In the evolving landscape of insurance, Homebody renters insurance emerges as a modern provider aiming to simplify and personalize protection for today’s tenants. This Homebody renters insurance review provides an in-depth look at this innovative company, which operates entirely online and focuses on a streamlined, user-friendly experience. Homebody differentiates itself by offering a single, comprehensive coverage amount that bundles protection for your belongings, liability, and additional living expenses, along with unique perks like smart home device reimbursement. This guide will examine the specifics of a Homebody policy, break down its all-in-one coverage model, evaluate its cost and digital claims process, and assess its strengths and potential drawbacks. Our goal is to help you determine if Homebody renters insurance aligns with your need for straightforward, tech-forward protection for your rental home.

Understanding the Homebody Renters Insurance Model

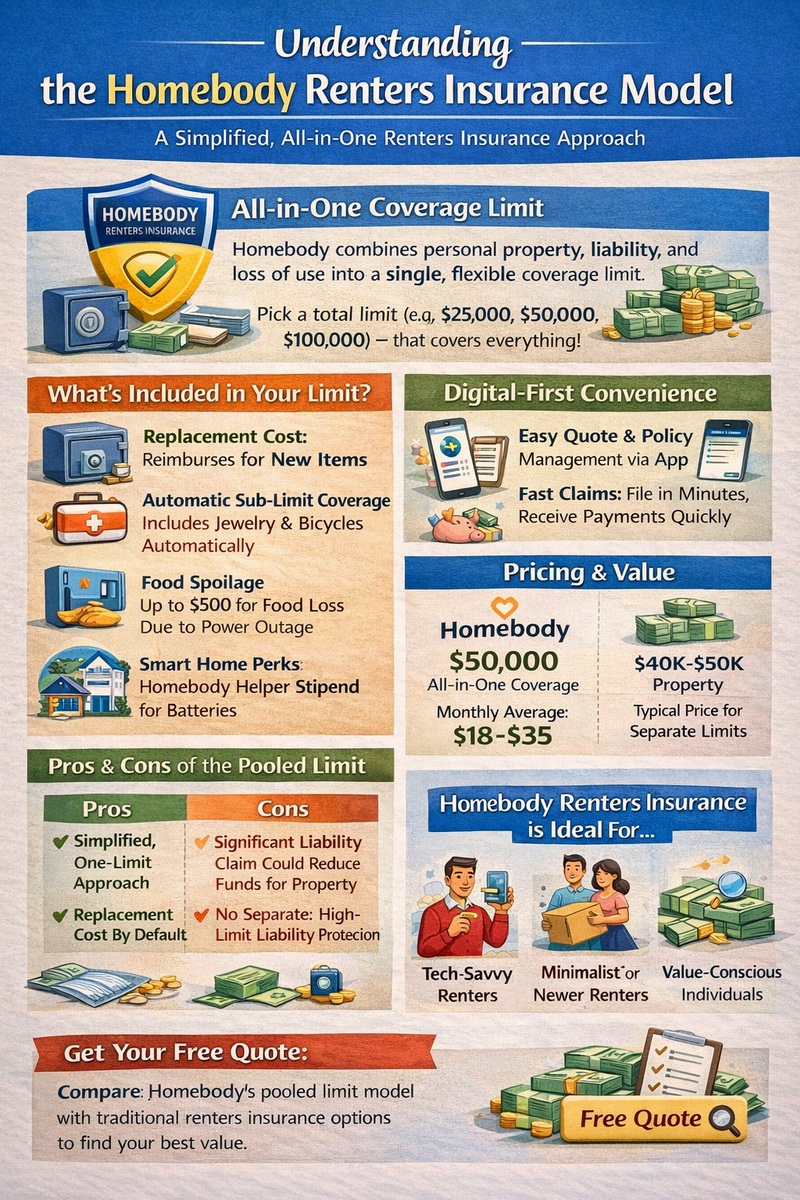

Homebody renters insurance takes a simplified approach to coverage. Instead of selecting separate limits for personal property, liability, and loss of use, you choose one total coverage amount (e.g., $25,000, $50,000, $100,000). This single limit applies across all categories of your policy, providing a pool of money that can be used flexibly to cover belongings, liability claims, or temporary living expenses as needed. The company promotes this as a simpler, more intuitive way to buy insurance. A standard Homebody policy includes all the essential protections: coverage for personal property against named perils like fire, theft, and vandalism; personal liability protection; medical payments to others; and loss of use coverage. Additionally, Homebody includes some modern perks, such as a stipend to replace batteries in smart home devices and coverage for food spoilage due to a power outage. This model is designed for renters who prefer a minimalist, digital-first insurance experience.

