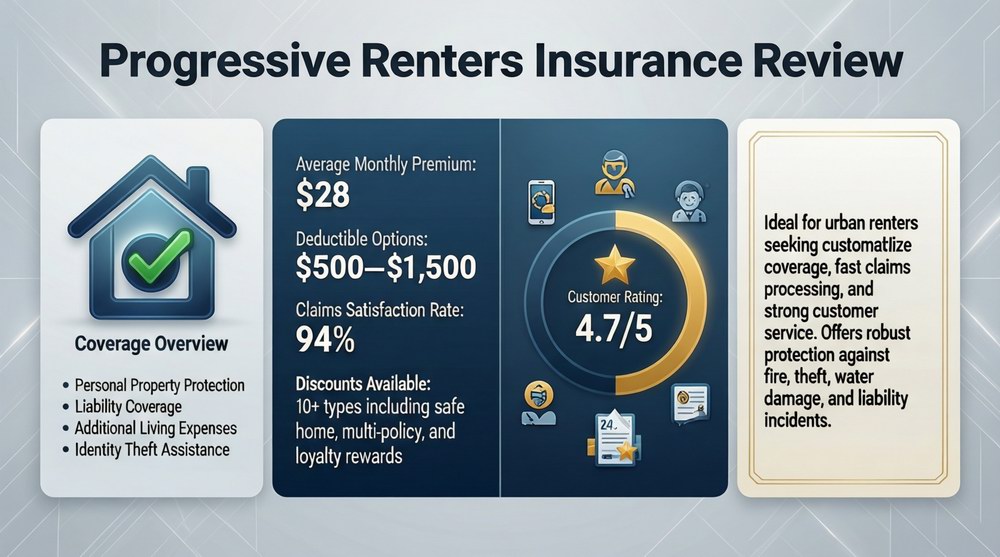

Article Summary: Navigating the world of renters insurance can feel overwhelming. In this detailed Progressive renters insurance review, we analyze the provider’s coverage options, claims process, customer reputation, and overall value. We break down exactly what a Progressive renters policy covers, including personal property, liability, and additional living expenses, while also examining common questions about claim payouts, denial rates, and deductibles. By comparing the significant pros, like bundling discounts and easy online management, against the notable cons, such as variable customer service experiences, this guide provides a clear framework to decide if Progressive is the optimal choice for protecting your belongings and finances as a renter.

What Does Progressive Renters Insurance Cover?

A Progressive renters policy, like standard HO-4 forms, is built on three core pillars of protection for your belongings, your finances, and your temporary living arrangements.

Understanding Personal Property and Liability Protection

The foundation of any renters insurance policy is personal property coverage. Progressive protects your belongings—furniture, electronics, clothing—from named perils like fire, theft, vandalism, and water damage from internal sources (e.g., a burst pipe). Equally important is personal liability coverage, which can cover legal expenses and medical bills if someone is injured in your home. Standard limits often start at $100,000.

Additional Progressive Renters Insurance Coverages and Important Endorsements

Beyond the basics, Progressive offers optional endorsements. You can add scheduled personal property coverage for high-value items like jewelry or art that exceed standard category limits. They also offer coverage for water backup and identity theft, which are not typically included in a base policy. Always review your personal property value carefully to avoid being underinsured.

