Fire is one of the most devastating perils a renter can face, capable of destroying personal belongings and displacing you from your home in an instant. Understanding your renters insurance fire coverage is essential for financial recovery and peace of mind. A standard renters insurance policy explicitly includes coverage for damage caused by fire and smoke, making it a cornerstone of your protection. This coverage extends to your personal property, provides liability protection if you are found responsible for a fire, and helps pay for temporary living expenses. This guide will provide a comprehensive overview of how renters insurance fire coverage works, what it includes and excludes, how to navigate the claims process after a fire, and crucial steps you can take before a loss to ensure you are fully prepared and adequately protected.

How Renters Insurance Fire Coverage Protects You

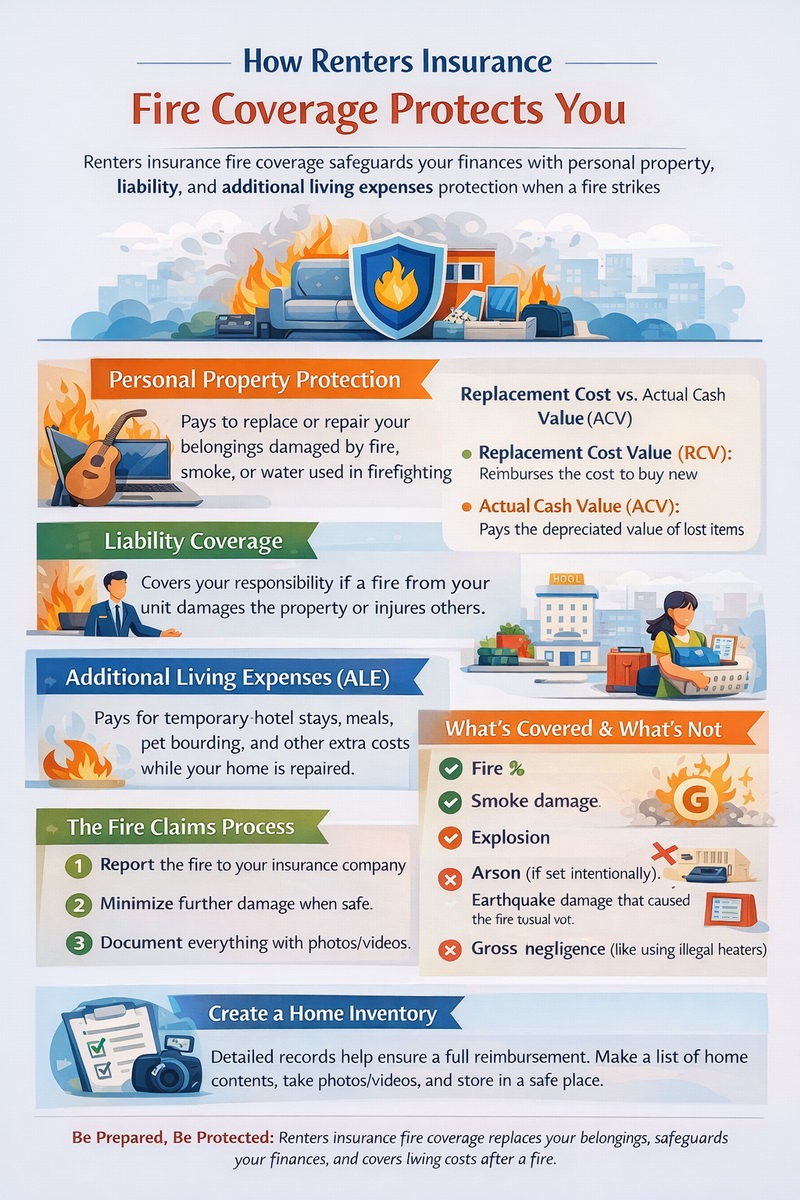

Renters insurance fire coverage is a multi-faceted protection that addresses the immediate and extended consequences of a fire. The primary component is personal property coverage, which pays to repair or replace your belongings—such as furniture, clothing, electronics, and appliances—that are damaged or destroyed by fire and smoke. It is vital to know whether your policy pays Actual Cash Value (ACV) or Replacement Cost Value (RCV); RCV is superior as it covers the cost to buy new items, not their depreciated value. Secondly, the liability portion of your policy is critical. If a fire starts in your unit due to your negligence (e.g., unattended cooking, faulty wiring you installed) and spreads, damaging the building or other tenants’ property, you could be held legally responsible. Your renters insurance provides a legal defense and covers resulting damages up to your policy limit. Finally, the loss of use or additional living expenses (ALE) coverage is activated, paying for hotel stays, restaurant meals, laundry, and other increased costs of living while your rental is being repaired or you find a new home.

