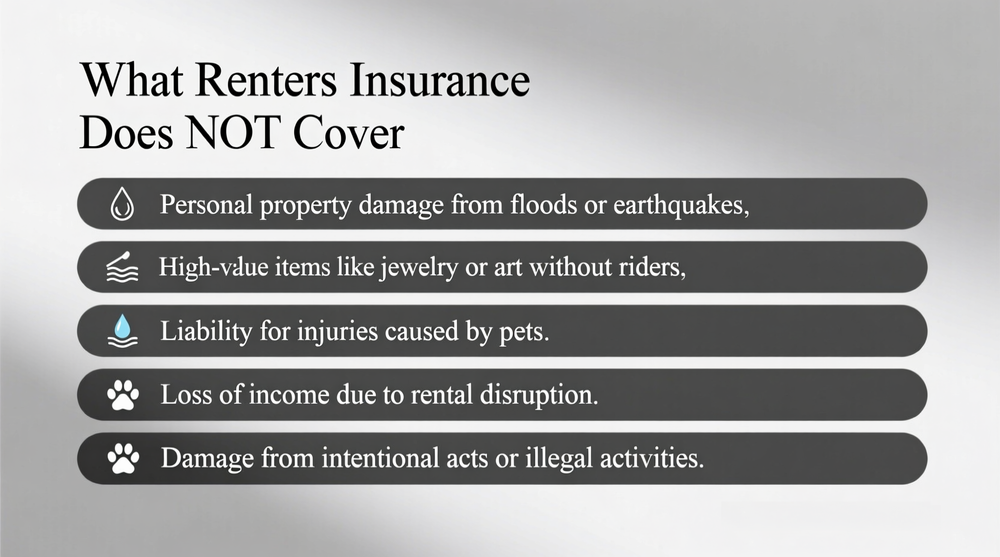

What renters insurance does NOT cover is just as important as what it does. Many renters face shocking claim denials after a loss. They mistakenly believe their policy is a safety net for everything. In reality, standard policies have critical exclusions. Knowing these gaps protects you from financial surprises. This guide details the 12 most common exclusions. We’ll explain floods, pet damage, roommate issues, and high-value items. You will learn how to identify and fix these coverage holes. Let’s build a complete protection plan for your rented home.

The Core Design: What Renters Insurance Does NOT Cover by Default

First, understand that renters insurance is designed for sudden accidents. For example, it covers theft or a fire. However, it is not designed for gradual problems or certain large-scale disasters. So, what renters insurance does NOT cover typically falls into three categories. These are structural damage, specific high-value items, and high-risk perils. Let’s explore each one.

1. Structural Damage to the Rental Unit

This is a vital distinction. Your landlord’s policy covers the building itself. This includes walls, floors, and built-in appliances. Your renters insurance only covers your personal belongings inside. For instance, a kitchen fire might ruin the cabinets (landlord’s responsibility) and your dishes (your coverage). Remember, you cannot claim for damage to the structure.

2. Expensive Items Beyond Sub-Limits

This is a major surprise for many people. Your policy has total coverage, like $30,000. But it also has sub-limits for specific categories. Commonly, jewelry has a $1,500 limit. Electronics might have a $2,500 limit. Therefore, a stolen $5,000 engagement ring would be underinsured by $3,500. This is a clear example of what renters insurance does NOT cover fully. The solution is a scheduled personal property rider for full value.

Everyday Life: Common Situations Not Covered

Now, let’s look at daily life scenarios. People often get these wrong. Understanding these exclusions prevents frustration later.

3. Damage Your Pet Causes to Your Belongings

Your puppy chewing your sofa? Your cat scratching your TV? Your policy will not cover that. What renters insurance does NOT cover includes damage from your own animals to your own stuff. However, liability coverage may protect you if your pet bites a guest. Always check for breed restrictions, as some companies exclude certain dogs entirely.

4. Floods, Earthquakes, and Landslides

Standard policies exclude “earth movement” and flooding. So, a river flood or an earthquake that ruins your apartment is not covered. You need separate, specific policies for these events. Don’t assume you’re protected. Flood insurance and earthquake insurance are separate purchases.

5. Pest Infestations Like Bed Bugs or Rodents

Insurers see pests as a maintenance issue. Therefore, damage from bed bugs, mice, or insects is excluded. The cost of extermination and replacing ruined furniture is your responsibility. Similarly, mold from a slow leak is also typically excluded.

