Navigating the specifics of renters insurance with pets requires a clear understanding of what is covered, what is excluded, and how to ensure both your belongings and your liability are adequately protected. This comprehensive guide will walk you through everything you need to know, from policy specifics and breed restrictions to managing your renters insurance cost as a responsible pet owner. For millions of Americans, pets are cherished members of the family. However, if you’re renting your home, your furry, feathered, or scaled companion introduces a unique layer of financial risk that standard renters insurance policies may not fully address. From a scratched door frame to an unexpected bite incident, pets can inadvertently lead to costly damages or liability claims.

How Renters Insurance with Pets Works: A Detailed Breakdown

Understanding how a standard policy adapts when you have animals is the first step. A typical renters insurance policy is built on three pillars: personal property coverage, liability protection, and loss of use. When you have pets, the liability coverage becomes your most critical shield. This component is designed to protect you financially if your pet causes injury to another person or damages their property. For example, if your dog bites a delivery person or your cat knocks over and breaks a neighbor’s valuable antique, your liability coverage can help pay for medical expenses or repairs, guarding you against a potentially ruinous lawsuit.

Finding the Right Policy: Your Guide to Renters Insurance with Pets

Not all policies are created equal for pet owners. Shopping for renters insurance with pets demands careful comparison. You must look beyond price to examine the “exclusions” section of each policy. Some insurers have broad exclusions for any animal-related liability, while others are more pet-friendly. Key questions to ask include: “Does this policy have breed restrictions?” “Is there an exclusion for any damage caused by pets to the dwelling?” and “What is the sub-limit for medical payments to others if my pet injures someone?” Getting clear answers upfront prevents devastating claim denials later.

Liability Limits and Renters Insurance with Pets

One of the most important decisions you’ll make involves your liability limit. The standard $100,000 may be insufficient for pet owners, especially with certain breeds where bite claims can soar into the hundreds of thousands. When evaluating renters insurance with pets, experts strongly recommend increasing your personal liability limit to at least $300,000 or $500,000. The incremental cost for this extra protection is usually minimal—often just a few dollars more per month—but it provides exponential peace of mind, ensuring a single incident doesn’t jeopardize your financial future.

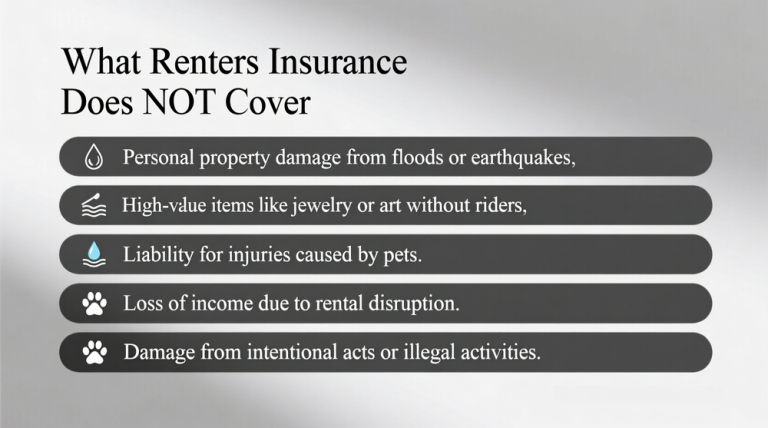

Common Exclusions in Renters Insurance with Pets You Must Know

While liability coverage is a boon for pet owners, numerous exclusions can create coverage gaps. The most significant is that damage your pet causes to your own personal property is almost universally excluded. If your new puppy destroys your laptop or your parrot ruins your sofa, your personal property coverage will not respond. This coverage is for named perils like fire or theft, not for damage from a member of your household. Furthermore, many policies exclude damage to the structure of the rental unit itself (walls, floors, built-in appliances) caused by your pet, making your security deposit your primary financial buffer.