Personal Property Protection After a Fire

When a fire strikes, the personal property component of your renters insurance fire coverage becomes your financial lifeline. This coverage applies regardless of where the fire originated—whether it started in your unit, a neighbor’s apartment, or a common area. It covers items directly damaged by flames, as well as items ruined by smoke, soot, and water used by firefighters. You will be reimbursed up to the personal property limit you selected on your policy, minus your deductible. However, standard policies have sub-limits for certain categories like jewelry, art, or electronics. If you own high-value items, you may need scheduled personal property coverage to ensure they are fully covered. Having a detailed home inventory is the single most important factor in successfully recovering the full value of your lost items. To understand the full scope of property protection, learn more about what renters insurance is.

Liability and Additional Living Expenses (ALE)

Two often-overlooked but critical aspects of renters insurance fire coverage are liability and ALE. Liability coverage protects your financial assets if you are found at fault for causing a fire. For example, if a candle you left burning tips over and causes significant damage to the apartment building, the landlord’s insurer may seek to recover costs from you. Your renters insurance liability coverage would handle this claim. The ALE coverage is equally vital. After a fire, your rental may be uninhabitable for weeks or months. ALE pays for the necessary increase in your living expenses. This includes hotel bills, restaurant meals (above your normal grocery budget), pet boarding, storage fees, and even laundry costs. There is typically a limit on ALE, often a percentage of your personal property coverage (e.g., 30%), or a time limit (e.g., 12 months). Ensuring this limit is sufficient is a key part of your renters insurance coverage review.

