For those who qualify, USAA renters insurance consistently ranks among the best in customer satisfaction and value. This comprehensive review analyzes whether USAA is good for renters insurance by examining its exceptional coverage options, competitive pricing, and renowned claims service. We detail what is covered, including high-tech items like laptops and protection against theft, while also outlining the primary disadvantage: strict eligibility requirements. By comparing costs, explaining why USAA rates are often cheaper, and exploring real-world claim experiences, this guide provides military members, veterans, and their families with the essential information needed to decide if USAA’s tenant policy is the right shield for their belongings and liability.

USAA Renters Insurance: Elite Coverage with Strict Eligibility

USAA is a member-owned association that provides financial services exclusively to the military community and their families. Its renters insurance products reflect this focus, often offering enhanced benefits and tailored service.

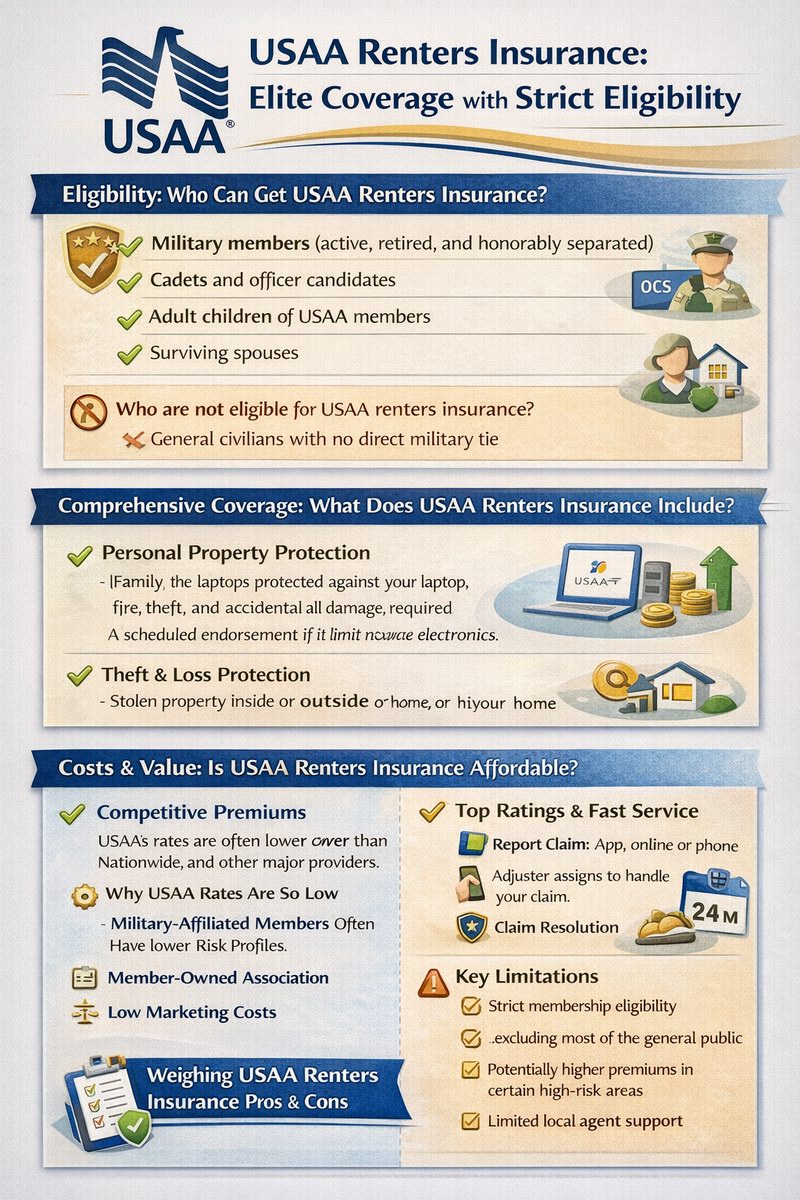

Who Is Eligible and Who Is Not for USAA Insurance?

Eligibility is the most critical factor. USAA membership, and thus access to its renters insurance, is restricted to: Active, retired, and honorably separated U.S. military officers and enlisted personnel; Cadets and officer candidates; Adult children of USAA members who have obtained their own policy; Widows and widowers of eligible members. Who is not eligible for USAA renters insurance? Generally, the general public without a direct military tie, including non-veteran civilians, cannot join. Eligibility is verified during the application process.

