Shopping for tenant coverage online can lead you to quote comparison sites like MyWebInsurance.com. This detailed MyWebInsurance.com Renters Insurance review investigates whether this platform is a legitimate, helpful tool for finding affordable protection. We explain that MyWebInsurance.com is not an insurance company but a digital marketplace and lead generator that connects you with major carriers. The review covers the pros of using such a service—like receiving multiple quotes quickly—and the significant cons, including potential for increased marketing calls and a lack of personalized guidance. We provide crucial tips for navigating the process safely and effectively to ensure you find the right renters insurance policy for your needs without compromise.

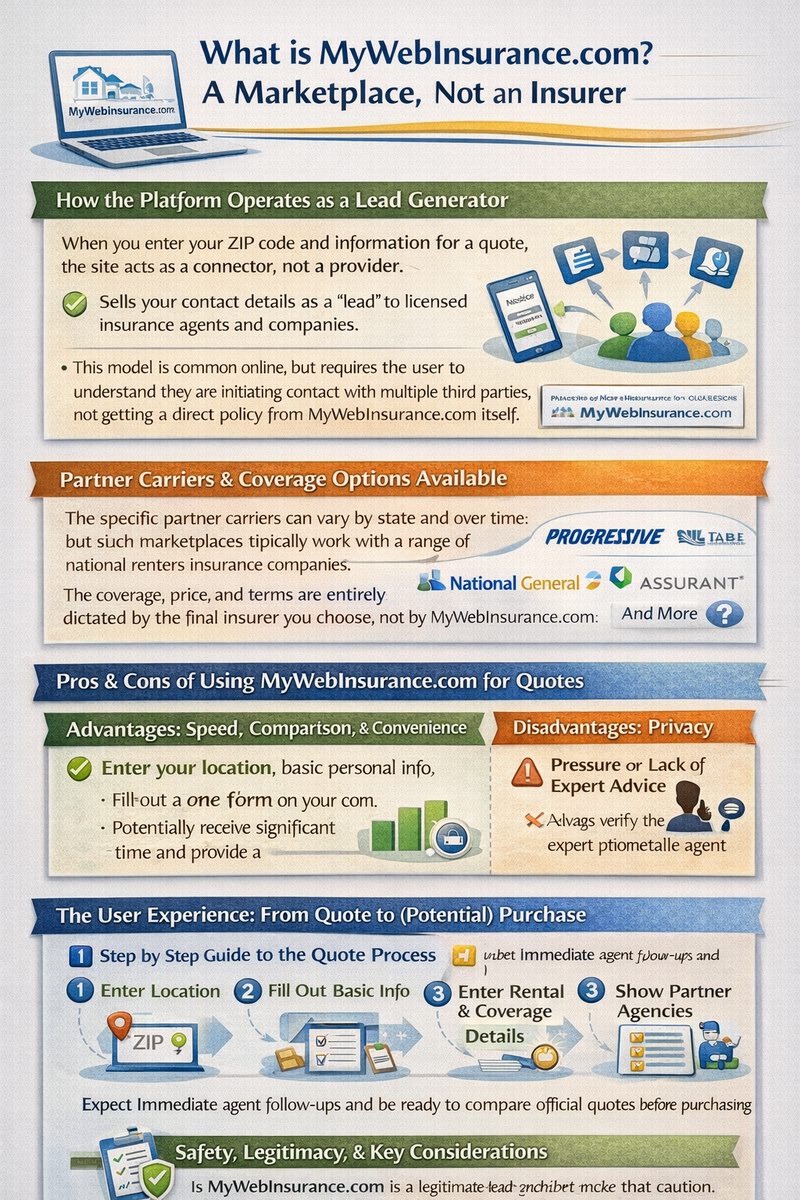

What is MyWebInsurance.com? A Marketplace, Not an Insurer

Understanding the fundamental nature of MyWebInsurance.com is key to setting proper expectations. It is a digital intermediary in the insurance shopping process.

How the Platform Operates as a Lead Generator

MyWebInsurance.com Renters Insurance services are part of a lead generation network. When you enter your ZIP code and information for a quote, the site acts as a connector, not a provider. It sells your contact details as a “lead” to licensed insurance agents and companies within its network who then contact you with quotes and sales pitches. This model is common online but requires the user to understand they are initiating contact with multiple third parties, not getting a direct policy from MyWebInsurance.com itself.

Partner Carriers and Coverage Options Available

The specific partner carriers can vary by state and over time, but such marketplaces typically work with a range of national and regional renters insurance companies. This may include providers like Progressive, National General, Assurant, and others. The coverage, price, and terms are entirely dictated by the final insurer you choose, not by MyWebInsurance.com. This means the quality of your policy depends on your selection from the quotes you receive.

Pros and Cons of Using MyWebInsurance.com for Quotes

Using an online aggregator has distinct advantages for speed and comparison, but it also comes with notable trade-offs that every renter should consider.

Advantages: Speed, Comparison, and Convenience

The primary benefit is efficiency. Instead of visiting five different insurer websites, you can fill out one form on MyWebInsurance.com to potentially receive several renters insurance cost quotes. This saves significant time and provides a snapshot of the market rate. It’s convenient for starting your research, especially if you are unsure which companies to contact and want a broad view of available options quickly.

