When asking how much is renters insurance for $100,000, it’s crucial to clarify what type of coverage you mean—personal property or liability. This comprehensive guide breaks down the cost for both. We provide clear national averages and factors that influence the premium for a high-limit policy, answering the direct question: How much does $100,000 renters insurance cost? We place this in context by explaining what a normal renters insurance policy costs and what constitutes a good coverage amount for the average tenant. The article specifically addresses whether major insurers like Geico renters insurance cover $100,000 and how their policies are structured. Most importantly, we help you evaluate your needs: Is 100k enough for renters insurance? for personal property or liability? And we provide expert guidance on determining what is a good amount to have for renters insurance based on your assets, lifestyle, and risk exposure. Whether you own valuable belongings or simply want robust liability protection, this guide will help you understand the investment required for substantial coverage.

Clarifying the $100,000 Coverage Question

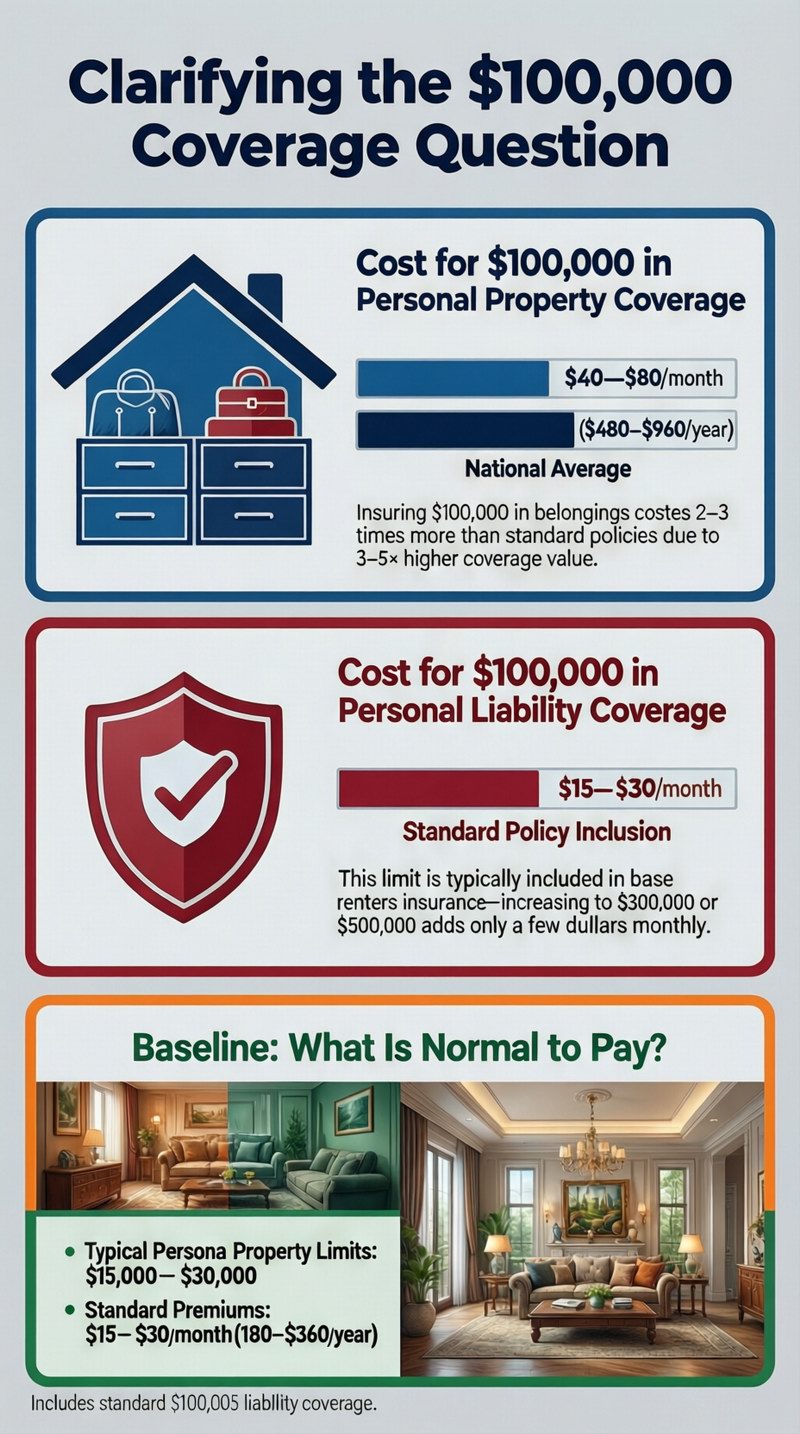

The phrase “$100,000 renters insurance” is ambiguous. It could refer to $100,000 in personal property coverage or $100,000 in personal liability coverage. The cost and necessity differ dramatically between the two.

