In the search for reliable and affordable renters insurance, you may encounter AGI, or American Government Insurance, as a potential provider. This AGI renters insurance review aims to provide a clear, objective analysis of the company’s offerings for tenants. AGI markets itself as a provider of straightforward insurance solutions, often focusing on value and essential coverage. For renters, this can translate to competitive rates for standard policies that protect personal property, provide liability coverage, and include loss of use benefits. However, navigating the specifics of any insurer is crucial before making a decision. This review will delve into the core features of an AGI renters insurance policy, examine typical costs and available discounts, evaluate the customer service and claims experience based on available data, and highlight both strengths and potential limitations. Our goal is to equip you with the knowledge needed to determine if AGI renters insurance aligns with your protection needs and budget.

Understanding AGI Renters Insurance Coverage Options

AGI renters insurance policies are designed to offer the fundamental protections that every tenant requires. The cornerstone of their coverage includes personal property insurance, which compensates you for loss or damage to your belongings due to covered perils such as fire, theft, vandalism, and certain weather-related events. A key detail in any AGI renters insurance review is understanding the settlement method—whether the policy pays Actual Cash Value (ACV), which deducts for depreciation, or Replacement Cost Value (RCV), which pays the amount to buy the item new. This distinction significantly impacts your potential reimbursement. Furthermore, AGI provides personal liability coverage, which is critical if you are found legally responsible for injuries to a guest or damage to someone else’s property. The policy also includes medical payments to others and loss of use coverage, which helps pay for additional living expenses if your rental unit becomes temporarily uninhabitable due to a covered loss.

Standard Policy Inclusions and Limits

A closer look at a typical AGI renters insurance policy reveals standard industry inclusions. Personal property coverage will have a total limit you select, with sub-limits for specific categories of items like jewelry, watches, furs, or silverware. For example, your policy might have a $30,000 total limit but only cover up to $1,500 for stolen jewelry. This is a common structure across the industry, not unique to AGI. Liability limits often start at $100,000, which is a reasonable baseline, but you can usually increase this amount for a modest premium increase. Loss of use coverage is typically a percentage of your personal property limit (e.g., 20-30%). It is essential to read your policy’s declarations page carefully to understand these specific numbers. For a broader understanding of how these coverage components work together, you can learn more about what renters insurance is and its standard structure.

Available Endorsements and Additional Protections

To tailor a policy to your specific situation, AGI likely offers various endorsements, also known as riders. These allow you to extend coverage beyond the standard policy terms. Common and valuable endorsements for an AGI renters insurance policy include scheduled personal property coverage for high-value items like engagement rings, expensive cameras, or musical instruments. This endorsement provides broader protection (often against accidental loss) and higher, agreed-upon limits. Another important option is replacement cost coverage for your personal property, which is highly recommended over actual cash value. You may also find endorsements for identity theft protection, which offers reimbursement and assistance services if your identity is compromised, and increased limits for business property if you work from home. Inquiring about the availability and cost of these add-ons is a critical step when considering AGI renters insurance.

