Allstate renters insurance is a policy offered by one of the nation’s largest and most established insurance carriers, designed to protect tenants’ personal property and provide liability coverage. Unlike newer, digital-only insurers, Allstate provides a blend of traditional agent support and modern online tools. This comprehensive review answers the most pressing questions tenants have about Allstate, from the specifics of what a policy covers to the realities of its claims process. We examine the structure of the policy declaration page, evaluate Allstate’s reputation for handling claims, and detail common exclusions and problems reported by customers. Furthermore, we analyze the factors that influence Allstate renters insurance pricing, its overall value as a protection plan, and the reasons behind claim denials to help you make an informed decision about protecting your rented home.

Understanding Allstate Renters Insurance Coverage

When considering Allstate renters insurance, it’s crucial to start with a clear definition of the product itself and the fundamental document that governs your coverage.

What is Allstate Renters Insurance?

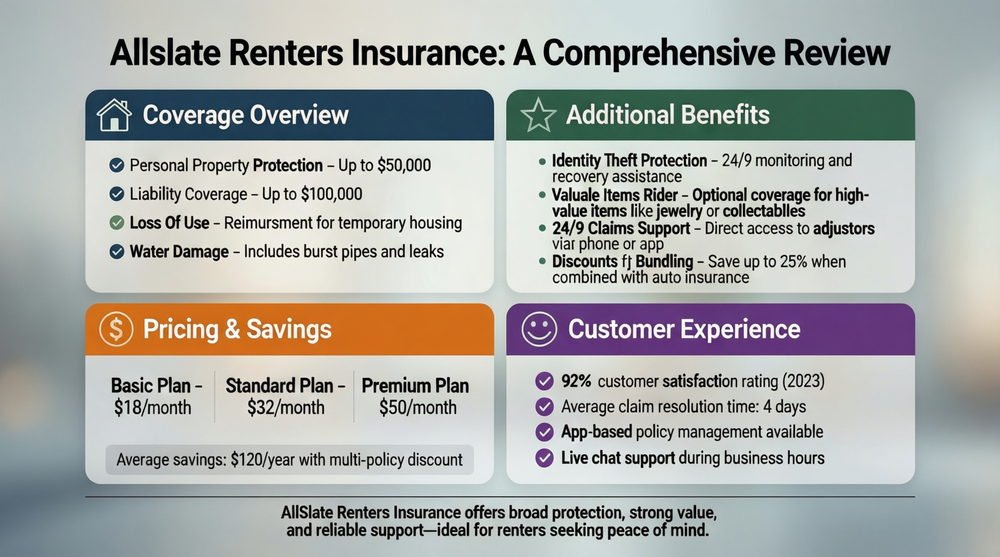

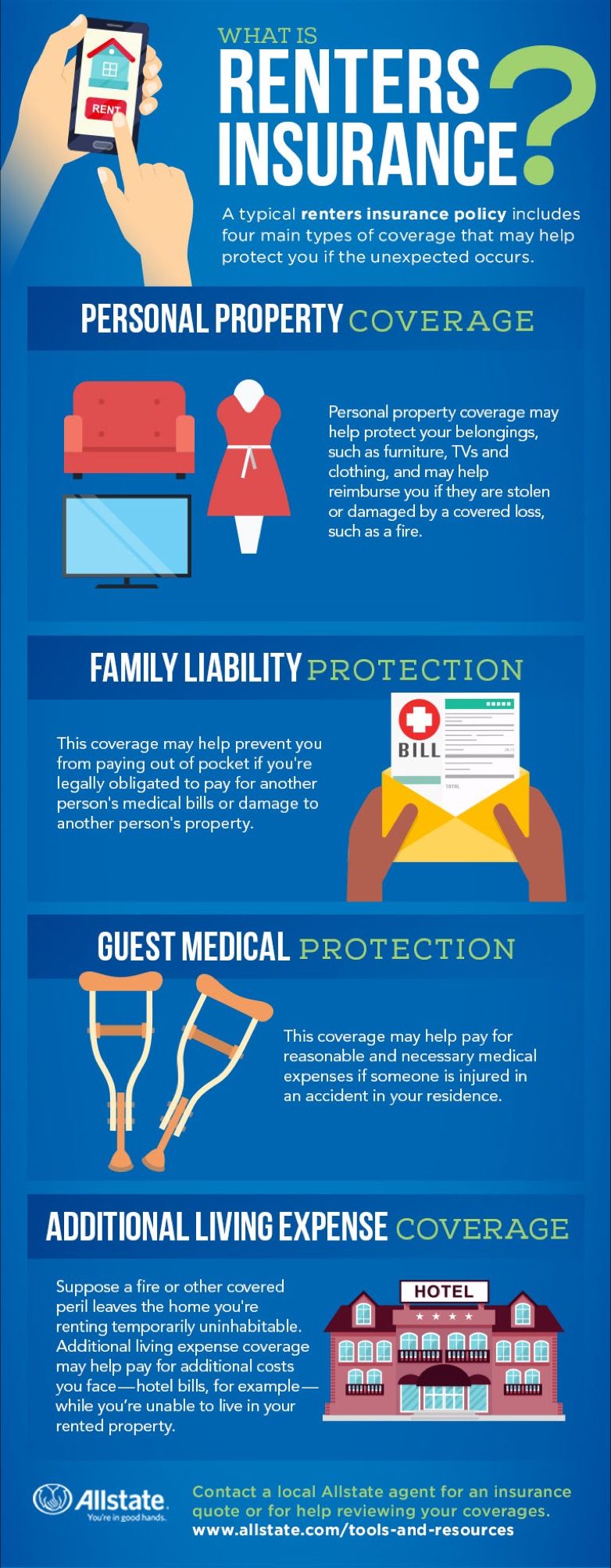

At its core, Allstate renters insurance is a contractual agreement where Allstate agrees to provide financial protection for your personal belongings and legal liability in exchange for a premium. It’s a form of renters insurance that covers losses from events like theft, fire, vandalism, and certain types of water damage. A standard Allstate policy includes three key components: Personal Property Coverage (for your stuff), Personal Liability Protection (if you’re sued for injury or property damage), and Additional Living Expenses (if you must temporarily relocate due to a covered loss). As a pillar of the insurance industry, Allstate offers the stability of a large, financially strong company with a nationwide network of agents.

Deciphering Your Policy: The Allstate Renters Insurance Policy Declaration

The Allstate renters insurance policy declaration page is the most important document you’ll receive. It’s not the full policy, but a summary that specifies the exact terms of your agreement. This page includes your name and address, the policy period (start and end dates), the specific coverage limits you selected for personal property and liability, your deductible amount, and the premium you pay. It also lists any endorsements (add-ons) you purchased, such as scheduled personal property coverage for high-value items like jewelry. Understanding this declaration page is essential because it defines the scope and limits of your renters insurance coverage. Always review it carefully and keep it with your important documents.

The Allstate Claims Process: From Filing to Payment

A policy’s true test comes when you need to file a claim. Understanding Allstate’s process, timeline, and reputation is key for any potential customer.

How to Initiate a Claim with Allstate