Analyzing the Pros and Cons of Progressive Renters Insurance

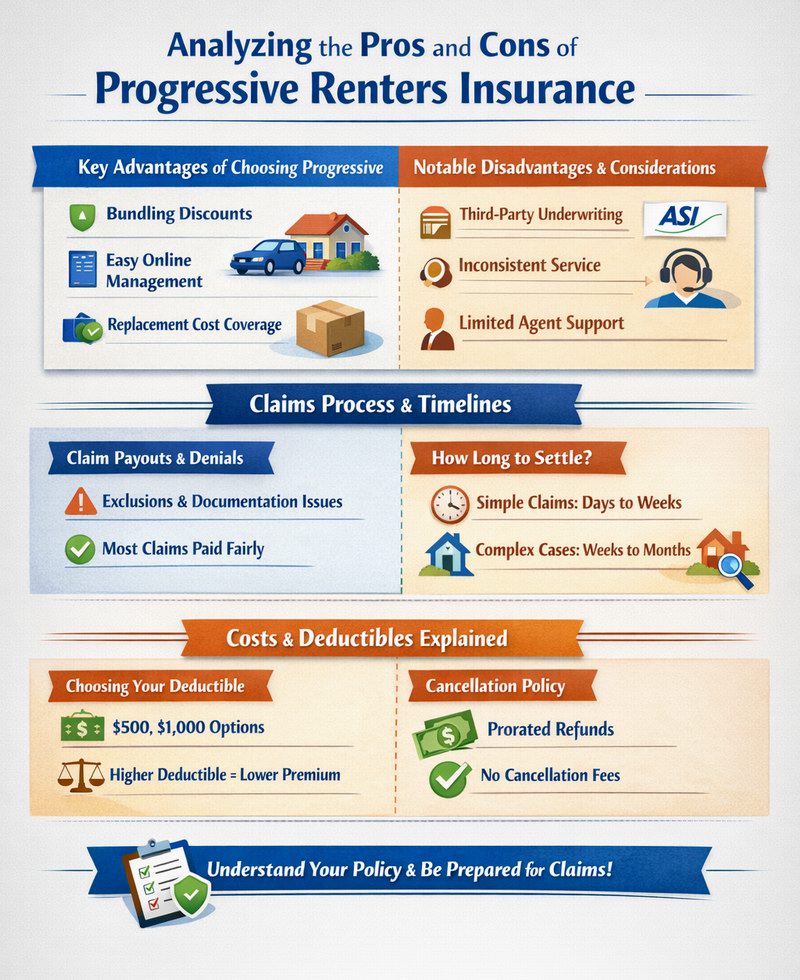

Choosing an insurance provider requires balancing benefits and drawbacks. Progressive has distinct advantages, particularly for certain customer profiles, but also has areas where competitors may excel.

Key Advantages of Progressive Renters Insurance

The most significant Progressive renters insurance pro is the potential for substantial savings through bundling. If you have (or are getting) a Progressive auto policy, the multi-policy discount can make the renters insurance cost very competitive. Their online quote and policy management tools are user-friendly, allowing for easy adjustments and payments. Furthermore, Progressive provides multiple payment plan options and offers a contents replacement cost endorsement, which pays to replace old items with new ones without depreciation.

Notable Disadvantages and Considerations of Progressive Renters Insurance

A primary con is that Progressive itself often acts as the underwriter for its policies sold online, but when purchased through an independent agent or bundled, the policy may actually be underwritten by a third-party company like American Strategic Insurance (ASI). This can lead to confusion during claims. Customer service experiences and claims handling efficiency can vary significantly, with some reviews citing slow communication. While their online tools are good, some renters may prefer a provider with more consistent in-person agent support.

Progressive Renters Insurance Claims Process: Payouts, Denials, and Timelines

The true test of any insurance policy is how the company handles a claim. Public perception, company culture, and procedural timelines all play a role in the claims experience.

Is Progressive Known to Deny or Pay Claims Fairly?

The question “Is Progressive known to deny claims?” is complex. Like all major insurers, Progressive pays out billions in claims annually. Most claims are processed without issue. However, claim denials typically occur due to policy exclusions (like flood damage), lack of documentation, misrepresentation on the application, or the claim amount being below the deductible. Progressive is not uniquely known for widespread unfair denials, but thorough documentation and understanding your policy are critical to a successful payout.

How Long Does Progressive Take to Settle a Claim?

The timeline for settling a Progressive renters insurance claim depends on complexity. Simple claims (e.g., a small theft with a police report and receipts) may be settled in a matter of days or weeks. More complex claims involving significant damage, liability disputes, or requiring special investigations can take several weeks or even months. Progressive, like most insurers, aims for efficiency but is also bound by the need to investigate claims thoroughly to prevent fraud.

Progressive Renters Insurance Costs, Deductibles, and Policy Management

Understanding the financial aspects—from your monthly premium to your out-of-pocket costs at claim time—is essential for budgeting and decision-making.

Breaking Down the Deductible and Premium Factors

Yes, Progressive renters insurance has a deductible. This is the amount you pay out-of-pocket toward a covered claim before insurance kicks in. You can often choose your deductible amount (e.g., $500, $1,000), which inversely affects your premium: a higher deductible usually means a lower monthly cost. Your premium is also determined by your location, coverage limits, claim history, and the safety features of your rental. Getting a personalized quote is the only way to know your exact renters insurance cost.