Breed and Species Restrictions in Renters Insurance

A major hurdle for many pet owners is the industry’s use of “restricted breed” lists. Based on claims history and risk assessment, insurers often exclude or surcharge for specific dog breeds like Pit Bulls, Rottweilers, German Shepherds, Akitas, and Wolf hybrids. Similarly, exotic pets such as reptiles, large birds, or “wild” animals are frequently excluded from liability coverage entirely. When shopping for renters insurance with pets, your first task is to verify if your specific animal is covered. Some progressive companies, like State Farm, evaluate dogs on an individual basis rather than banning entire breeds.

Excluded Incidents in Your Renters Insurance with Pets Policy

Beyond the type of pet, the circumstances of an incident matter. Many policies will deny a claim if the injury occurred while the animal was being used for a business purpose (like guard dog duties) or if you were violating a local law (like a leash ordinance) at the time. Some policies may also exclude incidents that happen off your premises, depending on the wording. A separate pet insurance policy is essential for managing healthcare costs. It’s imperative to read your policy’s “conditions” and “exclusions” sections related to animals or personal liability to understand the precise boundaries of your renters insurance coverage.

| Scenario | Covered by Renters Insurance? | Key Factors & Notes |

|---|---|---|

| Your dog bites a guest at your apartment, requiring stitches. | Typically YES (Liability) | Coverage applies unless your dog’s breed is on the policy’s excluded list. Your liability limit is the maximum payout. |

| Your cat scratches and ruins your landlord’s newly installed carpet. | Possibly YES (Liability) | Damage to the landlord’s property (the dwelling) may be covered under your liability protection if you are legally liable. |

| Your pet rabbit chews through the wiring of your personal television. | NO | Damage to your own belongings by your pet is not covered under personal property coverage. |

| Your dog gets loose and knocks over a neighbor’s child, causing a minor injury. | YES (Medical Payments to Others) | The “med pay” portion of your liability coverage can cover small medical bills (e.g., $1,000-$5,000) without a lawsuit. |

| You are sued after your excluded-breed dog injures someone. | NO | If you failed to disclose a pet or own an excluded breed, the insurer will deny the liability claim and legal defense. |

Strategic Tips for Optimizing Your Renters Insurance with Pets

Securing a policy is just the beginning. Proactive management ensures you have the strongest possible protection at the best price. Implementing these strategies can prevent claims, demonstrate responsibility to insurers, and potentially lower your renters insurance cost over the long term.

1. Documentation and Transparency for Renters Insurance with Pets

Create a “pet resume” for your landlord and insurer. Include vaccination records, spay/neuter certificates, obedience training diplomas (like the AKC Canine Good Citizen), and a reference from a previous landlord or veterinarian. This portfolio demonstrates you are a responsible owner, which can help when seeking coverage for a restricted breed or negotiating with a reluctant landlord. Always be 100% transparent about your pet’s history; a prior bite incident must be disclosed.

2. Proactive Risk Management Beyond Insurance

Insurance is a financial backstop; prevention is the first line of defense. Secure your rental with pet gates, provide ample chew toys to deter destructive behavior, and ensure your pet gets regular exercise to mitigate anxiety-related issues. For dogs, consistent training and socialization are non-negotiable investments that directly reduce liability risk. Consider using a muzzle in high-stress public situations if your dog has any reactivity, as this shows due diligence.

3. Bundling and Discounts for Pet Owners

When you shop for renters insurance with pets, ask about discounts. Many insurers offer a multi-policy discount if you bundle your renters insurance with your auto insurance. Some may offer a discount for having a monitored home security system, which can also prevent pet-related escapes. While pet-specific discounts are rare, being a member of certain organizations (like alumni associations or professional groups) can sometimes unlock lower rates.

