When searching for dependable and affordable coverage for your rental home, you may come across MSI Renters Insurance as a potential provider. This MSI Renters Insurance review offers a thorough, unbiased examination of the company’s offerings, aimed at helping tenants make an informed decision. MSI, which may stand for a regional insurer or a specific insurance program, provides the essential protections renters need, but the details of its coverage, cost, and service are key to evaluation. This analysis will delve into the specifics of an MSI renters insurance policy, exploring standard inclusions, optional endorsements, and unique features. We will assess typical pricing structures, available discounts, and the critical claims handling process. Furthermore, we will synthesize available customer feedback to provide a balanced view of the strengths and potential drawbacks, empowering you to determine if MSI Renters Insurance aligns with your specific needs for safeguarding your belongings and personal liability.

Understanding MSI Renters Insurance Policy Coverage

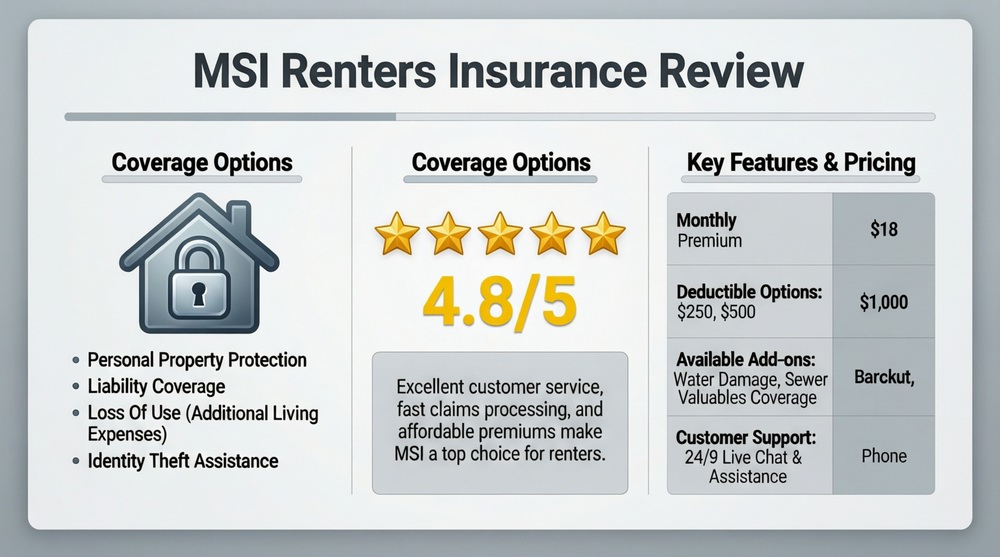

An MSI Renters Insurance policy is designed to provide the fundamental layers of protection required in any rental situation. The core of the policy typically includes personal property coverage, which protects your belongings from perils like fire, theft, vandalism, and certain types of water damage. A crucial detail to confirm in any MSI Renters Insurance quote is whether the coverage is for Actual Cash Value (ACV) or Replacement Cost Value (RCV), as this drastically affects claim payouts. Additionally, the policy includes personal liability coverage, which is essential if you are found responsible for injuries to a guest or damage to another person’s property. Medical payments to others and loss of use coverage, which helps cover additional living expenses if your rental becomes uninhabitable, are also standard components. Understanding the limits and sub-limits within these categories is the first step in evaluating the adequacy of an MSI policy for your specific circumstances.

Standard Policy Components and Coverage Limits

Examining the specifics of an MSI Renters Insurance policy reveals a structure built on industry standards. You will select a total limit for personal property coverage, but it is vital to be aware of internal sub-limits for categories such as jewelry, electronics, collectibles, and cash. For example, while your overall limit might be $40,000, reimbursement for stolen jewelry might be capped at $1,500. Liability limits often start at $100,000 and can be increased. Loss of use coverage is generally a percentage of your personal property limit. It is imperative to review your policy’s declarations page or sample documents to understand these specific numbers and avoid surprises during a claim. For a foundational explanation of these standard elements, you can explore what renters insurance is and how each part functions.