What is Included in the All-in-One Coverage?

Digging into the details of Homebody renters insurance reveals a policy built for convenience. The single coverage amount you select is the maximum the policy will pay out in total across all claim types during the policy period. For example, if you have a $50,000 policy and file a claim for $15,000 in stolen belongings, you would have $35,000 remaining for any future liability or additional living expense claims. The personal property coverage typically includes replacement cost value (RCV) for belongings, which is a significant advantage over actual cash value (ACV) policies. Homebody also includes automatic coverage for items like jewelry and bikes up to certain sub-limits, which can be increased. The liability coverage is robust, and the loss of use benefit is included within your total limit. For a comparison to traditional policy structures, you can explore what renters insurance is and its standard components.

The Digital Experience and Smart Home Focus

A key aspect of any Homebody renters insurance review is its fully digital platform. The entire process—from getting a quote and purchasing a policy to filing claims and managing your account—is handled through Homebody’s website or mobile app. The interface is clean and designed for ease of use. A unique feature is Homebody’s focus on smart home technology. They offer a “Homebody Helper” benefit, which provides a small annual reimbursement (e.g., $50) for batteries in connected devices like smoke detectors, door locks, or water leak sensors. This incentivizes and rewards renters for making their homes safer. The digital experience extends to claims, which are filed through the app with the ability to upload photos and chat with claims specialists. This model is tailored for tech-savvy renters who are comfortable managing their financial products online without agent interaction.

Analyzing the Cost and Value of Homebody Renters Insurance

Homebody renters insurance positions itself as a competitively priced, value-driven option. Your premium is based on the single coverage amount you choose, your location, and the details of your rental property. Because the company operates with a digital-first model and a simplified product structure, it can often offer lower overhead costs, which may translate to competitive rates. The inclusion of replacement cost coverage and the smart home battery reimbursement adds value compared to some basic policies from traditional insurers. However, it is crucial to understand that the single, pooled limit means a large liability claim could significantly reduce the amount available to replace your belongings later, or vice versa. When evaluating cost, you should compare the total Homebody premium for a given coverage amount against the premium for a traditional policy with similar, but separate, limits for property and liability.

How Does Homebody’s Pricing Compare?

Based on available market comparisons, Homebody renters insurance often falls within a competitive price range for the coverage it provides. For a $50,000 all-in-one policy, monthly premiums might range from $18 to $35, depending on your location and risk factors. This is generally in line with or slightly below what you might pay for a traditional policy with $40,000-$50,000 in personal property coverage and $100,000 in liability. The true comparison requires matching the total protection. A traditional $50,000 policy with separate $100,000 liability is not directly equivalent to Homebody’s $50,000 pooled limit. For renters with relatively low liability risk who prioritize simple pricing, Homebody can be an excellent value. For those wanting high, distinct liability limits, the traditional model might be preferable. For context on average market rates, see our guide on renters insurance cost.

Understanding the Pooled Limit: Pros and Cons

The pooled limit is the most distinctive and consequential feature of Homebody renters insurance. The primary advantage is simplicity: you have one number to remember and manage. It can also be efficient for renters who do not need extremely high liability limits, as it avoids paying for separate, unused capacity. The potential disadvantage is the risk of underinsurance in one area depleting coverage for another. For instance, if you have a $30,000 policy and successfully face a $25,000 liability lawsuit, you would only have $5,000 left to cover all your personal belongings for the remainder of the policy term. This interlinked coverage requires you to carefully consider your total potential risk when selecting your limit. It is a different way of thinking about renters insurance coverage that may not suit everyone, particularly those with significant assets to protect.