Analyzing the Cost and Value of AGI Renters Insurance

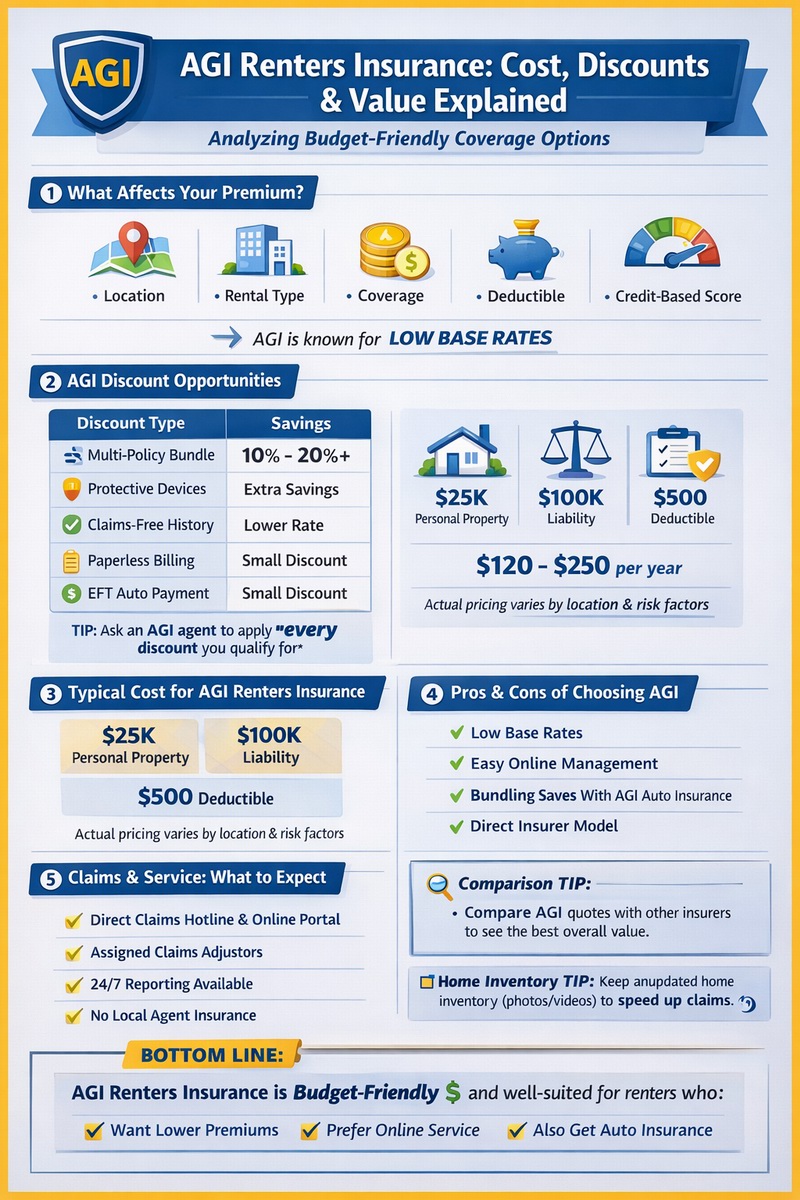

A primary consideration for most renters is affordability, making the cost a central part of this AGI renters insurance review. AGI frequently positions itself as a budget-friendly option, offering competitive base rates for essential coverage. Your final premium will be calculated based on standard risk factors: the location and type of your rental property, the amount of personal property and liability coverage you choose, your selected deductible, and your personal claims history and credit-based insurance score (where permitted by law). AGI may offer several common discounts to reduce this premium further. These can include multi-policy discounts for bundling renters insurance with another product like auto insurance, protective device discounts for having smoke detectors, burglar alarms, or deadbolt locks, and possibly discounts for being claim-free or for setting up automatic payments. Obtaining a personalized quote is the only way to know the exact cost for your profile.

How Competitive Are AGI Renters Insurance Rates?

Based on market comparisons and consumer reports, AGI renters insurance often falls on the more affordable end of the spectrum, particularly for customers seeking a no-frills, basic policy. They achieve this by focusing on core coverage and operating with a potentially leaner cost structure. For a policy with $25,000 in personal property coverage, $100,000 in liability, and a $500 deductible, annual premiums might range from $120 to $250 for many customers, depending heavily on location and risk factors. The most significant savings typically come from bundling policies. However, it is crucial to compare like with like. A lower quote from AGI might be for an Actual Cash Value settlement, while a slightly higher quote from a competitor might include Replacement Cost. To effectively compare, you must ensure the coverage limits and terms are identical. For context on average pricing, reviewing information on general renters insurance cost factors can be helpful.

Potential Discounts to Lower Your Premium

To maximize the value of an AGI renters insurance policy, you should actively inquire about all applicable discounts. The multi-policy or bundling discount is usually the most substantial and is a strong reason to consider AGI if you also need auto insurance from them. Security system discounts are common; if your rental has a centrally monitored burglar alarm or fire alarm system, be sure to mention it. Other potential discounts could include a claims-free discount for maintaining a record without filed claims, an early signing discount if you purchase a policy well before your current one expires, and billing discounts for opting for paperless documents and automatic electronic funds transfer (EFT). When requesting a quote, ask the agent to apply every discount for which you qualify, as this can transform an already competitive AGI renters insurance quote into an even more compelling offer.

Customer Service and Claims Experience Review

The true test of any insurance company occurs when you need to file a claim or require customer support. In this AGI renters insurance review, we assess the service experience based on consumer feedback and company processes. AGI operates as a direct-to-consumer provider, which means policies are typically sold online or over the phone without local agent representation. This model can lead to lower overhead and, consequently, lower premiums, but it also means you will not have a dedicated local agent to call for hands-on help. Customer service is generally handled through central call centers and online portals. Feedback on service responsiveness is mixed, as is common with many direct insurers; some customers report smooth interactions, while others note challenges in reaching specific representatives. It is advisable to review current customer ratings on independent platforms like the Better Business Bureau (BBB) for the most up-to-date sentiment on AGI’s customer service performance.