Comprehensive Coverage: From Laptops to Theft and Beyond

A USAA renters policy provides robust standard coverage. To answer specific questions: Does USAA renters insurance cover laptops? Yes, laptops are covered under personal property protection against named perils like fire, theft, or accidental damage (e.g., a spilled drink). However, for the best claim outcome, you may need a scheduled personal property endorsement for very high-value electronics. Does USAA renters insurance cover theft? Absolutely. Theft, both inside and outside your home, is a standard named peril, providing crucial protection for your belongings.

Analyzing Cost, Value, and the USAA Pricing Advantage

A common perception is that USAA renters insurance offers significant value. We examine the cost structure and the reasons behind its competitive pricing.

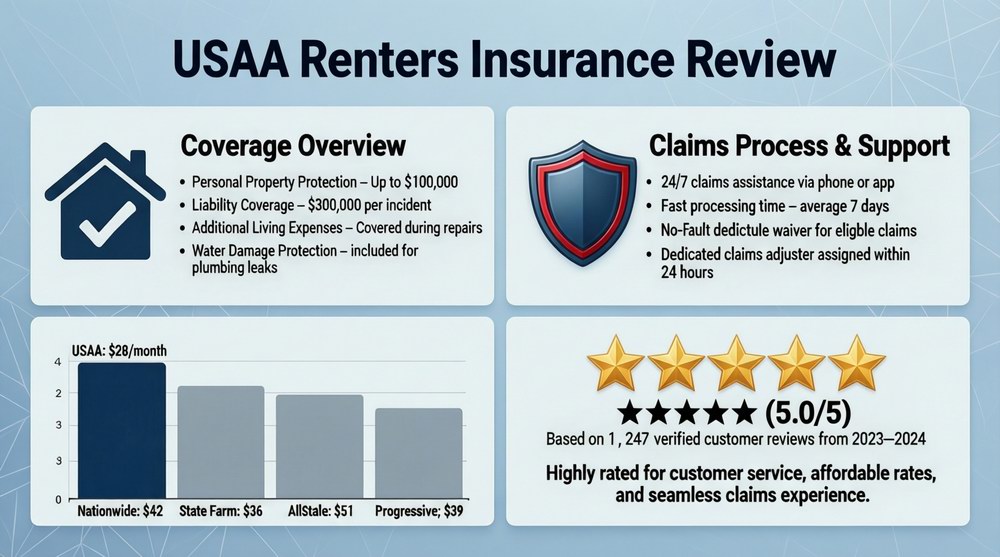

Is USAA Renters Insurance Expensive? A Cost Comparison

Contrary to the question “Is USAA renters insurance high?”, industry studies consistently show USAA’s premiums are among the most competitive in the market, often beating major national carriers. For a direct comparison: Is USAA insurance cheaper than Nationwide? In most markets and for most eligible customer profiles, USAA’s average premiums are lower than Nationwide’s for equivalent renters insurance coverage. However, individual quotes vary based on location, coverage limits, and deductible choice.

Why Are USAA’s Rates So Competitive?

The question “Why is USAA insurance so much cheaper?” has several answers. First, USAA’s unique membership model creates a pool of customers (military-affiliated individuals) statistically associated with lower risk profiles, which can lead to lower overall claims costs. Second, as a member-owned association, profits are returned to members through dividends (when declared) and reinvested in service, rather than paid to outside shareholders. Third, their exceptional customer retention reduces marketing and acquisition costs, savings often passed to members.

The Claims Experience: Reputation, Process, and Timelines

USAA’s reputation for outstanding claims service is a cornerstone of its brand. We look at how this translates for renters insurance policyholders.

Is USAA Good at Paying Renters Insurance Claims?

USAA consistently receives the highest ratings in J.D. Power and other consumer satisfaction surveys for claims handling. The answer to “Is USAA good at paying claims?” is a resounding yes, based on overwhelming customer feedback. The process is known for being straightforward, empathetic, and efficient. Members can file claims 24/7 online, via the app, or by phone, and are often assigned a dedicated adjuster quickly. Their focus on member service generally leads to a fair and less adversarial process.

