Securing renters insurance PA is a critical step for protecting your financial well-being as a tenant in the Keystone State. This comprehensive guide addresses the most common questions Pennsylvania residents have about renters insurance Pennsylvania, starting with cost. We provide clear data on the average cost of renters insurance in Pennsylvania, breaking down how premiums differ between major metropolitan areas like Philadelphia and Pittsburgh versus rural counties, and explaining the key factors that determine your final price. A central focus is on the legal landscape: we definitively answer whether the state of PA requires renters insurance and clarify the significant difference between state law and lease contract requirements. Beyond cost and legality, the article details what a standard Pennsylvania policy covers, from personal property and liability protection to additional living expenses, and offers practical advice for tenants on how to find the best value. Whether you’re renting in Center City Philadelphia, suburban Harrisburg, or anywhere in between, this guide provides the essential information you need to make an informed decision about this affordable and crucial form of protection.

The Cost of Renters Insurance in Pennsylvania

Understanding the price of protection is the first step for most tenants. Pennsylvania offers generally affordable rates, but significant variations exist across the state.

Statewide Averages and Regional Variations

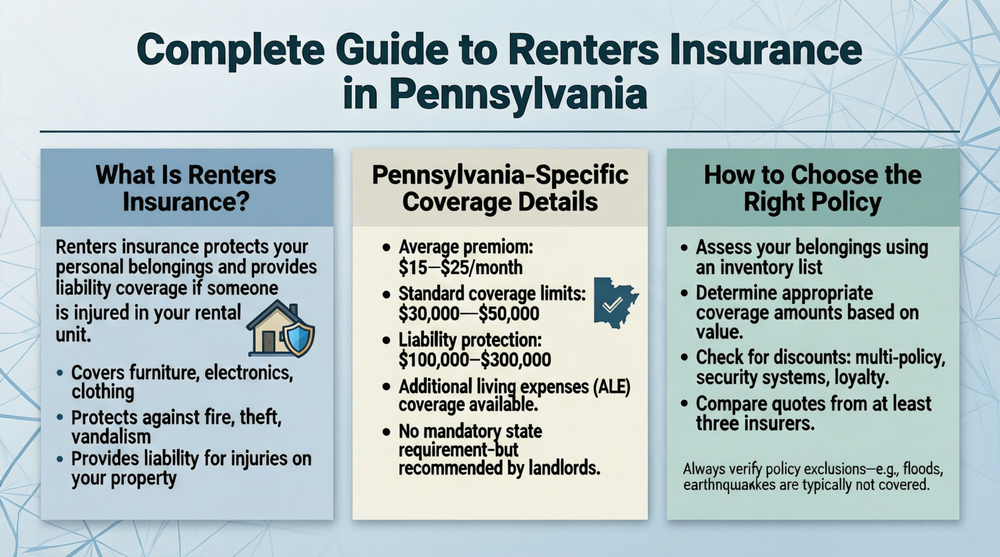

So, how much is renters insurance in PA? and what is the average cost of renters insurance in Pennsylvania? Statewide, tenants can expect to pay an average of **$15 to $30 per month**, or approximately **$180 to $360 annually**. To answer the identical question, how much is renters insurance in Pennsylvania?—it’s the same range, but your specific quote will vary. This average is for a standard policy with $20,000-$30,000 in personal property coverage and $100,000 in liability protection. However, geography plays a major role. In urban centers with higher property crime rates and greater claim frequency, such as **Philadelphia**, average premiums tend to be on the higher end of that spectrum, sometimes exceeding $25/month. In contrast, renters in more rural areas like Susquehanna County or smaller cities like Erie often see rates at the lower end, potentially under $20/month. Pittsburgh typically falls somewhere in the middle of the state average.

Key Factors Determining Your Pennsylvania Premium

Your final renters insurance cost in PA is calculated using a personalized risk assessment. Insurers consider:

- Location (ZIP Code): This is the biggest driver. Premiums are higher in areas with greater risk of theft, vandalism, and certain weather-related perils.

- Coverage Limits: The more personal property value you insure and the higher your liability limit, the higher your premium.

- Deductible: Choosing a higher deductible (e.g., $1,000) lowers your monthly payment; a lower deductible ($250 or $500) increases it.

- Discounts: Pennsylvania insurers offer discounts for bundling with auto insurance, having safety devices (smoke alarms, burglar alarms), being claim-free, and sometimes for being a non-smoker.

- Credit-Based Insurance Score: In Pennsylvania, where permitted by law, insurers may use credit information as a factor in determining rates, as those with higher scores statistically file fewer claims.

Shopping around with multiple providers is the most effective way to find a competitive rate for your renters insurance Pennsylvania needs.

Pennsylvania Laws and Legal Requirements for Tenants

A major point of confusion for many renters is whether carrying insurance is a legal obligation. The answer in PA is straightforward but important to understand fully.