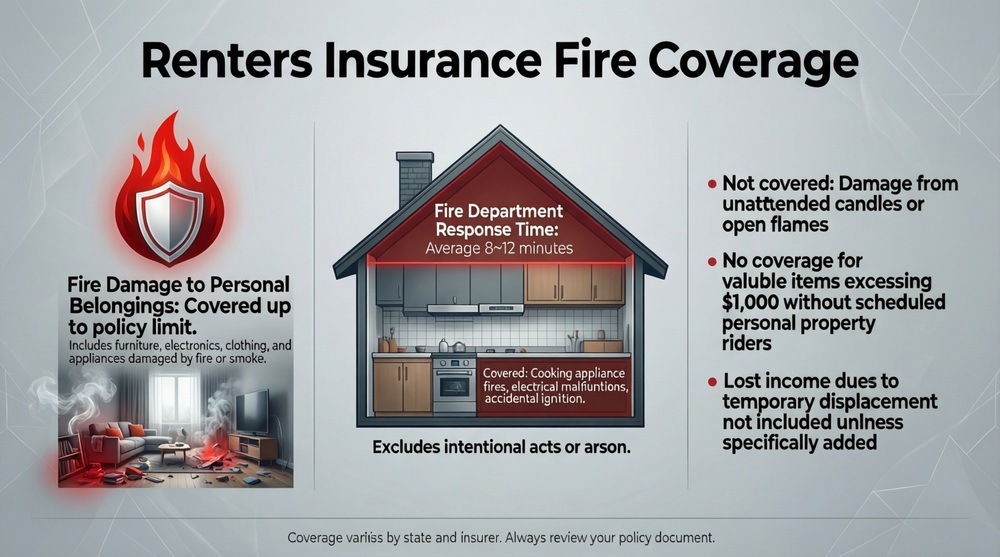

What’s Covered and What’s Not in a Fire Claim

While renters insurance fire coverage is broad, it is not unlimited, and understanding policy exclusions is crucial. Covered perils typically include fire and lightning, smoke damage, and explosion. The cause of the fire usually doesn’t matter (whether electrical, cooking, arson by a third party, etc.), unless it is proven you intentionally set the fire, which is fraud and not covered. However, standard policies exclude damage from certain related events. For instance, if a fire is caused by an earthquake, the fire damage might be covered, but the earthquake damage to the structure that caused the fire would not be. Most importantly, if the fire results from your own gross negligence or intentional illegal activities, the claim may be denied. It is also essential to know that the policy covers your personal property, not the physical structure of the building—that remains the landlord’s responsibility.

Common Exclusions and Special Circumstances

Being aware of common exclusions helps prevent claim disputes. First, wear and tear or deterioration is not covered; an insurer won’t pay for an old appliance that was already failing before the fire. Second, if you operate a business from home, business inventory and specialized equipment may have limited coverage or require a separate endorsement. Third, extremely high-value items like fine art or rare collectibles may be subject to low sub-limits unless separately scheduled. Fourth, if you are found to have violated your lease in a way that contributed to the fire (e.g., using prohibited space heaters, hoarding), the insurer may deny the claim. Always review your policy’s “exclusions” section. For a clear understanding of what drives your policy’s pricing, including risk factors like fire, see our guide on renters insurance cost.

The Importance of a Home Inventory for Fire Claims

After a fire, you will need to provide your insurance company with a detailed list of everything you lost, including descriptions, approximate age, and value. This is incredibly difficult and emotionally taxing to do from memory in the aftermath of a disaster. A pre-existing home inventory is the most powerful tool you have to ensure a smooth and fair settlement under your renters insurance fire coverage. A thorough inventory includes photos or videos of each room, receipts for major items, serial numbers for electronics, and notes on the make/model of furniture. Store this inventory digitally in the cloud or in a secure off-site location. This documentation drastically speeds up the claims process, helps you remember items you might otherwise forget, and provides proof of ownership, leading to a more accurate and complete reimbursement for your losses.

The Fire Claims Process: Step-by-Step Guide

Knowing what to do immediately after a fire can protect your safety and strengthen your insurance claim. First, ensure everyone is safe and accounted for, and contact emergency services if necessary. Once authorities say it is safe to do so, you can begin the claims process. Step 1: Contact your insurance company or agent as soon as possible to report the loss. Most insurers have 24/7 claims hotlines. Provide your policy number and a brief description. Step 2: Mitigate further damage if it is safe. This might mean arranging for a board-up service for broken windows or water extraction to prevent mold—keep receipts, as these costs are often covered. Step 3: Document everything. Take extensive photos and video of all damage before anything is moved or cleaned. Step 4: Cooperate fully with the insurance adjuster assigned to your claim. They will inspect the damage, review your inventory, and determine the settlement amount based on your policy terms.

Working with the Adjuster and Understanding Settlement

The insurance adjuster plays a pivotal role in your renters insurance fire coverage claim. Their job is to investigate the cause and extent of the loss. Be prepared to provide your home inventory, any photos/videos you took after the fire, and a list of damaged items. For a total loss, you may need to provide a “proof of loss” statement, a formal document itemizing everything. The adjuster will calculate the value of your lost items based on your policy’s settlement type (ACV or RCV). If you have RCV coverage, you may initially receive a check for the ACV amount. After you actually replace the item and submit the receipt, you will receive the difference. Keep all receipts for ALE expenses, as you will need to submit them for reimbursement. Be patient but persistent, and maintain clear, documented communication with your adjuster throughout the process.