How Long Does USAA Cover Additional Living Expenses?

An important aspect of a claim is loss of use coverage. How long does USAA cover a rental? Under the Additional Living Expenses (ALE) portion of a standard USAA renters policy, coverage typically applies for up to 24 months from the date of the loss that made your home uninhabitable. This is a generous timeframe compared to some insurers and is designed to cover the cost of a comparable temporary residence, meals, and other incurred expenses while your rental is being repaired or you find a new home.

Weighing the Pros and Cons: Is USAA the Right Choice?

While highly rated, USAA renters insurance is not a perfect fit for everyone, even within the eligible community.

Significant Advantages of Choosing USAA

The advantages are substantial: top-tier customer service and claims satisfaction, consistently competitive renters insurance cost, generous standard policy features (like replacement cost coverage for personal property), and seamless integration with other USAA products (auto, banking) for bundling discounts. Their understanding of military life is also reflected in flexible policies for deployments and Permanent Change of Station (PCS) moves.

Key Disadvantages and Limitations to Consider

The primary disadvantages of USAA renters insurance stem from its exclusivity. The strict eligibility requirements shut out a vast portion of the population. Some members in certain high-risk geographic areas may find pricing less competitive. Furthermore, while their digital tools are excellent, members who prefer extensive in-person, local agent support might find other carriers like State Farm better suited to that style of service.

Final Verdict: Who Should Get USAA Renters Insurance?

In conclusion, this USAA renters insurance review finds it to be an outstanding product for those who qualify. If you are an active or former military member, or an eligible family member, obtaining a quote from USAA is essentially mandatory. It is likely to offer the best combination of price, comprehensive renters insurance coverage, and customer-centric service in the market. For eligible individuals, the question is not so much “Is USAA good for renters insurance?” but rather, “Is there any compelling reason to choose someone else?” For the vast majority, the answer will be no. For those outside the military community, excellent alternatives exist, but they will be comparing against the gold standard that USAA represents.

Frequently Asked Questions (FAQ)

Is USAA good for renters insurance?

Yes, for those who are eligible, USAA is consistently rated as one of the absolute best providers for renters insurance. It excels in customer satisfaction, claims handling, competitive pricing, and comprehensive coverage options, making it a top-tier choice for the military community.

Who is not eligible for USAA renters insurance?

The general public cannot get USAA renters insurance. Eligibility is restricted to active, retired, and honorably separated U.S. military members and officers, cadets, officer candidates, and their eligible family members (spouses, widows/widowers, and adult children of members). Civilians without a direct military affiliation are not eligible.

What are the disadvantages of USAA renters insurance?

The primary disadvantage is the strict eligibility requirement, which excludes most of the population. Other potential drawbacks could include less competitive pricing in some specific high-risk locales and a service model that is primarily digital/phone-based, which may not suit those who prefer frequent in-person interactions with a local agent.

Is USAA good at paying claims and how long does it take?

USAA has an exceptional reputation for paying claims fairly and efficiently. They consistently rank highest in customer satisfaction for claims handling. Settlement timelines vary by complexity, but their process is streamlined. For Additional Living Expenses (ALE), USAA typically provides coverage for temporary housing for up to 24 months.

Does USAA renters insurance cover laptops and theft?

Yes, on both counts. Laptops are covered under personal property protection for named perils like fire, theft, or accidental damage. Theft is a standard covered peril, protecting your belongings from stolen items both inside and outside your home. For very expensive laptops, consider a scheduled personal property endorsement.

Why is USAA renters insurance often cheaper than competitors?

USAA’s lower average premiums are attributed to its exclusive membership pool (military-affiliated individuals, a statistically lower-risk group), its member-owned structure that returns profits, and extremely high customer retention that reduces marketing costs. These factors allow them to offer highly competitive rates to eligible members.

How does USAA compare to Nationwide on cost?

For eligible customers, USAA renters insurance is typically cheaper than Nationwide for comparable coverage. National industry surveys and quote comparisons consistently place USAA’s average premiums below those of Nationwide and other major national carriers, solidifying its position as a high-value provider for its membership base.

For an independent, authoritative look at how renters insurance works and its importance, see the guide from the Insurance Information Institute.