Article Summary: Discovering your renters insurance claim denied can be a frustrating and stressful experience, leaving you to cover losses you believed were protected. This comprehensive guide explains the most common reasons insurers deny claims, from insufficient documentation and policy exclusions to issues of misrepresentation or late reporting. We provide a detailed, step-by-step blueprint for appealing a denial, including how to meticulously review your policy, gather compelling evidence, and escalate your case effectively. You’ll also learn crucial strategies to prevent future claim rejections by understanding your coverage thoroughly and maintaining proper documentation. If you’re facing a renters insurance claim denied situation, this guide equips you with the knowledge and tools to fight back and secure the coverage you deserve.

Top Reasons Why Renters Insurance Claims Get Denied

Understanding why an insurance company says renters insurance claim denied is the first step toward challenging their decision. Denials are rarely arbitrary; they are based on specific policy language and claims procedures.

1. Lack of Documentation or Proof of Loss

This is arguably the leading cause of claim denials. Insurance companies operate on evidence. A claim for stolen electronics without a police report, or for water damage without photos and repair estimates, is often deemed unsubstantiated. Proof must establish both the occurrence of the covered event and the value of what was lost.

2. The Cause of Loss is a Policy Exclusion

All renters insurance policies list “exclusions”—perils they explicitly do not cover. Common exclusions that lead to a renters insurance claim denied include:

- Flooding: Surface water or groundwater entering the home requires separate flood insurance.

- Earthquake: Typically excluded, though often available as an add-on.

- Intentional Loss: Damage you or a resident family member cause on purpose.

- Wear and Tear/Maintenance: Slow leaks, mold from humidity, or deterioration are considered homeowner maintenance issues.

3. Misrepresentation or Non-Disclosure on Application

If you failed to disclose a material fact when applying for renters insurance—such as owning a prohibited breed of dog, running a business from home, or having a previous claim history—the insurer may deny a related claim and potentially void the policy entirely, citing material misrepresentation.

4. Filing the Claim After the Deadline

Your policy requires you to report losses “promptly” or within a specific timeframe (often 48-72 hours for theft, sooner for reporting to police). Delaying notification can compromise the insurer’s ability to investigate and is a valid ground for denial.

5. Insufficient Coverage for the Item (Sub-limits)

Even if a claim is approved, you might not get the full amount you expected. Policies have “sub-limits” for categories like jewelry, fine art, or electronics (e.g., $1,500 for all jewelry). A $5,000 ring stolen may only yield a $1,500 payout unless it was specifically scheduled on the policy.

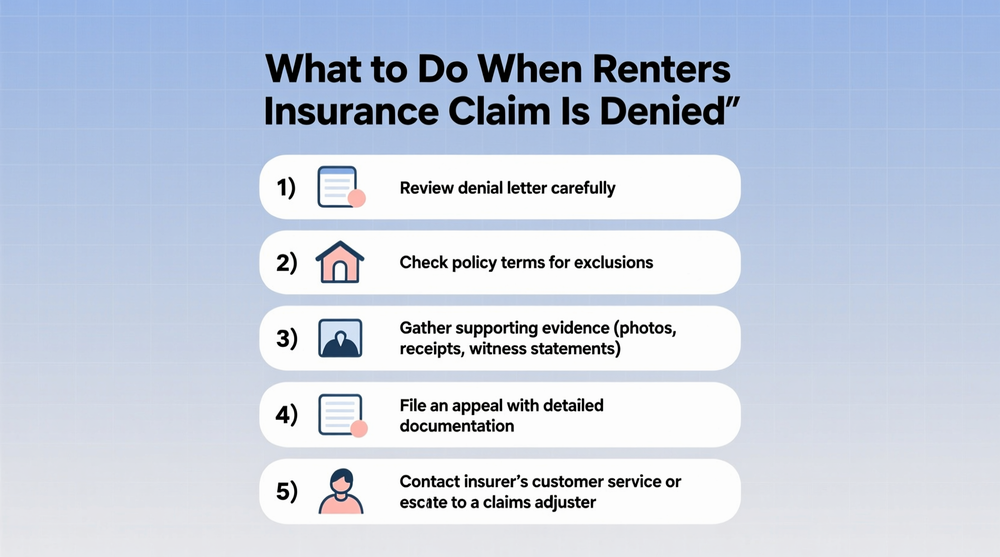

The Step-by-Step Appeal Process for a Denied Renters Insurance Claim

When renters insurance claim denied, a denial letter is not the final word. A structured, professional appeal can overturn the decision.

Step 1: Review the Formal Denial Letter & Your Policy

The insurer is legally obligated to provide a denial in writing, citing the specific policy language justifying their decision. Obtain your full policy document (not just the summary) and cross-reference the cited clauses. Understand exactly which exclusion or condition they claim you violated.

Step 2: Gather Compelling Evidence & Documentation

Build an airtight case to counter the denial reason. This may include:

- New photos/video evidence you didn’t submit initially.

- Original receipts, credit card statements, or owner’s manuals proving ownership and value.

- A detailed, written timeline of the event and your actions.

- Expert opinions (e.g., a contractor’s report stating damage was from a sudden pipe burst, not long-term seepage).

Step 3: Draft and Submit a Formal Appeal Letter

Your appeal should be a clear, factual, and unemotional business letter. It must include:

- Your policy number and claim number.

- A statement that you are appealing the denial.

- A point-by-point rebuttal of the denial reasons, referencing specific policy sections.

