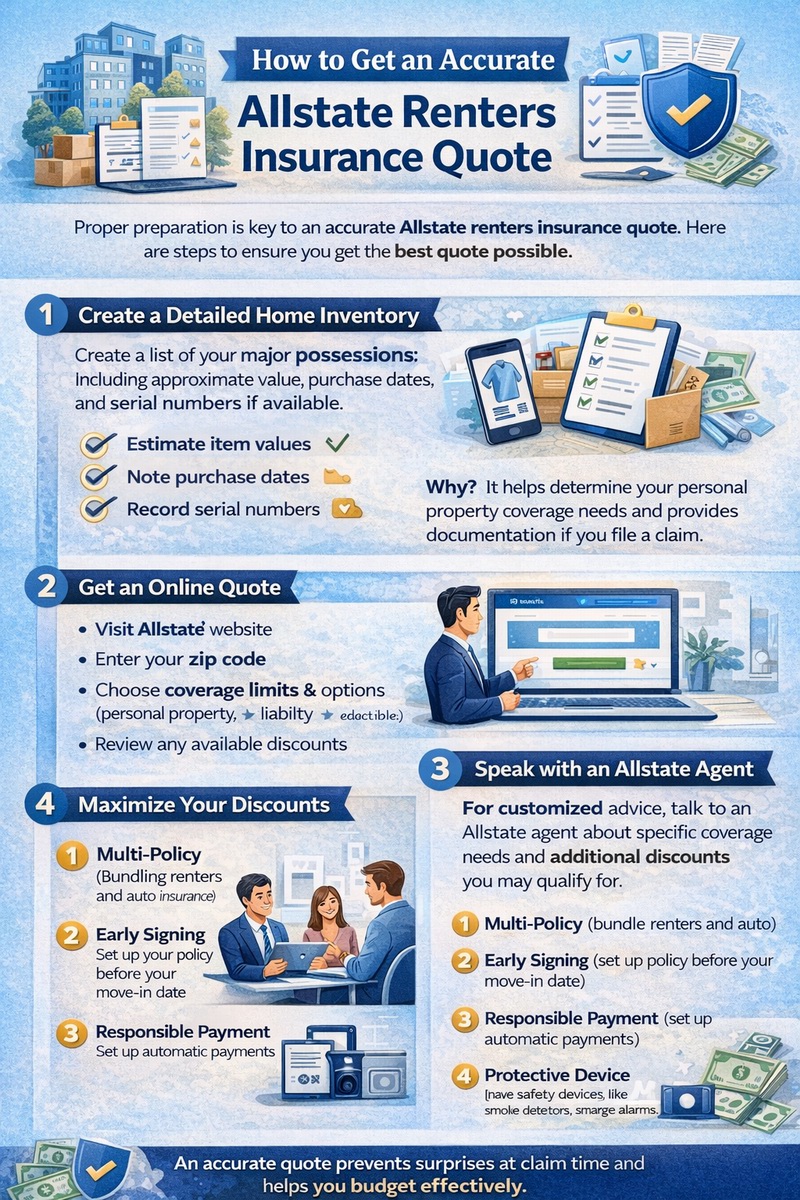

How to Get an Accurate Allstate Renters Insurance Quote

To ensure your Allstate renters insurance quote is as accurate and useful as possible, proper preparation is key. An accurate quote prevents surprises at claim time and helps you budget effectively. The process is straightforward but requires you to gather specific information about yourself and your belongings. Start by taking a detailed home inventory. This means creating a list of your major possessions, noting their approximate value, purchase date, and serial numbers if available. You can use a simple spreadsheet, a home inventory app, or even a video walkthrough of your apartment. This exercise serves two purposes: it helps you determine how much personal property coverage you truly need, and it provides crucial documentation if you ever need to file a claim. Having this information ready before you start the quoting process will streamline your experience and lead to a more tailored Allstate renters insurance quote.