The AGI Claims Filing and Settlement Process

Understanding the claims process is paramount. With AGI renters insurance, you would typically initiate a claim by calling their dedicated claims hotline or filing through an online portal. A claims adjuster would then be assigned to investigate your loss, review the damage, and determine the payout according to your policy terms. The efficiency and fairness of this process are critical. Factors that influence a positive outcome include having a detailed home inventory with photos or videos of your belongings and promptly reporting the loss. Potential challenges, as noted in some consumer reviews for similar direct insurers, can include longer-than-average hold times during peak periods or delays in adjuster assignment. To prepare, ensure you understand your full renters insurance coverage details and keep your policy documents accessible. For an independent perspective on claims best practices, resources from the Insurance Information Institute offer valuable guidance.

Strengths and Weaknesses of Choosing AGI

To provide a balanced AGI renters insurance review, it is important to summarize key advantages and potential drawbacks. A primary strength is cost-competitiveness; AGI often provides some of the most affordable base rates in the market, making it accessible for budget-conscious renters. The direct model simplifies purchasing and management for those comfortable with digital interactions. However, weaknesses may include less personalized service due to the lack of local agents, which can be a drawback for those who prefer a dedicated contact. Coverage options may be more basic compared to larger national carriers, with fewer innovative endorsements or perks. As with any insurer, it is wise to compare AGI’s offer with other providers. Using a comparison service like Tejribati can help you see multiple quotes side-by-side to ensure you are getting the best overall value, not just the lowest price.

Final Recommendations: Is AGI Renters Insurance Right for You?

This comprehensive AGI renters insurance review leads to a targeted recommendation. AGI renters insurance appears to be a strong contender for specific renters: those who prioritize finding the most affordable possible premium for essential, no-frills coverage, and who are comfortable managing their policy online or via phone without a local agent. It may also be a good fit for renters looking to bundle with AGI auto insurance to secure a significant discount. However, renters who value highly personalized service, desire a wide array of specialized coverage endorsements, or prefer working with a company that has extensive consumer feedback and high rankings in customer satisfaction surveys may want to compare AGI with other more established national brands. The final step should always be to obtain a detailed quote from AGI, carefully review the policy terms—especially regarding settlement type (ACV vs. RCV)—and compare it with at least two other competitors to make a fully informed decision.

Frequently Asked Questions (FAQ)

What does AGI stand for in AGI renters insurance?

AGI typically stands for American Government Insurance. It is an insurance provider that offers various personal lines insurance products, including renters insurance, often directly to consumers.

Can I get an AGI renters insurance quote online?

Yes, AGI primarily operates as a direct insurer, meaning you can likely obtain a quote and purchase a policy directly through their official website or by calling their customer service number, without needing to go through an independent agent.

Does AGI offer replacement cost coverage for personal property?

This is a critical question to ask when getting a quote. AGI may offer both Actual Cash Value (ACV) and Replacement Cost Value (RCV) options. The RCV endorsement usually costs more but provides significantly better protection, as it pays to replace items with new ones. Always confirm which type is included in your quoted price.

How do I file a claim with AGI renters insurance?

You would file a claim by contacting AGI’s claims department directly. The contact number for claims should be listed on your policy documents, declarations page, and the company’s website. It is recommended to report claims as soon as possible after a loss occurs.

Are there bundle discounts for having auto and renters insurance with AGI?

Most insurers, including direct providers like AGI, offer multi-policy discounts. If AGI also sells auto insurance in your state, bundling your renters and auto policies with them will almost certainly qualify you for a discount on both policies, reducing your overall insurance costs.

What are common complaints about AGI renters insurance?

Common consumer complaints for direct insurers like AGI often relate to customer service accessibility, claims processing delays during high-volume periods, and misunderstandings over policy coverage details. It is advisable to research recent customer reviews on trusted third-party sites for current feedback.

How does AGI renters insurance compare to larger companies like State Farm or Allstate?

AGI often competes on price, potentially offering lower base rates than larger, well-known carriers. However, larger companies may provide more extensive agent networks, a wider range of policy endorsements, and more robust digital tools. The best choice depends on whether you prioritize low cost or a fuller service experience.