Dispute Resolution and Maximizing Your Claim

If you disagree with the adjuster’s assessment, you have options. First, review your policy again to ensure you understand the coverage. Then, present your case to the adjuster with supporting documentation, such as receipts, comparable prices for items, or contractor estimates for cleaning/repair. If you cannot reach an agreement, ask to speak with the adjuster’s supervisor. Most insurers have a formal appeals process. You can also hire a public adjuster, a licensed professional who works on your behalf for a percentage of the settlement, or seek mediation. To find the best insurer for this critical coverage, compare options using a service like Tejribati. For expert, third-party advice on handling property claims, the Insurance Information Institute is an invaluable resource.

Preparing Before a Fire: Proactive Protection

The best way to manage renters insurance fire coverage is to ensure you have adequate protection before a disaster strikes. Annually review your policy limits to account for new purchases. Consider upgrading to Replacement Cost coverage if you don’t have it. Create and update your home inventory. Install and maintain smoke alarms and fire extinguishers in your rental—this not only saves lives but may also qualify you for a protective device discount on your premium. Know your policy’s ALE limits and ensure they are sufficient for your area’s cost of living. Understand your responsibilities under your lease regarding fire safety. By taking these proactive steps, you transform your renters insurance from a reactive safety net into a cornerstone of a comprehensive risk management plan, giving you confidence that you can recover financially if the unthinkable happens.

Conclusion: Your Essential Financial Recovery Tool

Renters insurance fire coverage is an indispensable component of your financial security as a tenant. It ensures that a fire does not lead to a total financial loss, providing the resources to replace your belongings, shield you from liability, and maintain your standard of living during displacement. The key to maximizing this coverage lies in understanding your policy, maintaining an accurate home inventory, and knowing the claims process. By choosing adequate limits, opting for replacement cost coverage, and preparing documentation in advance, you empower yourself to navigate the aftermath of a fire with clarity and confidence. Don’t wait for disaster to strike—review your policy today and take the necessary steps to ensure your renters insurance fire coverage is robust and ready to protect what matters most.

Frequently Asked Questions (FAQ)

Does renters insurance cover accidental fires I cause?

Yes, renters insurance fire coverage typically covers fires you cause accidentally, such as a cooking fire or an electrical mishap. However, fires caused by intentional acts or gross negligence (like using illegal indoor fireworks) may not be covered.

Will renters insurance pay for a hotel after a fire?

Yes, through the Additional Living Expenses (ALE) portion of your policy. It will reimburse you for reasonable hotel costs, meals, and other extra expenses incurred while your rental home is being repaired or until you find a new permanent residence.

Are smoke and water damage from firefighting covered?

Yes. Standard renters insurance fire coverage includes damage from smoke and soot. It also covers water damage caused by firefighters putting out the blaze, as this is considered a direct result of the covered peril (fire).

How do I prove what I owned after a total fire loss?

This is where a pre-fire home inventory is critical. Photos, videos, receipts, and even photos from social media can serve as proof of ownership. Without an inventory, you will need to recreate a list from memory, which is much more challenging.

What if the fire was my landlord’s fault?

Your renters insurance should still cover your personal property loss. Your insurer may then subrogate, meaning they may seek to recover what they paid you from the landlord or the landlord’s insurance company if their negligence caused the fire.

Does my policy cover the structure of my rental building?

No. Renters insurance covers your personal property, liability, and additional living expenses. The physical structure of the apartment or rental house is the financial responsibility of the landlord and is covered by their property insurance policy.

How can I make sure I have enough coverage for a fire?

Conduct a thorough home inventory to calculate the total replacement cost of your belongings. Choose a personal property limit that meets or exceeds this amount, opt for Replacement Cost over Actual Cash Value, and ensure your ALE limit is sufficient for your area’s cost of living.