Step-by-Step Guide to the Online Quoting Process

Allstate offers a user-friendly online platform to get a preliminary Allstate renters insurance quote in minutes. Begin by visiting the Allstate website and navigating to the renters insurance section. You will be prompted to enter your zip code, which customizes the quote for your geographic area. Next, you will input basic information about yourself and your rental property, such as the type of dwelling (apartment, condo, house), its construction details, and your requested policy start date. The system will then guide you through selecting your coverage limits and options. You will choose a personal property limit, a liability limit (often starting at $100,000), and a deductible amount. You will also have the chance to add endorsements for high-value items like jewelry or electronics. Finally, you will input information for any applicable discounts, such as bundling with auto insurance, having protective devices, or being claim-free. After submitting, you will receive your personalized Allstate renters insurance quote, which you can then adjust by tweaking coverage levels to see how it affects the premium.

Speaking with an Allstate Agent for a Customized Quote

While the online tool provides a great starting point, speaking directly with an Allstate agent can unlock a more nuanced and potentially more valuable Allstate renters insurance quote. An agent can explain complex coverage options in simple terms, identify discounts you may have missed online, and provide professional advice based on your specific situation. For instance, if you work from home, an agent might recommend adding an endorsement to cover business equipment that exceeds standard personal property limits. They can also clarify the specifics of Allstate’s unique features, like Claim RateGuard, which promises your premium won’t go up just because you file a claim. An agent can help you navigate the details of renters insurance coverage to ensure there are no gaps in your protection. This personalized consultation ensures your final policy is not just a generic product, but a tailored financial safety net.

Maximizing Value and Minimizing Your Allstate Renters Insurance Quote

Finding the right balance between comprehensive protection and an affordable premium is the goal for every renter. Fortunately, there are several proven strategies to maximize the value you get from your Allstate renters insurance quote while minimizing the cost. Discounts are your most powerful tool. Allstate offers a variety of savings opportunities that can significantly reduce your premium. The most substantial is often the multi-policy discount, commonly known as bundling. By purchasing your renters insurance alongside another policy like auto insurance from Allstate, you can save a considerable percentage on both policies. Other discounts may apply for having safety features like fire extinguishers, deadbolt locks, or a centrally monitored security system in your rental unit. Additionally, maintaining a good credit score (where applicable), staying claim-free, and opting for paperless billing and automatic payments can also lead to lower rates on your Allstate renters insurance quote.

Important Discounts to Ask About

When reviewing your Allstate renters insurance quote, proactively ask about every potential discount. Do not assume they are all applied automatically. Key discounts include the Multi-Policy Discount, which is arguably the biggest saver. The Early Signing Discount rewards you for setting up your policy well before your move-in date. The Responsible Payment Discount is for setting up automatic monthly payments from your bank account. If your rental property has specific safety and security devices like smoke detectors, burglar alarms, or fire sprinklers, make sure to mention them, as they may qualify for a Protective Device Discount. Some professional affiliations or alumni associations also partner with Allstate to offer group discounts. Taking the time to inquire about each one can transform your initial Allstate renters insurance quote into a much more budget-friendly figure without sacrificing necessary coverage.

Balancing Deductibles and Coverage Limits

One of the most effective ways to control the cost of your Allstate renters insurance quote is by strategically adjusting your deductible and coverage limits. The deductible is the amount you agree to pay out of pocket when you file a claim. Opting for a higher deductible (e.g., $1,000 instead of $500) will result in a lower monthly premium. This is a smart financial move if you have a sufficient emergency fund to cover that higher deductible if needed. Conversely, carefully evaluate your coverage limits. While increasing your personal property limit will raise your premium, being underinsured can be catastrophic. Use your home inventory to estimate a realistic value for your belongings. For a clearer picture of how these choices impact price, researching the general renters insurance cost factors can provide helpful context. The goal is to avoid both overpaying for unnecessary coverage and risking being underprotected to save a few dollars each month.

Finalizing Your Policy and Next Steps After the Quote

Once you are satisfied with your Allstate renters insurance quote and have made adjustments to optimize coverage and cost, the next step is to officially bind the policy. This process turns the quote into an active contract. You will provide final confirmation of your information, select your payment plan (monthly, semi-annually, etc.), and make your first payment. Upon completion, you will receive your policy documents, which include your declarations page—a summary of your coverages, limits, deductibles, and premium. It is imperative to read these documents thoroughly to ensure everything matches what you discussed and expected from your quote. Store these documents in a safe, easily accessible place, both physically and digitally. Additionally, keep your home inventory updated and store it separately from your home, such as in a cloud storage service. This preparation makes the claims process, should you ever need it, far smoother and less stressful.