Cancellation Policy and Potential Refunds

You can cancel your Progressive renters insurance at any time by calling customer service or your agent. To the question, “Do I get money back if I cancel?” the answer is typically yes, for any unused portion of your premium. If you pay annually and cancel halfway through the term, you should receive a prorated refund. If you pay monthly, you simply stop the payments. There is generally no cancellation fee for a standard renters policy, but it’s wise to confirm this when you call.

Company Culture and Customer Reputation

An insurer’s internal culture and public reputation can subtly influence customer interactions, claims handling, and overall satisfaction.

Understanding “The Golden Rule” and Corporate Culture

Progressive’s stated culture emphasizes integrity, golden rule behavior, excellence, and profit. “What is the golden rule at Progressive?” It refers to treating others as you would want to be treated—a principle they aim to apply to customer and employee interactions. However, like any large corporation, the lived experience can vary by department and team. Some external reviews from employees and customers suggest a strong focus on efficiency and process, which can sometimes be perceived as impersonal.

Why Does Progressive Have a Mixed Reputation?

Addressing “Why does Progressive have a bad reputation?” in some circles requires context. Some reputation stems from their aggressive auto insurance advertising and their role as a defendant in auto injury lawsuits, which can color public perception across all their products. Regarding renters insurance coverage, negative reviews often center on specific frustrating claims experiences or customer service hurdles. It’s a classic case where dissatisfied customers are more likely to voice their experiences online than satisfied ones, but the recurring themes in complaints are worth noting as potential risk areas.

Conclusion: Who Should Consider Progressive Renters Insurance?

In conclusion, this Progressive renters insurance review finds it to be a solid, competitively-priced option, particularly for a specific audience. Progressive is an excellent fit for existing Progressive auto customers who can leverage a bundling discount, for tech-savvy renters who prefer online management, and for those seeking basic to mid-level coverage with a reputable national provider. However, renters with very high-value possessions that need specialized appraisals and service, or those who prioritize a consistent, personalized agent relationship above all else, may want to compare quotes and service models from other insurers. Ultimately, the best choice depends on weighing the tangible renters insurance cost savings and convenience against the potential for variable service experiences.

Frequently Asked Questions (FAQ)

What does a Progressive renters policy cover?

A standard Progressive renters insurance (HO-4) policy covers three main areas: 1) Personal Property for your belongings against perils like fire, theft, and vandalism; 2) Personal Liability for injuries to others or damage you cause to their property; and 3) Additional Living Expenses (ALE) for costs if your rental is uninhabitable. Optional endorsements can cover high-value items, water backup, and identity theft.

Does Progressive renters insurance have a deductible?

Yes, like most property insurance, Progressive renters insurance has a deductible. This is your chosen out-of-pocket amount (e.g., $500 or $1,000) that you pay toward a covered claim before the insurance company pays. Selecting a higher deductible will lower your monthly premium.

What are Progressive renters insurance’s pros and cons?

Pros include strong bundling discounts with auto insurance, easy online tools, multiple payment options, and optional replacement cost coverage. Cons can include variable customer service experiences, potential confusion as policies may be underwritten by third-party partners, and a claims process that some find slow for complex cases.

How long does Progressive take to settle a claim?

Settlement times vary. Simple, well-documented claims may be processed in days or a few weeks. More complex claims involving large losses, liability questions, or investigations can take several weeks to months. Promptly filing and providing thorough documentation can help speed up the process.

Can I cancel Progressive renters insurance? Do I get a refund?

Yes, you can cancel at any time by contacting customer service or your agent. Typically, you will receive a prorated refund for any unused, prepaid portion of your premium. For example, if you pay annually and cancel halfway, you should get about 50% back. There is usually no cancellation fee.

Is Progressive good about paying out claims? Are they known to deny claims?

Progressive pays out billions in valid claims each year. Most claims are paid without major issue. Denials are not disproportionately common but typically follow industry patterns: claims for uncovered perils (like floods), situations below the deductible, lack of evidence, or material misrepresentation on the application. Understanding your policy’s inclusions and exclusions is key.

What is the culture of Progressive insurance?

Progressive’s official corporate culture is built on principles of integrity, the Golden Rule (treating others as you want to be treated), excellence, and profit. In practice, as a large, process-driven organization, experiences can vary. Some reviews highlight a strong focus on efficiency and metrics, which can be perceived differently by employees and customers.

For an independent overview of standard policy frameworks, the Insurance Information Institute provides authoritative resources.