State Law vs. Lease Contracts: What’s Required?

The direct questions—Does PA require renters insurance? and Does Pennsylvania require renters insurance?—have the same clear answer: **No, there is no Pennsylvania state law that mandates all tenants carry renters insurance.** Unlike auto insurance, the Commonwealth does not legislate that renters must have a policy. However, this is only half the story. Pennsylvania law fully allows and supports **landlords requiring renters insurance in the lease agreement**. This is an extremely common practice. Most standard lease forms used by landlords and property management companies across PA include a clause that makes it the tenant’s responsibility to obtain and maintain a renters insurance policy for the duration of their tenancy. Therefore, while the state doesn’t require it, your lease contract very well might.

Consequences of Not Having Required Coverage

If your lease includes an insurance requirement clause and you fail to get a policy or let it lapse, you are in breach of your contract. The landlord’s recourse is not criminal penalty but contractual enforcement. They can issue a formal notice to “cure” the violation, giving you a set period (often 30 days) to provide proof of insurance. If you fail to comply, the landlord may have grounds to begin eviction proceedings for violating the lease terms. They may also choose not to renew your lease when it expires. For these reasons, it is imperative to carefully read your entire lease agreement before signing to understand all your obligations, including any requirement for renters insurance.

What Pennsylvania Renters Insurance Covers

A standard HO-4 policy in Pennsylvania provides robust, multi-faceted protection that is highly valuable for a minimal monthly cost.

Core Coverage Components in a PA Policy

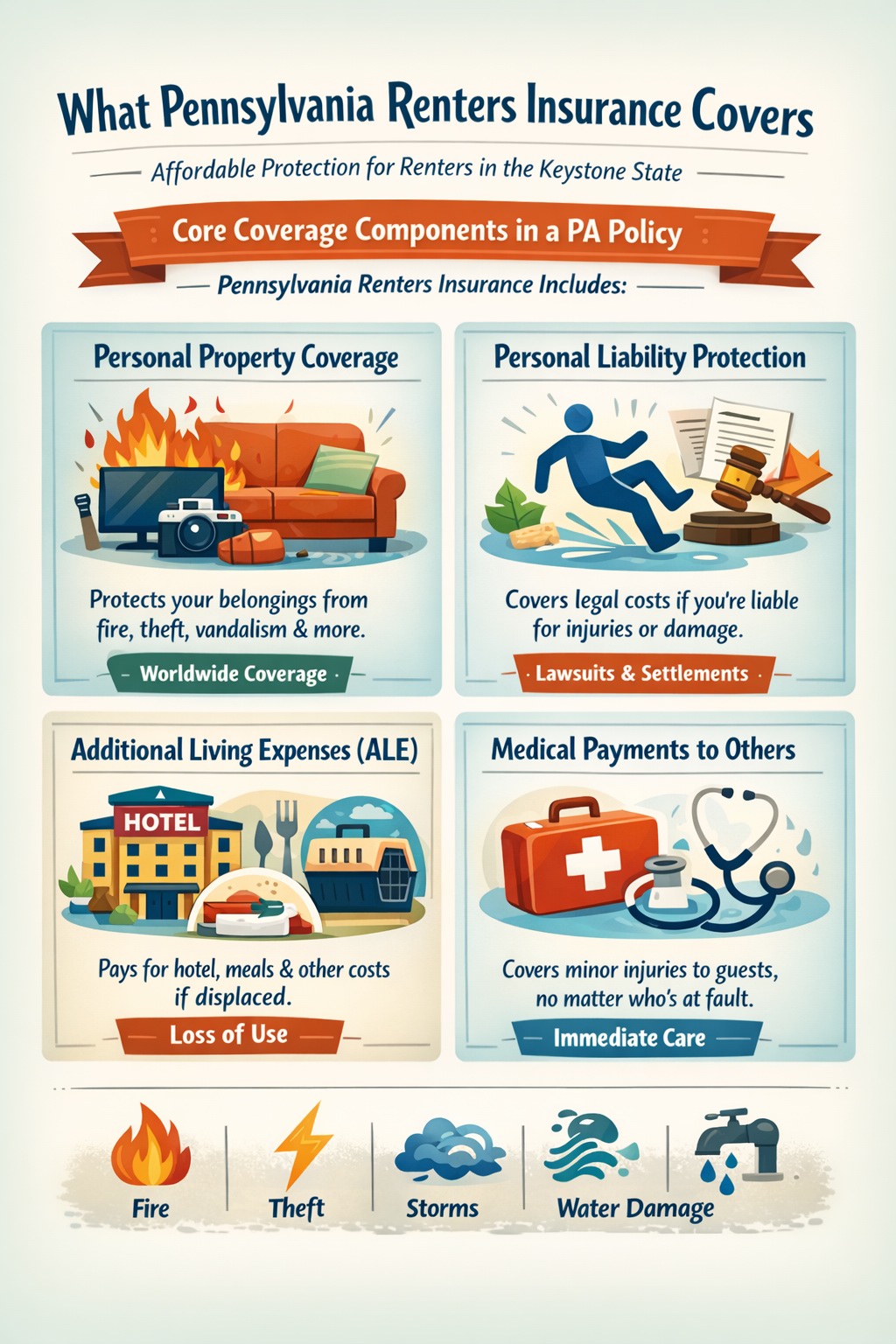

A typical renters insurance PA policy includes four key areas of coverage:

