Article Summary: When budgeting for a new rental, understanding the renters insurance cost is crucial, and it varies significantly between apartments and single-family houses. This comprehensive guide breaks down the key factors—from building security and rebuild costs to location risks and personal liability exposures—that cause these price differences. We provide clear comparisons of average annual and monthly premiums for both property types, explain how coverage needs diverge, and offer targeted strategies to lower your premium whether you’re in a high-rise condo or a suburban rental home. Armed with this knowledge, you can make an informed decision and secure the right renters insurance protection without overpaying.

Key Factors That Influence Renters Insurance Cost by Property Type

The premium you pay for renters insurance is a calculated risk assessment by insurance companies. For apartments and houses, the risk profile differs in fundamental ways, leading to distinct cost calculations. Understanding these core factors is the first step to understanding your quote.

Building Construction and Shared Risk (Apartments)

In an apartment or condo complex, your risk is shared. A unit’s proximity to centralized building systems (like plumbing mains or electrical panels) and shared walls can influence premiums. While a fire might start in a neighboring unit, modern apartment buildings often have superior fire suppression systems (like sprinklers) and secure entry points, which can lead to discounts on your policy. The building’s overall construction materials (concrete vs. wood-frame) and year built also factor into the risk assessment. Generally, the concentrated nature of apartments can sometimes mitigate certain perils compared to a standalone house.

Property Size and Rebuild Complexity (Houses)

Renting a house typically means you are responsible for a larger physical footprint. More square footage usually means you own more personal property to insure, directly increasing your personal property coverage limit—a primary driver of cost. Furthermore, while you don’t insure the structure itself, insurers consider the potential liability exposure. A single-family home with a backyard, driveway, and multiple entry points presents more opportunities for guest injuries (slips, falls, dog incidents) compared to an interior apartment unit. This increased liability risk can nudge premiums higher for houses.

Location and Crime Rate Impact

This is a universal but critical factor. Whether it’s an apartment in a downtown zip code or a house in a specific suburb, local crime statistics for theft and vandalism heavily influence premiums. Apartments in secured buildings with doormen and monitored cameras may see lower theft risk premiums than a standalone house in the same neighborhood. Conversely, a house in a low-crime rural area might be cheaper to insure than an apartment in a high-density urban center. Always check your specific area’s crime data.

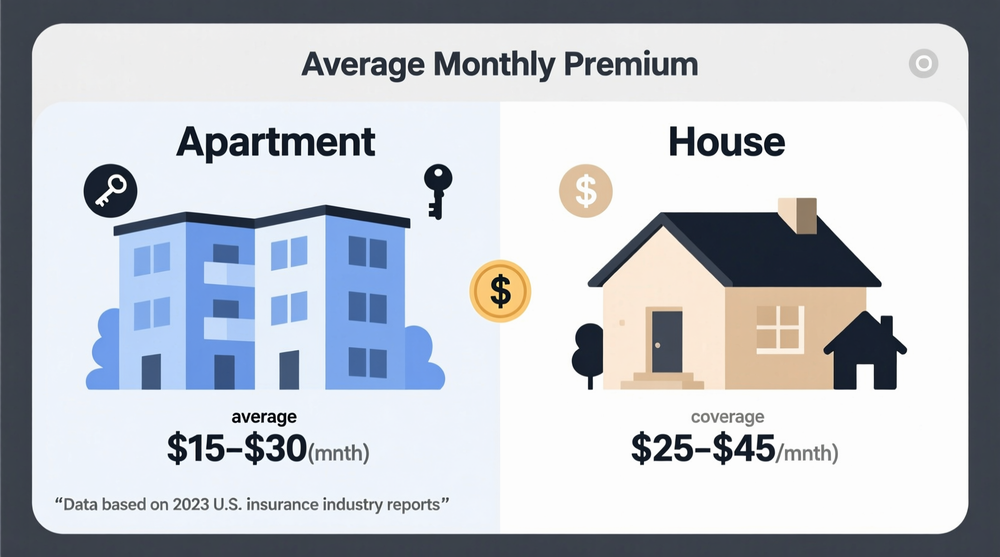

Average Cost Breakdown: Apartments vs. Houses

While individual circumstances vary wildly, national and regional data reveals clear trends in average renters insurance cost for different dwelling types. The following table provides a snapshot of what you might expect to pay, though your actual quote will depend on the factors previously discussed.

| Coverage Aspect | Average for Apartments/Condos | Average for Single-Family Rental Houses | Why the Difference? |

|---|---|---|---|

| Annual Premium | $140 – $180 | $175 – $250+ | Houses often require higher personal property limits and carry greater liability exposure. |

| Monthly Premium | $12 – $15 | $15 – $22 | Reflects the annual cost broken into monthly payments. |

| Personal Property Coverage (Typical) | $20,000 – $30,000 | $30,000 – $50,000+ | Houses have more rooms to furnish, often including garages, patios, and basements. |

| Liability Coverage (Typical) | $100,000 (standard) | $100,000 – $300,000 (common) | Homeowners often opt for higher limits due to property features like pools, decks, or larger yards. |

| Discount Potential | Higher for security systems, newer buildings | Higher for bundled policies, claims-free history | Apartment discounts are often building-centric; house discounts are more policyholder-centric. |

The Deductible Decision: How It Lowers Your Cost

Your deductible—the amount you pay out-of-pocket before insurance kicks in—is a powerful lever for controlling your premium. Opting for a higher deductible (e.g., $1,000 instead of $500) will lower your monthly or annual renters insurance cost for both apartments and houses. This strategy makes financial sense if you have sufficient savings to cover the higher deductible in case of a claim. It’s a direct trade-off: lower ongoing premiums versus higher upfront cost during a loss.