Knowing how to make a claim with Allstate renters insurance can streamline a stressful experience. Allstate provides multiple channels: you can file through your local Allstate agent, call their 24/7 claims hotline, or use the Allstate mobile app or website. The process typically involves providing your policy number, describing the incident (date, cause, and estimated loss), and submitting an inventory of damaged or stolen items with proof of value (receipts, photos, videos). An Allstate claims adjuster will then be assigned to investigate the loss, assess the damage, and determine coverage based on your policy terms. Prompt reporting and thorough documentation are your best allies for a smooth claims process.

Timeline and Reputation: How Long and How Good?

Two critical questions are: How long does Allstate take to pay a claim? and How good is Allstate with claims? The payment timeline varies significantly based on complexity. Simple, well-documented claims (like a stolen laptop) can be settled in a few days to a week. More complex claims involving significant damage, liability disputes, or unclear circumstances can take several weeks or even months. Allstate’s reputation in the claims department is mixed but leans positive for standard cases. They receive praise for their widespread agent network, which can provide local, personalized support during a claim. However, like many large insurers, they face criticism for delays on complex claims and for being stringent during the adjustment phase. Their financial strength (consistently high ratings from A.M. Best) means they have the resources to pay large, valid claims.

Exclusions, Limitations, and Common Customer Issues

No insurance policy covers everything. Being aware of exclusions and common pitfalls is crucial to avoid surprises.

What Allstate Renters Insurance Does Not Cover

Understanding what is not covered by the Allstate Protection Plan is as important as knowing what is covered. Standard exclusions across the industry, which Allstate follows, include damage from floods and earthquakes (require separate policies), intentional loss caused by the policyholder, normal wear and tear, and infestations (e.g., bugs or rodents). Furthermore, what does Allstate not cover that sometimes surprises renters? There are often sub-limits for certain categories of items, such as cash, jewelry, watches, furs, and collectibles. For example, your policy may have a $1,500 sub-limit for jewelry theft, regardless of your overall personal property limit. You must add a “scheduled personal property” endorsement to fully cover high-value items.

Navigating Common Problems and Denials

Potential customers should be aware of common problems with Allstate plans. These can include premium increases at renewal, complexities in canceling a policy mid-term, and challenges in getting full value for older items without receipts due to depreciation (unless you have replacement cost coverage). A major concern for many is the perception: Why does Allstate deny so many claims? It’s important to note that denial rates are not publicly disclosed in a way that allows for easy comparison. Claims are typically denied for specific, contract-based reasons: the cause of loss is an excluded peril (like a flood), the loss amount is below the deductible, there’s a lack of evidence or proof of loss, suspected fraud, or a lapse in premium payment. Meticulous documentation and understanding your policy’s fine print are the best defenses against denial.

Evaluating Cost, Value, and the Final Verdict

The final decision often comes down to price versus perceived value and service.