- A summary of the new evidence you are enclosing.

- A clear request for the action you want (a full review and reversal of the denial).

- A deadline for their response (e.g., 15 business days).

Step 4: Escalate Within the Insurance Company

If the first appeal is rejected, ask to have your case reviewed by a claims supervisor or the company’s internal dispute resolution team. Persistence at a higher level can often yield a different outcome.

Step 5: File a Complaint with Your State’s Department of Insurance

If internal appeals fail, file a complaint with your state’s regulatory body. Insurance companies must respond to these complaints, and the involvement of a regulator often prompts a serious re-evaluation. For Ohio, this is the Ohio Department of Insurance.

Legal Rights and Options When a Renters Insurance Claim is Wrongfully Denied

Renters insurance claim denied and appeals and regulatory complaints don’t work? legal avenues remain.

Understanding “Bad Faith” Insurance Practices

Insurers have a legal duty to handle claims fairly and in good faith. Actions that may constitute “bad faith” include:

- Denying a claim without a reasonable investigation.

- Failing to explain the denial with specific policy references.

- Significantly delaying payment without justification.

- Offering a settlement far below the claim’s reasonable value.

A successful bad faith lawsuit can result in payment of the claim plus additional damages.

Hiring an Attorney vs. Public Adjuster

For complex or high-value denials, professional help may be necessary.

| Professional | Role | Best For | Cost |

|---|---|---|---|

| Public Adjuster | Works for YOU to assess damage, document the claim, and negotiate with your insurer. | Disputes over the value or extent of damage. | Percentage of the final settlement (typically 10-20%). |

| Insurance Attorney | Provides legal advice, sends demand letters, and can file a lawsuit for breach of contract or bad faith. | Clear wrongful denials, policy interpretation disputes, or suspected bad faith. | Hourly rate or contingency fee (a percentage of winnings). |

How to Prevent Future Renters Insurance Claim Denials

Proactive management of your policy is the best defense against denial.

Conduct a Thorough Annual Policy Review

Don’t just auto-renew. Each year, read your policy’s “Declarations Page” for coverage limits and the “Exclusions” section. Ask your agent questions about anything unclear. Update your policy after major purchases (e.g., new laptop, jewelry) to ensure adequate renters insurance coverage.

Create and Maintain a Home Inventory

A dynamic home inventory is your most powerful tool. Use a video walkthrough of your home, narrating items, showing serial numbers, and estimating values. Store this video and photos of receipts in cloud storage (e.g., Google Drive, Dropbox). Update it after significant purchases.

Understand and Mitigate Common Exclusions

Know your policy’s gaps and fill them.

- Flood: Check FEMA’s flood maps and purchase a separate policy if needed.

- Sewer Backup: This is a common and critical add-on endorsement for renters insurance cost that is often worth the extra premium.

- High-Value Items: “Schedule” expensive jewelry, art, or equipment by providing an appraisal to your insurer for full coverage.

Conclusion

Receiving a notice that your renters insurance claim denied is a significant setback, but it is frequently not the end of the road. By methodically understanding the denial reason, leveraging a formal appeals process, and knowing when to involve regulators or legal professionals, you can effectively challenge the insurer’s decision. More importantly, by taking proactive steps like maintaining detailed inventories, understanding your policy exclusions, and reporting claims promptly, you can dramatically reduce the risk of future denials. Treat your renters insurance as an active partnership—know your responsibilities, document everything, and advocate fiercely for your rights as a policyholder.

Frequently Asked Questions (FAQ)

1. How long do I have to appeal a denied renters insurance claim?

There is no universal deadline, but you should act immediately. Your policy may specify an appeal timeframe, and delaying can hurt your case. Starting the appeal process within 30-60 days of receiving the denial letter is generally advisable.

2. Can my insurance company cancel my policy just because I filed a claim?

In most states, an insurer cannot cancel a policy mid-term solely because you filed a claim. However, they may choose not to renew your policy when it expires if you have multiple claims. A single claim for a significant, legitimate loss should not lead to non-renewal in most cases.

3. What is the difference between a claim being denied and a claim being underpaid?

A denial means the insurer refuses to pay anything, arguing the loss isn’t covered. An underpayment means they’ve accepted the claim but offered a settlement you believe is too low, often due to a dispute over the item’s value or the repair cost. The dispute resolution strategies differ slightly.

4. Should I ever accept the insurance company’s first denial as final?

Almost never. The initial denial is often a standard procedure. Many claims are successfully overturned on the first appeal with additional documentation or clarification. Always pursue at least one formal appeal before giving up.

5. What specific words should I look for in my denial letter?

Key phrases that indicate the denial reason include: “not a covered peril,” “policy exclusion applies,” “lack of supporting documentation,” “failure to mitigate damages,” “loss occurred outside the policy period,” or “material misrepresentation on application.” Each requires a specific rebuttal strategy.

6. Does hiring a public adjuster or attorney guarantee I’ll win my appeal?

No, it does not guarantee victory, but it significantly increases your chances for complex cases. These professionals understand policy language, claims law, and negotiation tactics far better than the average consumer. They can identify errors or bad faith practices that you might miss.

7. If my appeal is successful, will my future premiums go up?

Potentially, yes. Any paid claim, even one initially denied but later paid on appeal, can be considered in your claims history and may affect your future renters insurance cost or eligibility. However, paying for a legitimate covered loss is the primary purpose of insurance.