When budgeting for your new apartment or rental home, a common and important question arises: how much does renters insurance cost? Understanding the price of this essential protection is key to making an informed decision. On average, renters insurance is remarkably affordable, typically costing between $15 and $30 per month, or about $180 to $360 annually. However, your specific premium can vary significantly based on a wide range of personal and geographic factors. This comprehensive guide will break down the national and state-by-state averages, delve into the specific variables that insurers use to calculate your rate, and provide actionable strategies for finding the most competitive price. We will also dispel common myths about cost and clarify the exceptional value that renters insurance provides for such a modest investment.

National and State Averages for Renters Insurance

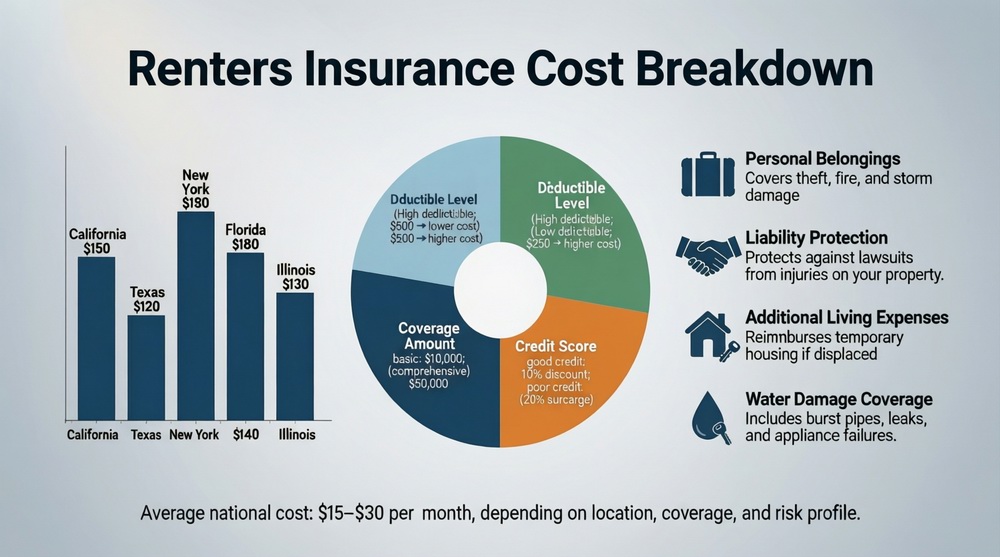

To answer “how much does renters insurance cost,” we must start with broad averages. According to recent industry data from the Insurance Information Institute and other sources, the average annual premium for a renters insurance policy in the United States is approximately $180 to $250 per year. This translates to roughly $15 to $21 per month—often less than the cost of a streaming subscription or a few cups of coffee. However, these averages mask significant regional variations. States with higher population densities, greater risk of natural disasters, or higher costs of living typically see higher average premiums. For instance, renters in Oklahoma, Texas, or Florida may pay above the national average due to severe weather risks like tornadoes and hurricanes, while those in the Midwest or Pacific Northwest might enjoy lower-than-average rates. It is crucial to get localized quotes to understand the baseline cost in your specific city or neighborhood.

What is the Monthly and Annual Cost Breakdown?

The monthly cost of renters insurance is designed to be manageable for most budgets. A policy offering $30,000 in personal property coverage, $100,000 in liability protection, and a $500 deductible commonly falls in the $15-$25 per month range. Annually, this means you are investing $180 to $300 for substantial financial protection. To put this in perspective, this annual cost is frequently less than replacing a single stolen laptop or a week’s worth of hotel expenses if you are displaced from your home. The premium is influenced by the coverage limits you choose; increasing your personal property limit to $50,000 or your liability limit to $300,000 will raise your cost, but often by only a few more dollars per month. For a foundational understanding of what you are paying for, you can explore what renters insurance is and its core components.

Why Location Drives Such Significant Price Differences

Your zip code is one of the most powerful factors determining how much your renters insurance will cost. Insurance companies analyze historical claims data for your area to assess risk. If you live in a region prone to theft, vandalism, wildfires, hurricanes, or severe storms, the statistical likelihood of a claim is higher, leading to increased premiums. Urban areas often have higher rates than rural areas due to higher crime rates and property values. Even within the same city, your premium can differ based on your neighborhood’s fire department rating (Proximity to a fire hydrant and station) and local crime statistics. This is why obtaining quotes specific to your exact address, not just your city, is a critical step in accurately estimating your cost.

Key Factors That Determine Your Personal Premium

Beyond location, several personal factors directly influence the final answer to “how much does renters insurance cost?” for you. Insurers use these variables to gauge your individual risk profile. The amount of coverage you select is the most obvious driver: higher limits for personal property and liability mean a higher premium. Your chosen deductible—the amount you pay out-of-pocket before insurance kicks in—also plays a major role. Opting for a higher deductible (e.g., $1,000 instead of $500) can lower your monthly payment. Your claims history matters; a record of previous insurance claims may result in a higher rate. In most states, insurers also use a credit-based insurance score, which studies have shown correlates with risk, to help determine your price. Finally, the construction and safety features of your rental building (like smoke detectors, burglar alarms, and fire sprinklers) can positively impact your rate.

How Your Belongings and Deductible Choice Affect Price

The total value of the belongings you need to insure is a primary cost factor. Conducting a thorough home inventory is the best way to determine an accurate personal property coverage limit. Underinsuring to save money is a risky gamble, while overestimating will lead to unnecessary premium expenses. Another critical choice is between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage. ACV policies, which reimburse you for the depreciated value of items, are cheaper. RCV policies, which pay to replace items with new ones, cost more but provide far better protection and are generally recommended. The deductible you select creates a direct trade-off: a higher deductible lowers your premium but increases your out-of-pocket cost during a claim. You must choose a deductible you can comfortably afford in an emergency. Understanding these elements of renters insurance coverage is essential for making smart, cost-effective choices.