Common Mistakes to Avoid When Purchasing

When acting on an Allstate renters insurance quote, several common pitfalls can leave renters vulnerable. A major mistake is underestimating the value of your belongings, leading to purchasing a policy with inadequate personal property limits. Use a detailed inventory to avoid this. Another error is overlooking the need for specific endorsements for high-value items like engagement rings, musical instruments, or collectibles, which have sub-limits in a standard policy. Renters also sometimes confuse a cheap premium with good value; the lowest Allstate renters insurance quote may come with a very high deductible or critical coverage exclusions. Finally, failing to review and update your policy annually is a mistake. As you acquire new possessions or your life situation changes, your coverage needs evolve. An annual check-in ensures your policy continues to provide the protection you require.

Leveraging Technology: The Allstate Mobile App

After you purchase your policy based on your Allstate renters insurance quote, the Allstate Mobile App becomes a powerful tool for managing your protection. The app allows you to access your digital ID card, view policy details, and make payments anytime. Crucially, it also provides a convenient way to store and update your home inventory by taking photos and adding descriptions directly within the app. In the event of a loss, you can initiate and track a claim right from your smartphone, often including the ability to upload photos of the damage. This integration of technology simplifies policy management and puts essential insurance functions right at your fingertips, adding significant value to the service you receive beyond the initial Allstate renters insurance quote.

Conclusion: Securing Your Peace of Mind with Confidence

Obtaining and understanding an Allstate renters insurance quote is a fundamental act of responsibility for any tenant. It transforms the abstract concept of risk into a concrete, manageable plan for protection. By methodically assessing your needs, navigating the quoting process with accurate information, and strategically applying discounts and adjustments, you can secure a policy that offers robust protection for your personal property and liability at a competitive price. Remember, the goal is not merely to find the cheapest option, but to secure a comprehensive safety net that aligns with your lifestyle and assets. With your policy in place, you gain the invaluable peace of mind that comes from knowing you, your belongings, and your financial future are protected, allowing you to truly feel at home in your rented space. Start the process today by getting your personalized Allstate renters insurance quote and taking control of your security.

Frequently Asked Questions (FAQ)

How long does it take to get an Allstate renters insurance quote?

You can get a preliminary Allstate renters insurance quote online in as little as five to ten minutes by entering basic information about yourself and your rental property. For a more detailed and customized quote, speaking with an Allstate agent may take 15-30 minutes.

Can I get an Allstate renters insurance quote without a social security number?

Yes, you can typically get an initial online estimate without providing your Social Security Number. However, to finalize a purchase and get the most accurate pricing, Allstate will likely require it for a full credit and identity check, as permitted by state law, which influences your final rate.

What is the difference between actual cash value and replacement cost in my quote?

These are two methods for settling personal property claims. “Actual Cash Value” (ACV) pays the depreciated value of your item at the time of loss. “Replacement Cost” pays the amount needed to buy a brand new equivalent item. A quote for replacement cost coverage will have a higher premium than one for ACV, but it provides much better protection. For expert insights on various insurance topics, consider resources from trusted industry authorities like the Insurance Information Institute.

Does my Allstate quote cover my roommate’s belongings?

No, a standard Allstate renters insurance quote and policy typically cover only the named insured and their relatives living in the household. Your roommate’s possessions are not covered under your policy. They would need to purchase their own separate renters insurance policy for protection.

Will getting multiple quotes from different companies affect my credit score?

When insurers like Allstate perform a “soft pull” to generate a renters insurance quote based on your credit information (where applicable), it does not impact your credit score. These are considered soft inquiries, unlike hard inquiries for a loan or credit card.

What happens if I need to cancel my policy after I’ve purchased it?

Allstate allows you to cancel your renters insurance policy at any time. You will typically receive a prorated refund for any unused portion of your premium, minus any applicable fees. It is best to contact your agent or customer service directly to initiate cancellation and confirm the specifics.

How can I lower my Allstate renters insurance quote if it seems too high?

You can lower your quote by raising your deductible, reviewing and accurately setting your personal property limit (avoiding overestimation), asking about every possible discount (especially bundling), and ensuring your home inventory accurately reflects your belongings. Comparing your quote with offers from other providers at Tejribati can also provide useful market context.