Is Allstate Expensive and Is It a Good Plan?

The question Is Allstate considered expensive? requires context. Compared to digital-native or direct-to-consumer insurers, Allstate’s renters insurance cost can be higher. This premium often reflects the cost of maintaining its large agent network, extensive advertising, and brand overhead. However, for many customers, the higher price buys accessibility to local, in-person support and the peace of mind that comes with a well-known, financially stable insurer. Your final cost will be personalized based on your location, coverage limits, deductible, claim history, and available discounts (like bundling with auto insurance or having protective devices).

The Bottom Line: Is Allstate a Good Protection Plan?

So, is Allstate a good protection plan? The answer depends on your priorities. If you value having a local agent you can call or visit for personalized service, prefer the stability of a major national brand, and are willing to potentially pay more for that access, then Allstate is a strong contender. Its policies are comprehensive, and its financial backing is robust. However, if your sole priority is finding the absolute lowest renters insurance premium and you are comfortable managing your policy entirely online without agent interaction, you may find more budget-friendly options elsewhere. Ultimately, Allstate renters insurance is a reliable, traditional option that offers solid protection, especially for those who appreciate a human touch in their insurance experience.

Frequently Asked Questions About Allstate Renters Insurance

What is Allstate renters insurance?

Allstate renters insurance is a policy from The Allstate Corporation that protects tenants against financial loss. It covers personal belongings from perils like theft and fire, provides liability coverage if someone is injured in your rental, and pays for additional living expenses if you’re temporarily displaced. It combines standard coverage with the option for local agent support.

How do I make a claim with Allstate renters insurance?

You can file a claim by contacting your local Allstate agent, calling their 24/7 claims hotline (1-800-ALLSTATE), or using the Allstate mobile app or website. Be ready to provide your policy number, details of the incident (date, cause, description), and a detailed list of damaged or stolen items with proof of ownership and value, such as photos, videos, or receipts.

What is not covered by the Allstate Protection Plan?

Standard Allstate renters insurance does not cover damage from floods or earthquakes (separate policies needed), intentional damage caused by the policyholder, normal wear and tear, or infestations (e.g., bed bugs). It also has specific sub-limits for categories like jewelry, cash, and collectibles, requiring additional endorsements for full coverage.

How long does Allstate take to pay a claim?

The timeline varies. Simple, straightforward claims with good documentation can be settled within a few days to a week. More complex claims involving large losses, liability questions, or require further investigation may take several weeks or months. The speed often depends on how quickly you provide required documentation and the complexity of the adjuster’s assessment.

What is the Allstate renters insurance policy declaration?

The policy declaration page is a summary document that outlines the key specifics of your insurance contract. It includes your personal information, policy period, exact coverage limits for property and liability, your deductible amount, the premium cost, and any additional endorsements you’ve purchased. It is the primary reference for your coverage details.

How good is Allstate with claims?

Allstate generally has a solid reputation for handling standard claims, supported by its large network of local agents who can provide personalized assistance. They receive high marks for financial strength and ability to pay. Customer satisfaction varies, with some reporting efficient, fair service and others experiencing delays or disputes on more complex or high-value claims, which is common in the industry.

What does Allstate not cover?

Beyond standard exclusions (floods, earthquakes, intentional acts), Allstate policies typically do not cover business property used in the home, damage from sewer backups (unless added by endorsement), loss involving pets or exotic animals, or damage from mold that results from long-term neglect. High-value items like fine art or expensive electronics may have coverage limits unless specifically scheduled.

What are common problems with Allstate plans?

Commonly reported issues include premium increases at renewal time, difficulties in canceling a policy mid-term without fees, challenges in proving the value of lost items without receipts, and perceived slow response times on complex claims. Some customers also find the process for adding endorsements or changing coverage to be less streamlined than with digital-only insurers.

Is Allstate a good protection plan?

Yes, for the right customer. Allstate offers reliable, comprehensive coverage backed by a financially strong, established company. It is an excellent choice for renters who value having access to a local agent for personalized service and advice. If you prioritize in-person support and brand stability over finding the very lowest possible premium, Allstate is a very good protection plan.

Why does Allstate deny so many claims?

Allstate, like all insurers, denies claims that fall outside the terms of the policy contract. Common reasons for denial include the cause of loss being an excluded peril (e.g., flood), lack of evidence or proof of loss, the loss being less than the deductible, policy lapses due to non-payment, or misrepresentation on the application. They are not uniquely prone to denials compared to other major carriers.

Is Allstate considered expensive?

Allstate renters insurance is often priced higher than some competitors, particularly digital-only companies. The premium reflects the cost of their extensive agent network, advertising, and brand reputation. However, cost varies widely based on location, coverage choices, discounts (like multi-policy bundles), and individual risk factors. It’s always wise to get a personalized quote and compare.

External Reference: For an independent overview of renters insurance fundamentals and consumer rights, the Insurance Information Institute (III) provides authoritative, unbiased educational resources.