In the evolving landscape of insurance, Toggle Renters Insurance emerges as a distinctly innovative player, challenging the traditional one-size-fits-all policy model. This Toggle Renters Insurance review provides an in-depth analysis of the company’s unique “pay-per-thing” approach, its coverage details, and overall value proposition for today’s renters. Unlike standard insurers, Toggle, a Farmers Insurance subsidiary, allows you to build a policy by adding individual coverage bundles for specific categories of belongings, such as electronics, sports equipment, or jewelry, on top of a base plan. This model promises greater flexibility and the potential to pay only for what you truly need. This review will dissect how this system works in practice, examining the core protections, the customization process, and the accompanying digital tools. We will analyze pricing transparency, the claims experience, and weigh the notable advantages and potential limitations of choosing Toggle Renters Insurance for protecting your rental home and possessions.

Understanding the Toggle Renters Insurance Model

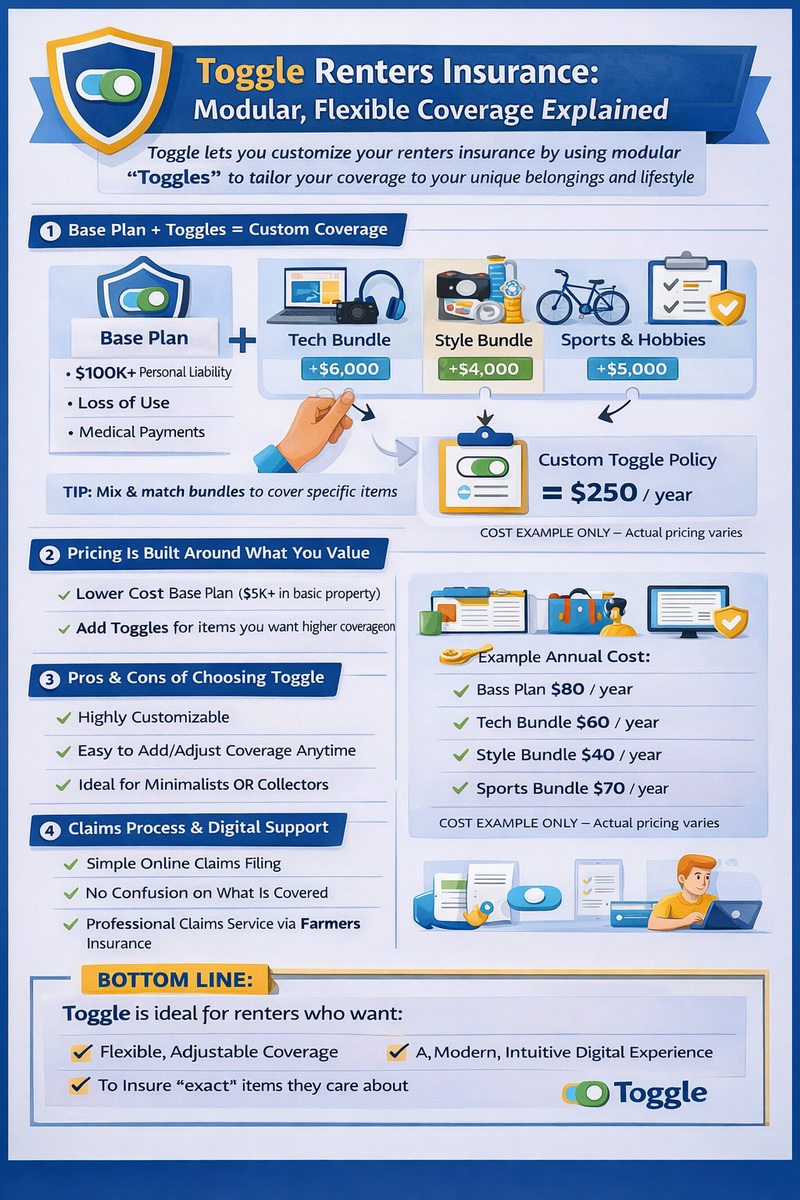

The foundational concept of Toggle Renters Insurance is its modular, a la carte structure. It begins with a base plan that includes the essential components required of any renters policy: personal liability coverage, medical payments to others, and loss of use coverage. Notably, the base plan traditionally includes only a minimal amount of personal property coverage for very basic items. The real customization begins with “Toggles” – which are add-on bundles you select to cover specific categories of your belongings. For example, you can add a “Tech Bundle” for your laptop and camera, a “Style Bundle” for clothing and jewelry, or a “Sports & Hobbies Bundle” for your bicycle or musical instruments. Each Toggle comes with a defined coverage limit and a specific price. This model is the centerpiece of any Toggle Renters Insurance review, as it fundamentally changes how you think about and purchase coverage, aiming for precision over estimation.