Optional Endorsements for Enhanced Protection

To customize your coverage, MSI Renters Insurance likely offers a range of endorsements or riders. These allow you to extend protection beyond the basic policy terms. A highly recommended option is the Replacement Cost endorsement for personal property, which ensures you receive the amount needed to buy new items, not their depreciated value. Scheduled Personal Property coverage is essential for high-value items like engagement rings, fine art, or high-end cameras, providing agreed-value coverage and protection against a broader range of perils, including accidental loss. Other common endorsements include Identity Theft Restoration coverage, which provides assistance and reimbursement if your identity is stolen, and increased limits for business property if you operate a home-based business. Inquiring about the availability and cost of these add-ons is a critical step when considering MSI Renters Insurance for comprehensive protection.

Analyzing the Cost and Discounts of MSI Renters Insurance

A central question for any renter is, “how much does MSI Renters Insurance cost?” The premium for an MSI policy is determined by standard risk factors: the location and type of your rental property, the coverage limits and deductible you choose, your claims history, and your credit-based insurance score (where permitted). MSI may position itself as a competitive option, potentially offering attractive base rates. To reduce this premium, they likely provide several common discounts. These can include a multi-policy discount for bundling renters insurance with another product like auto insurance, protective device discounts for having smoke detectors, burglar alarms, or deadbolt locks, and discounts for being claim-free or for opting into paperless billing and automatic payments. Obtaining a personalized quote is the only way to ascertain your exact cost, and comparing that quote with others is essential for evaluating value.

How Competitive Are MSI Renters Insurance Rates?

Based on general market analysis, MSI Renters Insurance often aims to be competitively priced, particularly for customers seeking straightforward, essential coverage. For a policy with $30,000 in personal property coverage, $100,000 in liability, and a $500 deductible, annual premiums might range from $150 to $280 for many renters, heavily influenced by geographic risk factors. The most significant savings typically come from bundling policies. However, it is crucial to ensure you are comparing equivalent coverage. A lower MSI Renters Insurance quote might be for an ACV settlement, while a slightly higher quote from a competitor includes RCV. Always verify the coverage details side-by-side. For broader context on what drives pricing across the market, reviewing information on general renters insurance cost can be instructive.

Maximizing Savings with Available Discounts

To get the best possible price on MSI Renters Insurance, you should proactively inquire about every applicable discount. The multi-policy discount is usually the most substantial and is a strong incentive to consider MSI if you also need another line of insurance from them. Security system discounts are common; accurately report any smoke alarms, fire extinguishers, deadbolt locks, or centrally monitored alarm systems in your rental. Other potential discounts could include a claims-free discount, an early signing discount, or a loyalty discount for renewing your policy. When you request a quote, either online or through an agent, ensure you provide all necessary information to qualify for these savings. This diligent approach can transform a standard MSI Renters Insurance quote into a more affordable and attractive offer, enhancing the overall value of the policy.

Customer Service and Claims Handling Review

The quality of customer service and the efficiency of the claims process are defining factors in any insurance experience. In this MSI Renters Insurance review, we assess these aspects based on common operational models and available consumer insights. MSI may operate through a network of local independent agents, through a direct-to-consumer model, or as a program offered through a larger organization (like a membership association). If service is provided through local agents, you may benefit from personalized advice and advocacy. If it is a direct model, service is typically handled via call centers and online platforms. Customer feedback on service responsiveness can vary; checking current ratings on independent platforms like the Better Business Bureau (BBB) or consumer review sites for “MSI Insurance” is highly recommended to gauge recent sentiment. The true measure of any insurer, however, is its performance during the claims process.