The Impact of Discounts on Your Final Rate

One of the most effective ways to reduce how much renters insurance costs is to take full advantage of available discounts. The most substantial discount is usually for bundling or having a multi-policy discount, which applies when you purchase your renters and auto insurance from the same company. This can save you 10% to 20% or more on both policies. Other common discounts include safety device discounts for having smoke detectors, fire extinguishers, deadbolt locks, or a centrally monitored security system in your rental. Claims-free discounts reward you for maintaining a history without filed claims. You may also receive discounts for setting up automatic payments, opting for paperless billing, or paying your annual premium in full upfront. Always ask an insurer about every discount for which you might qualify, as this can significantly lower your final premium.

How to Get the Best Price on Renters Insurance

Securing an affordable rate requires a proactive approach. Start by shopping around and comparing quotes from at least three different insurers. Companies weigh risk factors differently, so prices can vary for the same coverage. Be sure to compare identical coverage limits, deductibles, and settlement types (ACV vs. RCV) for an accurate comparison. Increase your deductible to a level you can afford, as this is a guaranteed way to lower your premium. Bundle your policies if possible, and ask about all applicable discounts. Maintain a good credit score where it is a permissible rating factor, as it can lead to better rates. Finally, consider the value of loyalty versus switching; sometimes, new customer promotions offer great rates, but other times, long-term customer discounts are valuable. Using comparison tools, like those available at Tejribati, can streamline this research process.

Comparing Quotes: Online vs. Agent-Based Insurers

The method you use to shop can also influence cost. Direct-to-consumer or online-only insurers (often called “insurtech” companies) frequently offer very competitive base rates due to their lower operational overhead. They are an excellent option for getting a quick, low-cost quote entirely online. Traditional agent-based insurers (like State Farm or Allstate) may have slightly higher base premiums but often provide more personalized service and may identify discounts or coverage nuances you might miss online. The best strategy is to get quotes from both types of providers. When comparing, ensure each quote includes the liability limit, personal property limit, deductible, and settlement type you desire. This apples-to-apples comparison is the only way to truly determine which company offers the best value for your specific needs when figuring out how much renters insurance will cost you.

Common Mistakes That Unnecessarily Increase Premiums

Some renters inadvertently pay more than necessary. A common mistake is not shopping around and simply renewing a policy year after year without checking for better rates. Overestimating the value of your belongings and purchasing excessive personal property coverage also inflates your premium without benefit. Conversely, skipping important endorsements like replacement cost coverage to save a few dollars can be a costly error if you have a claim. Failing to ask about and apply for every available discount is like leaving money on the table. Finally, filing small claims for minor losses can sometimes lead to a premium increase that outweighs the claim payout, so it is often wise to handle very small losses out-of-pocket if you can afford to do so. For comprehensive, independent advice on managing insurance costs, resources from the Insurance Information Institute are highly recommended.

The Bottom Line: Value Versus Cost

When asking “how much does renters insurance cost,” it is vital to frame the expense in terms of the immense value it provides. For an average of $20 per month, you secure protection for potentially tens of thousands of dollars worth of personal belongings, robust liability coverage that shields your assets and future income from lawsuits, and a safety net for additional living expenses during a crisis. This makes renters insurance one of the most cost-effective financial safety nets available. The key is to view it not as an optional monthly bill, but as a non-negotiable component of a responsible financial plan for anyone who rents their home. By understanding the factors that influence price and taking steps to shop smartly, you can obtain this crucial protection at a price that fits your budget, ensuring peace of mind without financial strain.

Frequently Asked Questions (FAQ)

What is the average monthly cost of renters insurance?

The average monthly cost of renters insurance in the United States typically ranges from $15 to $30, with a national average around $20 per month. Your exact cost depends on your location, coverage choices, and personal risk factors.

Is renters insurance worth the cost?

Absolutely. Given its low average monthly cost, renters insurance provides exceptional value. It protects you from potentially devastating financial losses due to theft, fire, or liability lawsuits, offering peace of mind for less than the cost of most monthly subscriptions.

Does my credit score affect my renters insurance cost?

In most states, yes. Insurance companies use a credit-based insurance score as a factor in determining rates, as statistically there is a correlation between credit history and the likelihood of filing a claim. Maintaining a good credit score can help you secure a lower premium.

Can I get renters insurance for less than $15 a month?

Yes, it is possible, especially if you opt for a lower personal property limit, a higher deductible, and qualify for multiple discounts. However, ensure the policy still provides adequate basic protection and is from a reputable company.

Why is my renters insurance quote higher than the average?

A quote above the average could be due to your location (high-risk area), a lower credit-based insurance score, a need for high coverage limits, a low deductible choice, or a history of previous insurance claims. Getting multiple quotes will help identify if this is standard for your profile.

Do I need a home inventory before I get a quote?

You do not need a completed inventory to get a quote, but having a rough estimate of your belongings’ total value is very helpful. It allows you to request an accurate personal property limit, preventing you from overpaying for excessive coverage or underinsuring yourself.

How can I lower my renters insurance cost immediately?

The quickest ways to lower your cost are to: 1) Increase your deductible, 2) Bundle with another policy (like auto insurance), 3) Ask about all possible discounts (security systems, paperless billing, etc.), and 4) Shop around and compare quotes from different companies.