What’s Included in the Base Plan and Toggle Add-Ons?

A critical step in this Toggle Renters Insurance review is clarifying what the base plan does and does not cover. The base plan typically provides substantial liability protection (often starting at $100,000), medical payments coverage, and loss of use benefits. However, it includes only a small, stated amount for “basic stuff” – usually a low limit like $2,000 to $4,000 for broad categories of personal property not specified in your added Toggles. This means if you do not add Toggles for your major possession categories, you may be significantly underinsured. Each Toggle add-on provides a higher, specific limit for that category and broader protection, often covering accidental damage (like dropping your phone) in addition to standard perils like theft and fire. This structure requires you to actively consider the value of your possessions in discrete groups. For a comparison to standard policy structures, you can explore what renters insurance is in a traditional sense.

The Digital Experience and Customization Process

Toggle’s entire experience is built for digital-native consumers. The process starts with an online questionnaire that guides you through selecting the Toggles relevant to your life. The interface is designed to be intuitive, asking simple questions about what you own and prompting you to add bundles accordingly. You can adjust limits and see the price impact in real-time, providing clear transparency. The platform also includes digital tools for managing your policy, accessing ID cards, and filing claims. A notable feature is the ability to easily adjust your coverage at any time—if you buy a new expensive bike, you can log in and add or increase a Toggle outside of the standard renewal period. This flexibility is a key selling point highlighted in many Toggle Renters Insurance reviews, appealing to renters with changing lifestyles or those who acquire significant new items throughout the year.

Analyzing Cost and Value of Toggle Renters Insurance

The pricing for Toggle Renters Insurance is inherently variable, as your premium is the sum of the base plan cost plus the price of each selected Toggle add-on. Factors influencing the base price include your location, desired liability limits, and deductible. The cost of each Toggle depends on the category and the coverage limit you choose within that bundle. This model can lead to significant savings for renters with fewer expensive belongings, as they can forego add-ons for categories that do not apply to them. Conversely, renters with high-value items across multiple categories may find the total premium adds up quickly. Toggle may offer standard discounts such as multi-policy discounts for bundling with auto insurance (through Farmers), protective device discounts, and payment plan discounts. The true test of value is comparing a fully customized Toggle quote against a traditional policy with equivalent total coverage limits.

Is Toggle Renters Insurance Cheaper Than Traditional Policies?

Whether Toggle Renters Insurance is more affordable depends entirely on your inventory. For a minimalist renter with modest electronics and clothing, skipping most Toggles could result in a very competitive premium. However, for a renter who needs to fully replace $30,000 worth of belongings, the cumulative cost of sufficient Toggle add-ons to reach that level of protection may be comparable to or even exceed the price of a standard $30,000 blanket policy from a competitor. The advantage is not necessarily a lower price, but rather the perception of paying for precise, itemized coverage without “wasting” money on a high blanket limit you may not need. To make an accurate comparison, you must build a Toggle quote that mirrors the total replacement cost of your belongings and then get a traditional quote for the same total amount. For context on market pricing, reviewing information on renters insurance cost is helpful.

Understanding Coverage Gaps and Limits

A crucial part of a responsible Toggle Renters Insurance review is examining potential gaps. The most significant risk is underestimating the value of your possessions or forgetting to add a Toggle for a category. If a fire destroys your living room and you only had Toggles for “Tech” and “Sports,” your basic furniture, books, and kitchenware would only be covered under the minimal “basic stuff” limit, potentially leaving you with a substantial out-of-pocket loss. It requires diligent self-assessment. Furthermore, each Toggle has its own sub-limit for certain types of items (e.g., a cap on jewelry within the “Style” bundle), which may necessitate scheduling an extra-high-value item separately. Understanding these inner limits is essential to ensure your renters insurance coverage is truly adequate. Toggle’s model puts the onus on the consumer to be thorough.