6. Your Roommate’s Personal Property

Your policy covers you and relatives living with you. It does not cover your roommate. If a fire happens, your laptop is covered but your roommate’s is not. Every adult in a rental should have their own policy. This is a key part of what renters insurance does NOT cover for shared living.

| What’s NOT Covered | Typical Scenario | How to Get Coverage |

|---|---|---|

| Flood Damage | Sewer backup from heavy rain ruins your basement apartment. | Buy a separate flood insurance policy (NFIP or private). |

| Pet Damage to Your Stuff | Your dog destroys your expensive rug and shoes. | Not covered. Prevention and training are your only options. |

| High-Value Jewelry (over limit) | A burglar steals your $5,000 engagement ring. | Add a “scheduled personal property” rider to your policy. |

| Bed Bugs or Mice | An infestation ruins your mattress and requires professional treatment. | Not covered. Regular cleaning and pest control are essential. |

| Roommate’s Belongings | A fire destroys your roommate’s television and laptop. | Your roommate needs their own separate renters insurance policy. |

| Business Equipment | Your home business loses $10,000 in inventory to a theft. | Get an in-home business endorsement or a separate business policy. |

Intentional Acts and Liability Exclusions

Insurance is for accidents, not for intentional or illegal acts. This is a non-negotiable rule.

7. Damage You Cause Intentionally

If you deliberately damage property, your claim will be denied. For example, smashing your own TV in anger will not be covered. The insurer may also cancel your policy. They expect responsible behavior from policyholders.

8. Losses During Illegal Activities

Any loss that happens during illegal activity voids your policy. For instance, if you are illegally subletting and a theft occurs, you have no coverage. A fire starting in a home drug lab would lead to a total denial. Always use your rental legally.

9. Your Car and Its Contents

Renters insurance does not cover your vehicle. Auto insurance handles car damage and theft. However, belongings stolen from your car might have limited coverage under off-premises theft protection. Always check your specific policy wording.

How to Close These Critical Coverage Gaps

Now that you know the gaps, you can fix them. Proactive steps will give you complete peace of mind.

10. Conduct a Home Inventory and Compare to Limits

First, document everything you own with photos and videos. Next, compare your high-value items to your policy’s sub-limits. Finally, contact your insurer to add riders for anything over the limit. This process clearly shows what renters insurance does NOT cover for you personally and lets you fix it.

11. Purchase Separate Policies for Major Risks

If you live in a high-risk area, act now. Get flood insurance if you’re in a flood zone. Buy earthquake insurance if you’re in a seismic area. For excluded dog breeds, seek a specialty insurer. Don’t assume you’re safe without these policies. For more on managing expenses, see our guide on renters insurance cost.

12. Use Endorsements to Fill Specific Holes

Endorsements are affordable policy add-ons. They can close specific gaps. Popular options include:

- Water Backup Coverage: Covers damage from sewer or drain backup.

- Equipment Breakdown: Covers sudden appliance or system failures.

- Identity Theft Restoration: Provides resources if your identity is stolen.

Talk to your agent about which endorsements fit your life. This enhances your overall renters insurance coverage.

Conclusion: Secure Complete Protection by Knowing the Gaps

In summary, understanding what renters insurance does NOT cover is your first line of defense. Review your policy document carefully. Talk to your agent about your specific concerns. Then, take action to fill the gaps with riders, endorsements, or separate policies. True security comes from a complete understanding of your coverage. Protect your home and finances by addressing these exclusions today. Start your journey with our complete overview of renters insurance.

Frequently Asked Questions (FAQ)

Q1: Does renters insurance pay for a hotel if my apartment is unlivable?

A: Yes, but only under specific conditions. Your “Loss of Use” coverage helps with hotel and food costs. However, this only applies if a covered peril (like a fire) makes your home unlivable. Excluded events like floods do not trigger this benefit.

Q2: What if a power surge fries my electronics?

A: Coverage depends on the source. Surges from external events like lightning are typically covered. Surges from internal faulty wiring are often denied as a maintenance issue. Using quality surge protectors is critical. For expert advice, consult FEMA’s guide on surge protection.

Q3: Are my things covered if they’re in a storage unit?

A: Most policies extend a portion (often 10%) of your personal property coverage to off-premises storage. However, standard sub-limits for categories like jewelry still apply. Always notify your insurer about high-value items in storage.

Q4: Will my policy pay for mold removal?

A: Generally, no. Mold resulting from long-term humidity or unrepaired leaks is excluded as a maintenance problem. Some policies offer limited coverage if mold stems directly from a sudden, covered water loss and you mitigate it promptly.

Q5: If a tree falls on my apartment, what’s covered?

A: Your landlord’s insurance fixes the building. Your renters insurance covers your damaged belongings inside. Your “Loss of Use” coverage can also pay for a hotel if you need to leave temporarily.

Q6: Is spoiled food covered in a power outage?

A: Possibly. If a covered peril (like a storm) causes the outage, spoilage is often covered up to a limit (e.g., $500). If the utility company causes the outage, coverage is unlikely. Check your policy for “refrigerated products” details.

Q7: Am I covered if my roommate causes damage?

A: No. Your policy covers your liability, not your roommate’s. If your roommate starts a kitchen fire, their liability is not covered. You would need to seek compensation from them directly. This is why each tenant needs their own policy.