Cost for $100,000 in Personal Property Coverage

First, let’s address the cost for insuring a high value of belongings. How much does $100,000 renters insurance cost when referring to personal property? This is a substantial amount of coverage, well above the typical $20,000-$30,000 policy. Insuring $100,000 worth of personal possessions will significantly increase your premium. Nationally, you can expect to pay approximately **$40 to $80 per month**, or **$480 to $960 annually**, for this level of personal property protection. The wide range depends heavily on your location (urban vs. rural), the specific risks in your area, your deductible, and your credit-based insurance score. To put it simply, how much does a $100,000 insurance policy cost for belongings? It costs 2-3 times more than a standard policy because you’re insuring 3-5 times more value.

Cost for $100,000 in Liability Coverage

Conversely, $100,000 in personal liability coverage is often the standard or base limit offered in a renters insurance policy. This part of the policy protects you if you’re sued for causing injury or property damage to others. The cost to include this $100,000 liability limit is baked into the standard premium. Therefore, if someone asks about the cost for “$100,000 renters insurance” meaning liability only, the answer is the standard rate: the national average of **$15 to $30 per month**. Increasing this liability limit to $300,000 or $500,000 usually only adds a few extra dollars per month, making higher liability limits an excellent value.

Normal Costs and Adequacy of $100,000 Coverage

To understand if $100,000 is appropriate, you must first know what’s typical and what factors determine a “good” amount of coverage.

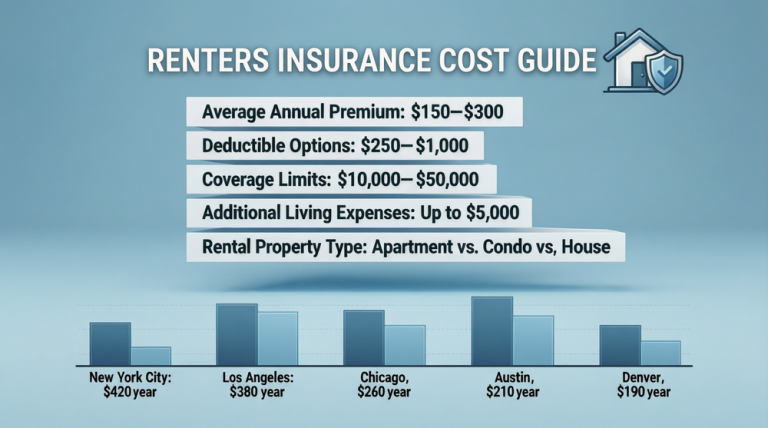

Baseline: What is Normal to Pay?

To contextualize the $100,000 cost, it’s important to know: How much is normal to pay for renters insurance? The vast majority of tenants purchase policies with personal property limits between $15,000 and $30,000. For this standard coverage, they pay the national average of **$15 to $30 per month** ($180-$360 per year). This normal renters insurance cost includes the standard $100,000 liability limit. So, a premium for $100,000 in *personal property* coverage is notably higher than the norm, while having $100,000 in *liability* coverage is the norm itself.

Is $100,000 Enough Coverage? Evaluating Your Needs

The question Is 100k enough for renters insurance? requires a two-part answer:

- For Personal Property: For most renters, $100,000 is more than enough—it’s a high limit suitable for those with expensive furniture, electronics, art, jewelry, or a large wardrobe. The average person does not need this much. You should conduct a home inventory to determine your actual need.

- For Personal Liability: $100,000 is often considered the *minimum* adequate amount. A serious injury to a guest or damage to the rental building could easily result in a lawsuit exceeding $100,000. Most experts recommend carrying **at least $300,000 to $500,000** in liability coverage, as the cost to increase from $100k to $300k is usually only $20-$40 more per *year*.

Major Insurers and Determining Your Optimal Coverage

Understanding how providers handle high limits and how to calculate your own needs is key to making a smart purchase.

Geico and High-Limit Policies

A common question is: Does Geico renters insurance cover $100,000? Yes, Geico offers renters insurance policies that can be customized to include $100,000 in personal property coverage and higher liability limits. Geico itself underwrites auto insurance but typically partners with other insurance companies (like Assurant) to provide the actual renters policy. You can easily select $100,000 or other limits during the online quoting process. The cost will follow the same principles as other insurers, based on your risk profile. It’s always wise to compare Geico’s quote for a renters insurance bundle with other major carriers.

What is a Good Amount to Have for Renters Insurance?