- Personal Property Coverage: Protects your belongings—furniture, electronics, clothing, kitchenware—from covered perils like fire, lightning, windstorm, hail, theft, vandalism, and damage from falling objects or plumbing/AC system overflows. This coverage often applies worldwide, not just inside your apartment.

- Personal Liability Protection: This is critically important. If you are found legally responsible for someone else’s bodily injury (e.g., a guest slips in your apartment) or property damage (e.g., you accidentally cause a kitchen fire that damages other units), this coverage helps pay for legal defense costs, settlements, or court judgments, up to your policy limit.

- Additional Living Expenses (ALE) or Loss of Use: If a covered disaster makes your rental unit temporarily uninhabitable, ALE covers the extra costs you incur to maintain your normal standard of living. This includes hotel bills, restaurant meals, laundry services, and pet boarding.

- Medical Payments to Others: This is a no-fault coverage that pays for reasonable medical expenses if a guest is injured on your property, regardless of who was at fault. It is designed to cover minor injuries and prevent small incidents from turning into liability lawsuits.

Pennsylvania-Specific Considerations and Exclusions

Pennsylvania tenants should be aware of common exclusions. Standard policies do **not** cover flood damage or earthquakes. Given Pennsylvania’s susceptibility to river flooding and flash floods, tenants in flood-prone areas should consider a separate policy through the National Flood Insurance Program (NFIP). Sewer or drain backup is another common exclusion that can often be added as an affordable endorsement. There are also internal sub-limits for high-value items like jewelry, fine art, or collectibles. If you own valuable items in these categories, you may need to “schedule” them separately on your policy with a professional appraisal. Understanding your specific renters insurance coverage details is key to avoiding gaps in protection.

Final Recommendations for Pennsylvania Tenants

Even in the absence of a state law, renters insurance Pennsylvania is an indispensable form of financial protection for any tenant. The average monthly cost of $15-$30 is a minimal investment compared to the tens of thousands of dollars in liability or personal property loss it can protect against. Before signing any lease, scrutinize it for an insurance requirement clause. Regardless of the lease, obtaining a policy is a prudent personal finance decision. Start by creating a home inventory to accurately estimate the value of your belongings. Then, gather quotes from at least three different insurers—including national carriers, regional PA companies, and digital providers. Be sure to ask about all available discounts, especially for bundling with your auto insurance if you have a car. Choose a deductible you can comfortably afford in case of a claim, and opt for “replacement cost” coverage for your belongings rather than “actual cash value” if your budget allows. By taking these steps, you secure not just your possessions, but also your financial future and your right to remain in your home following a covered disaster.

Frequently Asked Questions About Pennsylvania Renters Insurance

How much is renters insurance in PA?

Renters insurance in Pennsylvania (PA) typically costs between $15 and $30 per month, or about $180 to $360 per year, for a standard policy. Your exact premium depends on your specific location (city vs. rural area), the value of your belongings, your chosen deductible, and the insurance company you select.

Does PA require renters insurance?

No, the state of Pennsylvania (PA) does not have a law that requires all renters to carry insurance. However, landlords in PA are legally allowed to include a clause in the lease agreement that makes renters insurance mandatory for their tenants. In such cases, it becomes a requirement of your lease contract.

How much is renters insurance in Pennsylvania?

The average cost of renters insurance in Pennsylvania is $15 to $30 monthly ($180-$360 annually). Prices are generally higher in urban areas like Philadelphia and lower in rural counties. Factors like your coverage limits, deductible, and discounts will determine your final rate.

Does Pennsylvania require renters insurance?

Pennsylvania state law does not mandate renters insurance for all tenants. The requirement can only come from your individual lease agreement. Always read your lease carefully, as most standard leases in Pennsylvania do include a clause requiring tenants to maintain a renters insurance policy.

What is the average cost of renters insurance in Pennsylvania?

The statewide average cost of renters insurance in Pennsylvania is approximately $20 per month or $240 per year. This is for a policy with $20,000-$30,000 in personal property coverage. Actual costs range from as low as $15/month in low-risk areas to over $30/month in high-cost urban centers.

External Reference: For consumer guidance on insurance and understanding policies in Pennsylvania, the Pennsylvania Insurance Department’s Consumer Guide is an authoritative state government resource.