Customer Experience and Claims Handling Review

Toggle Renters Insurance operates entirely online and via mobile, aligning with its target audience of digitally-savvy renters. Customer service is provided through digital channels (chat, email) and a phone support line, without local agents. This streamlined model can mean fast, efficient service for routine questions and changes but may lack the personalized guidance some policyholders desire, especially when navigating a first-time claim. The claims process is designed to be integrated into the digital platform. You can file a claim online, and the process is theoretically simplified because your policy already categorizes your damaged items into specific Toggles. However, you will still need to provide proof of ownership and value, such as receipts or photos. The efficiency of claims settlement will depend on the underlying underwriter’s (Farmers Insurance) processes. Checking recent customer reviews on independent sites can provide insight into current satisfaction levels with Toggle’s support and claims handling.

The Claims Process in a Toggle-Specific Model

Filing a claim with Toggle Renters Insurance follows a digital-first path. You would report the claim through their app or website, specifying which Toggle categories are involved. The modular nature of the policy could potentially make assessing the loss more straightforward for both you and the adjuster, as items are pre-categorized. However, challenges could arise if you need to claim items that fell under the low “basic stuff” coverage or if there is a dispute over whether an item belongs to a specific Toggle category. Having a detailed home inventory, which Toggle encourages you to maintain digitally, remains critically important. For expert advice on preparing for a claim, resources from the Insurance Information Institute are invaluable. The success of this model hinges on the clarity of your initial policy setup and the responsiveness of the claims team.

Advantages and Disadvantages of Choosing Toggle

This Toggle Renters Insurance review would be incomplete without a balanced summary of pros and cons. The primary advantages are customization and flexibility; you can tailor coverage closely to your actual belongings and adjust it as your life changes. The transparent, itemized pricing model is appealing, and the digital experience is generally sleek and user-friendly. For the right person, it can feel more fair and modern. The main disadvantages involve the risk of coverage gaps due to user error in selecting Toggles, the potential for higher costs if you have many valuable items across categories, and the lack of local agent support for complex situations. It may not be the best fit for renters who prefer a set-it-and-forget-it blanket policy or who want professional advice from an agent. Comparing Toggle’s quote with other options on a platform like Tejribati is highly recommended to see all available choices.

Final Recommendation: Who Should Consider Toggle?

Based on this comprehensive analysis, Toggle Renters Insurance is an ideal solution for a specific type of renter. It is perfectly suited for tech-savvy, detail-oriented individuals who have a clear understanding of what they own and enjoy having granular control over their financial products. It works well for renters with a minimalist lifestyle or those whose valuable possessions are concentrated in one or two clear categories (e.g., a photographer with expensive tech but modest furniture). Conversely, it may be less optimal for renters with densely furnished homes containing many medium-value items across all categories, as the Toggle model could become cumbersome and expensive. It is also less ideal for those uncomfortable with self-directed insurance planning. The final step is to use Toggle’s online tool to build a quote based on a meticulous home inventory, then compare that total cost and coverage against a few traditional quotes to make a confident, informed decision.

Frequently Asked Questions (FAQ)

How does Toggle’s “pay-per-thing” model actually work?

You start with a base plan for liability and minimal property coverage. Then, you add individual coverage “Toggles” for specific categories like electronics, jewelry, or sports gear. Each Toggle you add increases your premium, but you only pay for the categories of belongings you actually need to insure.

What happens if I forget to add a Toggle for a category of my stuff?

Items not covered by a specific Toggle are only protected under the very low “basic stuff” coverage in your base plan (e.g., $2,000 total). If you have a significant loss in an uncovered category, you would likely face a large coverage gap and out-of-pocket expenses.

Can I change my Toggles after I buy the policy?

Yes, a key feature of Toggle Renters Insurance is flexibility. You can log into your account online or via the app at any time to add new Toggles, remove existing ones, or adjust limits, with changes typically prorated and effective immediately or shortly thereafter.

Does Toggle offer liability coverage?

Yes, substantial personal liability coverage is a core part of the base plan, not an add-on. This is a critical component that protects you if someone is injured in your home or you cause damage to others’ property.

Is Toggle Renters Insurance underwritten by a reputable company?

Yes, Toggle is a brand owned by Farmers Insurance, a large, established, and financially stable insurer. Your policy is ultimately underwritten by a Farmers Insurance company, providing the security of a major carrier behind the innovative front-end model.

How do I file a claim with Toggle?

Claims are filed digitally through the Toggle website or mobile app. You will describe the incident, indicate which Toggle categories are affected, and submit supporting documentation. A claims adjuster from Farmers will then be assigned to manage your case.

Is Toggle available in all states?

No, Toggle Renters Insurance is not available nationwide. It is gradually rolling out to different states. You must check the Toggle website or enter your zip code in their quote tool to confirm availability in your specific location.