Determining what is a good amount to have for renters insurance is a personal calculation with two components:

- Personal Property: A good amount is the total replacement cost of all your belongings. Create a detailed room-by-room inventory, estimating what it would cost to buy everything new today. Don’t forget clothing, kitchenware, electronics, and furniture. This total is your ideal personal property limit.

- Personal Liability: A good amount is enough to protect your current assets and future income from a lawsuit. If you have savings, investments, or a high income, you should carry liability limits equal to or greater than your net worth. For most, a minimum of $300,000 is advised, with $500,000 being a safer target for a few dollars more per month.

For additional living expenses, a standard policy typically sets this at 20-40% of your personal property limit, which is usually sufficient.

Factors Affecting Premium for High-Value Policies

If you determine you need $100,000 in personal property coverage, these elements will most impact your premium.

Key Rating Factors for Expensive Belongings

When you insure a high value of property, insurers scrutinize risk more closely. Your location becomes even more critical—living in an area with high theft rates or severe weather will drive up the cost for $100,000 of coverage. The presence of specific high-risk items like fine art, jewelry, or collectibles may require them to be “scheduled” (itemized) on the policy, which involves an appraisal and an additional premium. Your deductible choice also has a larger dollar impact; opting for a $2,500 deductible instead of $500 can significantly lower your monthly cost. Finally, the type of coverage—renters insurance coverage that provides “Replacement Cost” (pays new price) versus “Actual Cash Value” (pays depreciated value)—will affect the premium, with Replacement Cost adding 10-25% to the cost but being far more valuable.

Maximizing Value on a High-Limit Policy

To get the best rate for a $100,000 personal property policy:

- Bundle: The multi-policy discount with auto insurance can save you 15-25%, offering substantial savings on an already higher premium.

- Increase Your Deductible: If you can afford a higher out-of-pocket cost per claim, this is the most effective way to lower your monthly bill.

- Ask About Security Discounts: Having a centrally monitored alarm system, deadbolts, and smoke detectors can qualify you for discounts.

- Shop Around Diligently: Premiums for high-limit policies vary even more between companies than standard policies. Get quotes from at least four different insurers.

Final Recommendations: Is $100,000 Right for You?

In conclusion, the cost for renters insurance for $100,000 in personal property is substantial ($40-$80/month) and is only necessary if you have a correspondingly high value of possessions. For liability, securing $100,000 is the baseline, but increasing it to $300,000 or $500,000 is inexpensive and highly recommended for broader protection. The best approach is to start with a thorough home inventory to determine your true personal property need—you may be surprised to find you need less (or more) than $100,000. For liability, err on the side of caution and choose a limit that protects your entire financial picture. When shopping, be precise in your quotes: specify whether you’re asking for $100,000 in personal property, liability, or both. By understanding these distinctions and assessing your actual risk, you can secure the right amount of renters insurance without overpaying for unnecessary coverage or, worse, leaving yourself dangerously underinsured.

Frequently Asked Questions About $100,000 Renters Insurance

How much does $100,000 renters insurance cost?

If you mean $100,000 in *personal property* coverage, the average cost is $40 to $80 per month ($480-$960 per year). If you mean a policy that includes the standard $100,000 in *liability* coverage, the cost is the national average of $15 to $30 per month. Always clarify which coverage type you’re referring to when getting a quote.

How much does a $100,000 insurance policy cost?

A renters insurance policy with $100,000 in personal property coverage typically costs between $40 and $80 monthly. This is 2-3 times the cost of a standard policy because it insures a much higher value of belongings. The final price depends heavily on your location, deductible, and the insurance company.

How much is normal to pay for renters insurance?

It is normal to pay $15 to $30 per month for a standard renters insurance policy. This normal price includes an average of $20,000-$30,000 in personal property coverage and the standard $100,000 in personal liability protection.

Does Geico renters insurance cover $100,000?

Yes, Geico offers renters insurance policies that can be customized to provide $100,000 in personal property coverage and $100,000 or more in liability coverage. You can select these limits during their online quote process. Geico facilitates the policy through its partner insurance companies.

Is 100k enough for renters insurance?

For personal property, $100,000 is enough for most renters and is actually a high limit. For personal liability, $100,000 is often the minimum offered but may be insufficient for a serious lawsuit. Most insurance experts recommend increasing liability coverage to at least $300,000, which is very affordable.

What is a good amount to have for renters insurance?

A good amount for personal property is the total replacement cost of all your belongings (determine via a home inventory). A good amount for liability is enough to protect your assets and future income—typically a minimum of $300,000, with $500,000 being a safer target for most renters.

External Reference: For guidance on conducting a home inventory to determine your coverage needs, the Insurance Information Institute’s Home Inventory Guide is an authoritative, step-by-step resource.