The MSI Claims Filing and Settlement Process

Understanding how to file and manage a claim is paramount. With MSI Renters Insurance, you would typically initiate a claim by contacting their dedicated claims department via phone or an online portal. A claims adjuster would then be assigned to investigate your loss, assess the damage, and determine the payout according to your policy terms. The efficiency and fairness of this process are critical. Factors that contribute to a positive outcome include maintaining a detailed home inventory with photos or videos of your belongings and reporting the loss promptly. Potential challenges, as noted in some consumer reviews for various insurers, can include delays in communication or disagreements over valuation. To be prepared, thoroughly understand your renters insurance coverage details before a loss occurs. For independent guidance, resources from the Insurance Information Institute offer reliable advice on navigating a claim.

Weighing the Advantages and Potential Drawbacks

A balanced MSI Renters Insurance review must summarize key pros and cons. Potential advantages include competitive pricing for basic coverage, the possibility of personalized service through local agents (depending on the model), and a standard suite of coverage options. If MSI is offered through a specific association or employer, there may be exclusive group rates or benefits. Potential drawbacks may include less brand recognition and consumer feedback compared to nationwide carriers, which can make independent research more challenging. Coverage options might be more basic, with fewer innovative endorsements or digital tools than larger, tech-forward insurers. As with any provider, it is wise to compare MSI’s offer with other reputable companies. Using a comparison service like Tejribati can help you view multiple quotes side-by-side to ensure you are getting the best overall value for your specific needs.

Final Verdict: Is MSI Renters Insurance a Good Fit?

After a comprehensive analysis, this MSI Renters Insurance review concludes with a targeted assessment. MSI Renters Insurance appears to be a viable option for renters seeking competitively priced, fundamental coverage, particularly if it is offered through a trusted local agent or a membership organization you belong to. It may be a good fit for those who prioritize straightforward protection and potentially personalized service over a wide array of high-tech features or national brand recognition. However, renters who desire a highly customizable policy with many specialty endorsements, or who prefer insurers with extensive online resources and documented customer satisfaction rankings, may want to compare MSI with other more established national brands. The final step should always be to obtain a detailed quote from MSI, carefully scrutinize the policy terms—especially regarding the settlement type (ACV vs. RCV) and sub-limits—and compare it with at least two other competitive quotes to make a fully informed decision.

Frequently Asked Questions (FAQ)

What does MSI stand for in MSI Renters Insurance?

MSI can stand for various entities, such as a regional insurance company name (e.g., “Midwest Security Insurance”) or a specific insurance program. It is important to verify the full legal name of the underwriting company on your policy documents to understand who is ultimately providing the coverage.

How do I get a quote for MSI Renters Insurance?

Quotes can typically be obtained by contacting MSI directly through their website or customer service phone number, or by working with a local independent insurance agent who represents the MSI insurance company in your area.

Does MSI offer replacement cost coverage for belongings?

This is a critical question to ask. MSI likely offers both Actual Cash Value (ACV) and Replacement Cost (RCV) options. The RCV endorsement is an upgrade that provides superior protection, paying to replace items with new ones. Always confirm which type of coverage is included in your quoted premium.

What is the process for filing a claim with MSI?

You would file a claim by contacting MSI’s claims department, whose phone number and online reporting instructions should be listed on your policy documents and the company’s website. It is recommended to report claims as soon as possible after a loss and to have your policy number and details of the incident ready.

Can I bundle my auto insurance with MSI Renters Insurance?

If MSI also sells auto insurance in your state, bundling is usually possible and is strongly encouraged, as it typically unlocks a significant multi-policy discount on both your renters and auto insurance premiums.

Is MSI Renters Insurance available nationwide?

Not necessarily. MSI may be a regional insurer or a program with limited geographic availability. You will need to check their website or contact them directly to confirm they offer renters insurance in your specific state and location.

How does MSI compare to larger, well-known renters insurance companies?

MSI may compete effectively on price and local agent service. Larger national carriers often have more brand recognition, extensive digital tools, and a wider range of policy options, but may come with higher overhead costs. The best choice depends on your individual priorities for cost, service, and coverage features.