Disadvantages: Privacy, Pressure, and Lack of Expert Advice

The major downside is the potential loss of privacy and an influx of sales contacts. By submitting your information, you consent to being contacted by multiple agents, which can lead to persistent phone calls and emails. Furthermore, you lose the benefit of personalized advice from a dedicated agent or a direct insurer’s customer service team who can explain nuanced renters insurance coverage details. The marketplace itself offers no ongoing service or claims support.

The User Experience: From Quote to (Potential) Purchase

Navigating the quote process on MyWebInsurance.com and the subsequent steps requires a strategic approach to ensure a positive outcome.

Step-by-Step Guide to the Quote Process

The process is straightforward: you enter your location, basic personal info, and details about your rental property and desired coverage. After submission, you are typically shown a list of partner agencies or a message that agents will contact you. It is critical to use accurate information to get valid quotes. Remember, the final policy details and binding coverage will come directly from the chosen insurance carrier, not from MyWebInsurance.com.

What to Expect After You Submit Your Information

Be prepared for multiple phone calls, often starting within minutes of your submission. The agents contacting you will have your basic info and will ask more detailed questions to provide a formal quote. It is wise to have a list of questions ready about coverage limits, deductibles, discounts, and the insurer’s claims process. You are under no obligation to purchase from the first agent who calls; take time to compare the official quotes you receive.

Safety, Legitimacy, and Key Considerations

While MyWebInsurance.com is a legitimate business, protecting yourself and making an informed decision requires following best practices for online insurance shopping.

Is MyWebInsurance.com a Legitimate Service?

Yes, MyWebInsurance.com is a legitimate lead generation website operating in the insurance vertical. It is not a scam. However, “legitimate” does not automatically mean it is the best or safest path for every consumer. Its business model is based on selling customer leads, which is a standard practice in digital marketing. Your experience will ultimately depend on the quality and ethics of the individual agents and companies in their network.

Critical Questions to Ask Any Contacting Agent

To maintain control and find the best renters insurance policy, vet every agent and quote thoroughly. Essential questions include: “Which specific insurance company will underwrite the policy?” “What are the exact coverage limits and deductibles?” “Can you email me the full quote and policy details in writing?” “What discounts are applied?” “What is the claims process for the underwriter?” Always verify the licensing of the agent and the financial strength rating (e.g., from A.M. Best) of the proposed insurer.

Final Verdict and Safer Alternative Strategies

So, is using MyWebInsurance.com Renters Insurance services a good idea? The answer depends on your shopping style and tolerance for sales outreach.

Who Might Benefit from This Marketplace?

This platform can be useful for renters who are comfortable with a high-volume, self-directed sales process and who value initial price comparison above all else. If you are tech-savvy, understand insurance basics, and are prepared to field many calls to sift through options, it can be a starting point. It may surface a carrier you hadn’t previously considered.

Recommended Alternatives for Shopping Renters Insurance

For most renters, a more controlled and supportive approach is advisable. Consider these alternatives: 1) Get direct quotes online from top-rated insurers like Lemonade, State Farm, or Allstate. 2) Use an independent insurance agent or broker who represents multiple companies and can provide personalized advice without selling your lead data indiscriminately. 3) Consult trusted renters insurance review sites that offer educational content alongside sponsored links, ensuring you are informed before you share your data. These methods often lead to a better long-term customer experience.

Frequently Asked Questions (FAQ)

Is MyWebInsurance.com a legitimate website for renters insurance?

Yes, MyWebInsurance.com is a legitimate online lead generation marketplace. It is not an insurance company itself but a platform that connects shoppers with licensed insurance agents and carriers from its network. While legitimate, users should be aware that submitting their information will result in multiple sales contacts.

How does MyWebInsurance.com work for getting renters insurance quotes?

You enter your ZIP code and basic information on the website. MyWebInsurance.com then sells that lead to partner insurance agencies. Those agents will contact you directly by phone and/or email to ask more detailed questions and provide actual quotes from the insurance companies they represent. The site itself does not provide binding quotes or policies.

What are the main advantages of using MyWebInsurance.com?

The primary advantage is convenience and speed for initial comparison shopping. By filling out one form, you may receive calls from multiple agents, giving you a quick overview of different companies and price points without visiting each insurer’s website individually.

What are the biggest drawbacks or risks of using MyWebInsurance.com?

Key drawbacks include: 1) Loss of privacy and an influx of sales calls/emails. 2) No personalized, unbiased advice during the selection process. 3) You are not their customer; the site offers no ongoing service or claims support. 4) The quality of the experience depends entirely on the agents who contact you.

Will MyWebInsurance.com provide me with the actual insurance policy?

No. MyWebInsurance.com does not underwrite, sell, or service insurance policies. It is a referral service. The actual insurance policy, billing, and claims support will come directly from the licensed insurance company you ultimately choose to purchase from after speaking with an agent.

What should I do after submitting my info on MyWebInsurance.com?

Be prepared to screen calls and take notes. Ask every agent which specific carrier they are quoting, request details in writing, and compare the coverage limits, deductibles, and exclusions—not just the price. Research the proposed insurer’s financial strength and customer service ratings before purchasing.

Are there better alternatives to MyWebInsurance.com for shopping?

Yes. For a more controlled experience, consider: 1) Getting quotes directly from highly-rated insurers’ websites. 2) Working with an independent insurance agent/broker who can shop multiple companies for you with a single point of contact. 3) Using comprehensive review and educational sites to inform your decision before applying anywhere.

For authoritative advice on how to shop for insurance smartly and avoid common pitfalls, the NerdWallet guide to shopping for insurance is an excellent resource.