How Location Trumps Property Type

It’s vital to remember that a rented house in a safe, low-risk suburb could still be cheaper to insure than an apartment in a high-crime urban neighborhood. State and even city-level regulations, natural disaster risk (wildfire, hurricane, flood zones), and local fire department ratings play an enormous role. Always get quotes specific to your address, as moving even a few blocks can change your premium. For a broader understanding of how insurers assess risk, you can refer to guides from authoritative sources like the Insurance Information Institute’s shopping guide.

Tailoring Your Coverage and Saving Money Based on Your Rental

Securing the right policy isn’t just about finding the lowest price; it’s about aligning your renters insurance coverage with your actual risk profile. Use these targeted strategies to ensure you’re adequately protected while managing costs effectively.

For Apartment Renters: Leverage Building Amenities

When getting quotes, be sure to mention any security or safety features your apartment building offers. A 24-hour doorman, monitored burglar alarm, gated parking, interior hallways, and building-wide sprinkler systems are not just amenities—they are risk mitigators in the eyes of an insurer. Providing proof of these features can unlock significant discounts. Additionally, because apartments are typically smaller, conduct a strict home inventory to avoid over-insuring your personal property; you may need less coverage than you think.

For House Renters: Prioritize Liability and Accurate Valuation

When renting a house, don’t skimp on liability coverage. The increased exposure makes sufficient limits ($300,000 to $500,000) a wise investment, and the cost increase is often marginal. Accurately value your personal property, including items in sheds, garages, and outdoor living spaces. Consider adding scheduled personal property endorsements for high-value items like bicycles or lawn equipment that might be stored in less secure areas. Also, inquire about discounts for installing independent security systems, smoke detectors, or deadbolt locks, as you have more control over these in a house.

Universal Money-Saving Strategies for Both

Regardless of where you live, several tactics can reduce your premium. Bundling your renters policy with your auto insurance (a multi-policy discount) is almost always the most effective saving method. Maintain a good credit-based insurance score (where permitted by state law), as it’s a major rating factor. Ask about other discounts for being claims-free, paying annually instead of monthly, or being a member of certain professional organizations. Finally, shop around and compare quotes at every renewal period; loyalty is rarely rewarded with the best price.

Conclusion: Smart Protection for Your Specific Rental Home

Understanding the dynamics behind renters insurance cost for apartments versus houses empowers you to be a savvy consumer. While houses generally command higher premiums due to greater property values and liability exposures, an apartment’s final cost is intensely location-dependent. The key takeaway is to look beyond the simple “apartment vs. house” dichotomy and focus on the specific risk factors of your dwelling, your possessions, and your neighborhood. By accurately assessing your needs, leveraging available discounts, and shopping competitively, you can secure comprehensive renters insurance that provides peace of mind and financial protection, all at a fair and manageable price for your unique rental situation.

Frequently Asked Questions (FAQs)

Is renters insurance more expensive for a house or an apartment?

Generally, renters insurance is more expensive for a single-family rental house than for an apartment. This is primarily because houses typically require higher personal property coverage limits (more belongings) and present greater liability risks (e.g., yard, driveway, more access points). However, a luxury apartment in a high-risk urban area could cost more than a house in a low-risk rural location.

Do I need more liability coverage if I rent a house?

Yes, it is often advisable. Renting a house usually comes with increased liability exposure due to features like sidewalks, driveways, yards, decks, or pools where guest injuries could occur. While $100,000 is standard, many financial advisors recommend renters in houses carry at least $300,000 to $500,000 in liability protection for robust coverage.

Does the security of my apartment building lower my cost?

Absolutely. Insurers offer discounts for risk-reducing features. If your apartment building has a monitored fire alarm, sprinkler system, secured entry, gated parking, or a 24-hour doorman, be sure to inform your insurance agent. These features can significantly reduce the risk of theft and fire damage, leading to lower premiums for you.

How does my deductible choice affect my premium for each property type?

The deductible impact is consistent across property types: a higher deductible equals a lower premium. Choosing a $1,000 deductible over a $500 deductible can reduce your annual premium by 10-25%. This is a strategic way to lower your renters insurance cost for both apartments and houses, provided you have savings to cover the higher out-of-pocket cost if you file a claim.

Will my policy cover a shed or detached garage at a rental house?

Usually, yes, but with limits. Standard renters insurance policies extend a percentage of your personal property coverage (often 10%) to structures not attached to your dwelling, like a shed or detached garage. However, items stored inside may be subject to sub-limits for specific categories like tools or lawn equipment. Review your policy and schedule high-value external items if necessary.

Can I get renters insurance if I’m renting a room in a house?

Yes, you can and should. You need a policy to cover your personal belongings in your room and provide personal liability protection. You will take out your own separate policy. It’s important to clarify with the homeowner and your insurer how coverage overlaps or excludes common areas to avoid gaps or disputes.