Choosing the right protection for your rental home is critical. In this comprehensive Assurant renters insurance review, we provide an unbiased analysis of the company’s policies, claims process, and overall value. We detail what Assurant renters insurance covers—including personal property, liability, and loss of use—and clearly outline common exclusions. By examining claim settlement timelines, customer feedback, and the company’s unique position as a provider often partnered with landlords and property managers, this guide answers the pressing question: “Is Assurant a good renters insurance?” We weigh notable advantages like convenient billing against potential disadvantages to help you make an informed decision for your belongings and financial security.

What Is Assurant Renters Insurance and Who Is It Through?

Assurant is a major specialty insurer known for niche market products. Unlike companies that sell directly to consumers first, Assurant’s renters insurance programs are often accessed through specific partnerships.

Assurant’s Business Model and Company Background

To understand “Who is Assurant renters insurance through?”, you must know their model. Assurant frequently partners with property management companies, landlords, and even retailers to offer tenant insurance as a bundled or recommended solution. When you rent an apartment, the leasing office may provide information or a required proof of insurance from Assurant. The company itself is a publicly-traded Fortune 500 company, providing a layer of financial stability. Renters insurance through these channels is designed for convenience, sometimes allowing premium payments to be added to your monthly rent.

What Does a Standard Assurant Renters Insurance Policy Cover?

A standard Assurant policy provides the three fundamental coverages. Personal Property coverage protects your belongings from named perils like fire, theft, and water damage. Liability coverage is crucial if you’re found responsible for injury to a guest or damage to the building itself. Additional Living Expenses (ALE) cover hotel and food costs if your unit becomes unlivable due to a covered event. It’s vital to read your specific policy details, as limits and sub-limits can vary.

Evaluating Assurant Renters Insurance Pros, Cons, and Overall Reputation

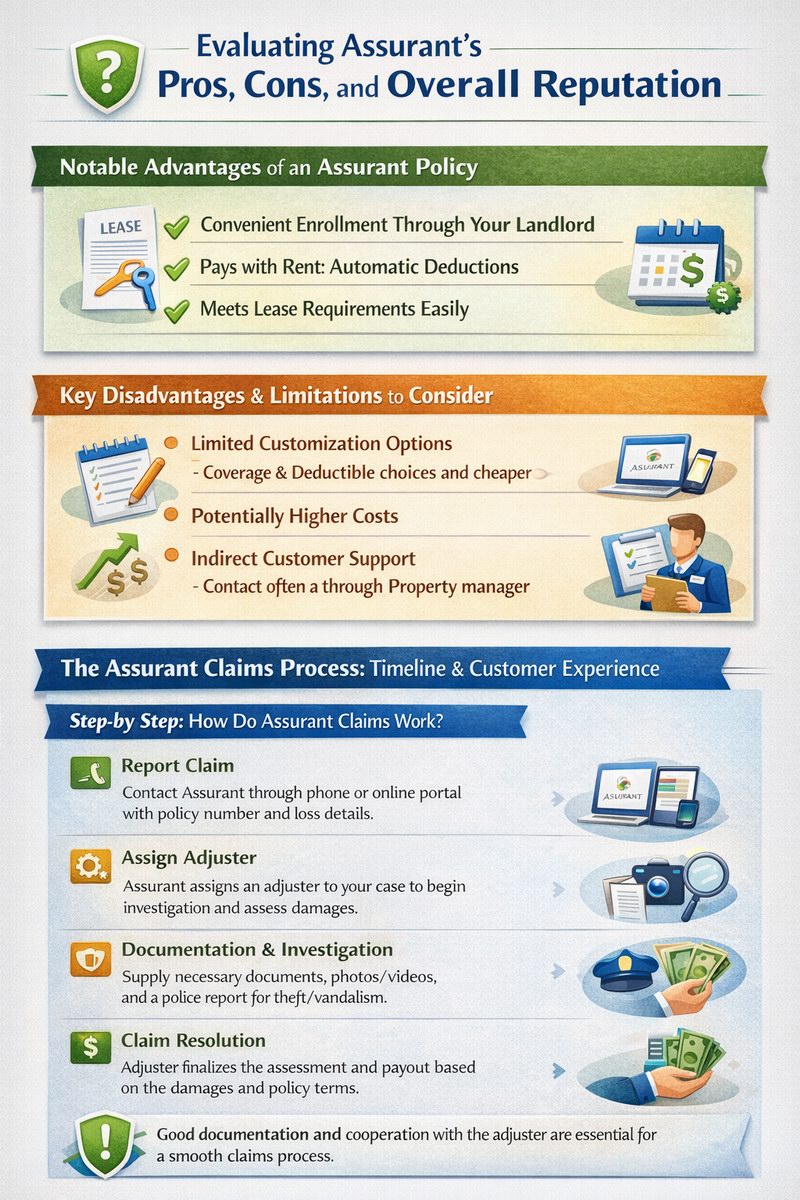

Determining “How good is Assurant insurance?” requires a balanced look at its strengths and weaknesses, particularly from a tenant’s perspective.

Notable Advantages of an Assurant Renters Insurance Policy

The primary advantage is extreme convenience if it’s offered through your landlord. Enrollment can be simple, and paying the premium alongside your rent via automatic deductions eliminates a separate bill. This model also ensures you meet any lease requirements for renters insurance coverage effortlessly. For basic compliance and coverage, it provides a straightforward solution that requires minimal shopping effort on the tenant’s part.

Key Disadvantages and Limitations to Consider

The main disadvantages of Assurant renters insurance stem from its partnership model. You may have less choice in coverage limits, deductible options, and endorsements compared to shopping the open market. The policy might be more of a “one-size-fits-most” solution. Furthermore, the convenience can sometimes come at a higher renters insurance cost than a policy you could find independently. Customer service experiences can be mixed, as your primary contact might be your property manager, not Assurant directly.