Customer Experience and Claims Process Review

Homebody’s customer experience is designed around digital convenience and quick service. Support is offered through email, chat, and phone, but there are no local agents. This appeals to those who prefer self-service and fast digital responses but may frustrate renters who want personalized, ongoing advice from a dedicated agent. The claims process is a central part of the Homebody renters insurance review. Claims are initiated and managed entirely through the app. You can upload photos, describe the incident, and track the claim’s status in real-time. Homebody states that many simple claims can be paid within hours. This efficiency is a major selling point. However, for complex claims (like a major theft or liability dispute), the lack of a local advocate could be a drawback. Checking recent customer reviews on third-party sites can provide insight into real-world claims satisfaction and support responsiveness.

Filing a Claim with Homebody: A Digital-First Approach

The claims process with Homebody renters insurance is built for speed. After an incident like a theft or water leak, you would open the Homebody app, navigate to the claims section, and follow the prompts. You will be asked to provide details, upload supporting photos or documents, and submit the claim electronically. A claims specialist is assigned to review the submission. For straightforward claims with clear documentation, the process can be very fast, with direct deposit payments issued quickly. The success of this model hinges on your ability to thoroughly document the loss. As with any insurer, having a pre-existing home inventory is immensely valuable. For expert advice on preparing for a claim, resources from the Insurance Information Institute are helpful. The digital process is efficient but places more responsibility on the policyholder to provide accurate, immediate documentation.

Advantages and Potential Drawbacks of Choosing Homebody

This Homebody renters insurance review would be incomplete without a balanced summary. Key advantages include a simple, all-in-one coverage model, a fully digital and user-friendly experience, fast claims processing for simple losses, and unique perks like the smart home battery reimbursement. The inclusion of replacement cost coverage by default is a significant plus. Potential drawbacks center on the pooled limit, which may not provide enough distinct protection for high-liability risks or valuable belongings. The lack of local agent support can be a negative for those who prefer guidance. Furthermore, as a newer, digital-only insurer, its long-term claims handling reputation for major disasters is still being established. It is wise to compare Homebody’s offering with other providers; using a service like Tejribati can help you see multiple options.

Final Recommendation: Who is Homebody Best For?

Based on this comprehensive analysis, Homebody renters insurance is an excellent fit for a specific type of renter. It is ideal for tech-savvy individuals who prefer managing everything online, appreciate a minimalist and simple coverage structure, and do not have exceptionally high-value possessions or complex liability concerns. It is a great choice for renters in smaller apartments or those just starting out who want an affordable, comprehensive policy with a modern interface. However, renters with significant assets, those who desire high separate liability limits (e.g., $500,000+), or people who prefer the personalized service of a local agent may find traditional insurers or hybrid models more suitable. The final step is to get a personalized Homebody quote, carefully consider if the pooled limit meets your total risk profile, and compare it with a few traditional quotes to ensure you are selecting the best overall value for your situation.

Frequently Asked Questions (FAQ)

What is the single coverage amount in a Homebody policy?

The single coverage amount is the total limit of your Homebody renters insurance policy. It is a pooled amount that covers all aspects of your policy combined: personal property replacement, liability claims, and additional living expenses.

Does Homebody cover replacement cost or actual cash value?

Homebody renters insurance typically includes replacement cost coverage for your personal belongings as a standard feature. This means you would receive the amount needed to buy a new equivalent item, not the depreciated value.

How does the smart home battery reimbursement work?

Homebody offers an annual benefit (e.g., $50) called “Homebody Helper” that reimburses you for batteries used in smart home devices like smoke alarms, water sensors, or smart locks. You submit receipts through the app to receive the reimbursement.

Can I increase coverage for specific items like jewelry?

Yes, while Homebody includes automatic coverage for items like jewelry and bikes, these have sub-limits. You can purchase additional “extra coverage” for specific high-value items to increase those limits for full protection.

What happens if I use my full limit on a liability claim?

If a liability claim uses your entire policy limit, you would have no remaining coverage for personal property or additional living expenses for the rest of that policy term. It is crucial to select a limit that accounts for your total potential risk.

Is Homebody renters insurance available in all states?

No, Homebody is not available nationwide. It is currently licensed in a growing number of states. You must enter your zip code on the Homebody website to check availability in your specific location.

How do I cancel my Homebody policy if I need to?

You can cancel your Homebody renters insurance policy at any time directly through your online account dashboard or by contacting their customer support. You should receive a pro-rated refund for any unused premium.