4. When to Consider Umbrella Insurance with Pets

If you have significant assets or a pet deemed higher risk, a personal umbrella liability policy is a wise escalation. This policy sits on top of your renters (and auto) insurance, providing an additional $1-$5 million in liability coverage. It’s relatively inexpensive and activates once the liability limits on your underlying renters policy are exhausted. For comprehensive protection in a litigious society, pairing umbrella insurance with a solid renters insurance policy is a powerful strategy for pet owners.

Conclusion: Securing Comprehensive Renters Insurance with Pets

Ultimately, securing robust renters insurance with pets is an essential act of responsibility for any tenant who shares their home with an animal. It transforms a potential financial catastrophe into a manageable incident. The process requires diligence—reading policy exclusions, disclosing your pet fully, opting for higher liability limits, and investing in training and prevention. By taking these steps, you can enjoy the profound companionship of your pet with the confidence that you have a solid financial plan in place. Start today by comparing quotes from several pet-friendly insurers to find the coverage that fits your unique family, ensuring everyone, on two legs or four, is protected.

Frequently Asked Questions (FAQ) About Renters Insurance with Pets

Q1: Is renters insurance with pets more expensive than a standard policy?

A: It can be, but not always. The cost increase primarily depends on your pet’s breed and species. Common pets like cats or small dogs may not increase your premium at all. However, owning a breed frequently found on restricted lists (e.g., Pit Bulls, Dobermans) can lead to a higher premium or require you to seek a specialty insurer. Always get quotes that include full pet disclosure for accurate pricing.

Q2: Will my renters insurance with pets cover my pet if it’s stolen or runs away?

A: No. Renters insurance does not cover the loss of your pet itself, as pets are generally considered living beings, not personal property in the context of theft coverage. However, if someone breaks into your home and also steals the crate or leash, those items may be covered under your personal property coverage. For expenses related to finding a lost pet (like rewards or ads), you would need specialized pet recovery insurance.

Q3: I’m getting a new puppy/kitten. When should I update my renters insurance?

A: You should contact your insurance company or agent before you bring the new pet home. This allows them to update your policy immediately, confirm there are no coverage issues with the breed or species, and inform you of any premium adjustment. Updating your policy proactively ensures there is no gap in your liability coverage from day one.

Q4: Does renters insurance with pets cover damage from pets like fleas or urine?

A: Almost certainly not. Damage considered to result from “vermin” (like fleas) or “gradual deterioration” (like repeated urine stains seeping into a floor) is typically excluded from both property and liability coverage. These are viewed as maintenance issues stemming from the pet owner’s failure to properly care for the animal and the dwelling. Such damages are the tenant’s responsibility and would be deducted from the security deposit.

Q5: Can I be denied renters insurance entirely because of my pet?

A: Yes. If you own a breed or type of animal that an insurer categorizes as “uninsurable” due to extreme risk (e.g., certain exotic animals or dogs with a severe bite history), they may refuse to issue you a policy altogether. In this case, you would need to seek out a company specializing in high-risk coverage, which will be more expensive, or explore your state’s Fair Access to Insurance Requirements (FAIR) Plan as a last resort for basic liability coverage.

Q6: Are emotional support animals (ESAs) or service animals treated differently in renters insurance with pets?

A: Service animals, which are trained to perform specific tasks for a disability, are generally not considered “pets” under the law and should not be subject to pet fees or breed restrictions by landlords. However, for insurance liability purposes, they are typically still assessed as an animal risk. Emotional support animals (ESAs), which provide comfort through presence but are not task-trained, may not receive the same legal exemptions from insurance underwriting guidelines regarding breed restrictions. Always disclose all animals to your insurer.

Q7: If I have multiple pets, does that affect my renters insurance with pets?

A: It can. While one cat might not change your premium, three large dogs might. Insurers assess the cumulative risk. More animals can mean a statistically higher chance of an incident. Some companies may ask how many pets you have or impose a limit. The key, as always, is full disclosure. Don’t assume because one pet didn’t increase your cost that three won’t; your policy could be voided for misrepresentation.