The Assurant Claims Process: Timeline and Customer Experience

Filing a claim is the moment of truth. Understanding how Assurant claims work, how long they take, and how to track them is essential for any policyholder.

Step-by-Step: How Do Assurant Claims Work?

Claims typically start by contacting Assurant directly via phone or online portal. You’ll need your policy number and details of the loss (date, cause, list of damaged items). An adjuster will be assigned to investigate, which may involve an interview, reviewing photos/videos, and examining police or repair reports. For theft or vandalism, a police report is mandatory. Clear documentation is your best tool for a smooth process.

How Long Does an Assurant Renters Claim Take to Settle and Pay?

So, “How long does an Assurant renters claim take?” Simple, well-documented claims (like a minor theft with receipts) may see a settlement within a few weeks. Complex claims involving significant damage, liability disputes, or requiring further investigation can take 30 to 60 days or longer. Payment is typically issued via check or direct deposit once the claim is approved and finalized. You can check your Assurant claim status by logging into your online account or calling the claims adjuster directly.

Policy Details: Coverage Exclusions, Cancellation, and Cost

Knowing what’s not covered is as important as knowing what is. Equally important are the financial and contractual details of your policy.

Common Exclusions: What Does Assurant Not Cover?

All renters insurance policies have exclusions. Standard Assurant policies typically do not cover damage from floods or earthquakes (separate policies are needed), intentional loss, normal wear and tear, infestations (like bed bugs or rodents), or damage from sewer backup unless a specific endorsement is purchased. High-value items like expensive jewelry, fine art, or collectibles have low sub-limits (e.g., $1,500 for theft of jewelry), requiring scheduled personal property coverage for full protection.

Managing Your Policy: Cancellation and Premium Questions

You can cancel your Assurant renters insurance by contacting customer service. If you move out, the policy is typically cancelable with potential for a prorated refund for any prepaid premium. However, if the policy is tied to your lease, you should also inform your property manager. It’s wise to have a new policy in place before canceling to avoid a lapse in renters insurance coverage, which can violate your lease and leave you exposed.

Assurant in the Market: Rankings, Reputation, and Final Verdict

Where does Assurant stand among competitors, and who is it best suited for in the broader rental market?

Industry Standing and What Assurant Is Known For

Assurant holds a strong “A” (Excellent) financial strength rating from A.M. Best, indicating its ability to pay claims. In terms of “What is the ranking of Assurant?” for customer satisfaction in the direct-to-consumer renters market, it often ranks in the middle or lower tiers in major studies like J.D. Power. This is largely due to its partnership model, which can distance the company from the end customer. Assurant is best known for its specialty, niche market approach, providing insurance solutions through partner networks rather than mass consumer advertising.

Final Recommendation: Who Should Consider Assurant Renters Insurance?

Assurant renters insurance is a viable, convenient option if it is presented or required by your landlord or property management company. It removes the shopping burden and ensures lease compliance. However, for tenants seeking the absolute best price, the most customizable coverage, or a company with top-tier direct customer service ratings, shopping independently is strongly recommended. Comparing quotes from several providers is the only way to confirm you’re getting the right balance of Assurant renters insurance cost and coverage for your specific situation.

Frequently Asked Questions (FAQ)

What does Assurant renters insurance cover?

A standard Assurant renters insurance policy covers personal property against named perils (fire, theft, vandalism, etc.), personal liability for injuries or property damage you cause, and additional living expenses if you cannot live in your rental due to a covered loss. Coverage limits and specific inclusions can vary based on the policy purchased through your landlord or property manager.

Is Assurant a good renters insurance company?

Assurant is a financially stable company that provides a convenient solution, especially when offered through a landlord. Whether it’s ‘good’ depends on your priorities. It’s good for effortless compliance and basic coverage. However, for the best price, highest customer service ratings, or extensive customization, comparing quotes from other direct providers is advisable.

How long does it take for Assurant to process and pay a claim?

The timeline varies. Simple, documented claims may be settled in a few weeks. More complex claims can take 30 to 60 days or longer. The speed depends on the claim’s complexity, the quality of your documentation (photos, receipts, police reports), and the adjuster’s investigation. You can check your claim status online or by contacting your adjuster.

What are the main disadvantages of Assurant renters insurance?

Potential disadvantages include less flexibility in choosing coverage limits and deductibles, potentially higher cost compared to shopping the open market, and variable customer service experiences as your point of contact may be your property manager first. The policy is often a standardized solution rather than a highly tailored one.

Can I cancel my Assurant renters insurance and how?

Yes, you can cancel by contacting Assurant customer service directly. If you prepaid your premium, you may receive a prorated refund for the unused portion. It’s crucial to also inform your property manager if the policy was a lease requirement and to secure new coverage before canceling to avoid a lapse in protection.

What does Assurant not cover in a standard policy?

Standard exclusions include flood and earthquake damage, normal wear and tear, pest infestations (e.g., bed bugs), intentional damage, and sewer backup (unless endorsed). High-value categories like jewelry, art, and collectibles have low coverage sub-limits, requiring additional scheduled personal property coverage for full protection.

Who owns Assurant and what are they known for?

Assurant is a publicly traded company (NYSE: AIZ). They are known for specializing in niche protection products, often distributed through business partners. Beyond renters insurance for tenants in partnered properties, they are a major provider of mobile phone insurance, extended warranties, and pre-funded funeral insurance.

For an objective overview of how to shop for and compare tenant policies, the NerdWallet guide to renters insurance offers a valuable, authoritative resource.