One of the most common and unsettling experiences for a renter is becoming a victim of theft. The immediate question that follows is: does renters insurance cover theft? The clear and reassuring answer is yes, standard renters insurance policies include coverage for personal property stolen from your home, your vehicle, or even while you are traveling. This protection is a core component designed to help you recover financially by reimbursing you for the value of your stolen belongings. However, understanding the specifics of this coverage—including policy limits, deductibles, and the claims process—is essential to ensuring you are fully protected. This guide will explain exactly how theft coverage works, what is and is not covered, the crucial steps to take after a burglary, and how to maximize your claim to replace what was lost.

How Renters Insurance Theft Coverage Works

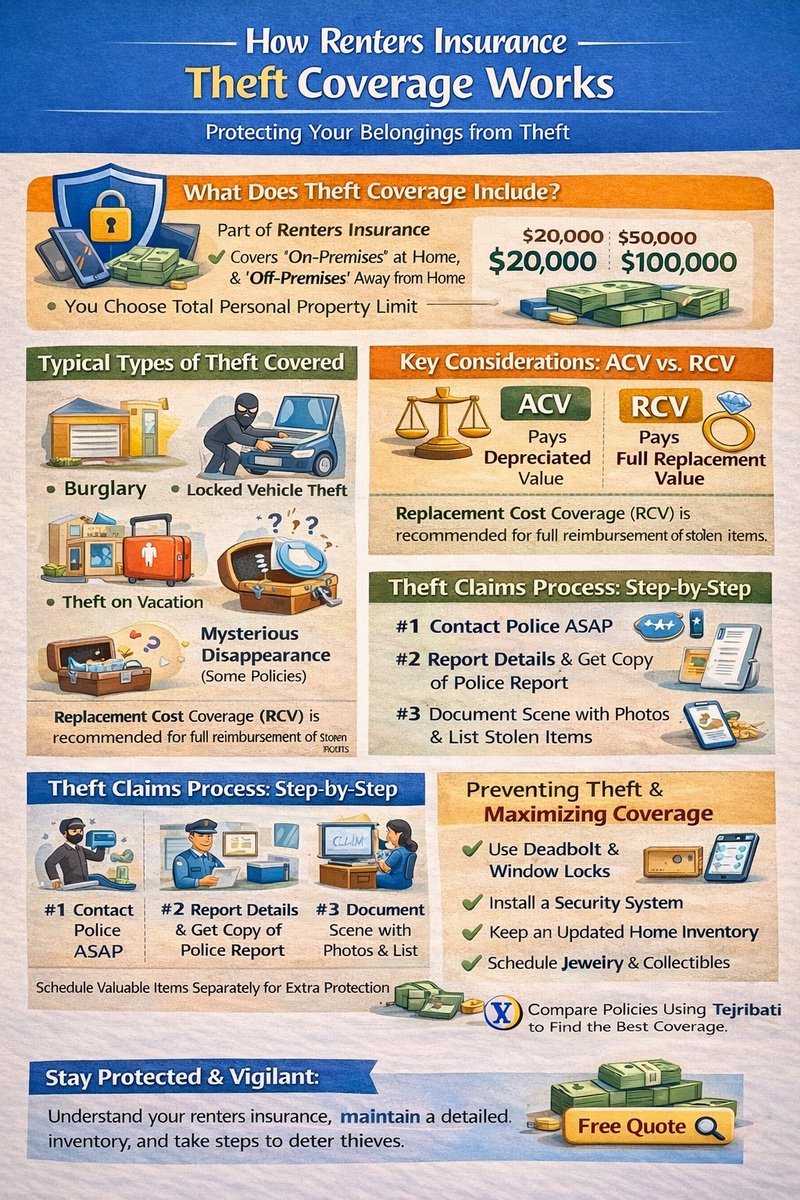

Renters insurance theft coverage is part of the personal property protection within your policy. It typically covers the theft of your belongings from your rented dwelling, as well as from other locations like your car, a hotel room, or a storage unit. This is known as “off-premises” coverage. When you file a theft claim, your insurer will reimburse you for the value of the stolen items, up to the personal property limit on your policy and after you pay your deductible. A critical detail is whether your policy provides “actual cash value” (ACV) or “replacement cost value” (RCV) coverage. ACV pays the depreciated value of your items at the time they were stolen, while RCV pays the amount it would cost to buy a new equivalent item today. RCV coverage is more comprehensive and is highly recommended. To understand the full scope of your policy’s protections, learn more about what renters insurance is.

What Types of Theft Are Typically Covered?

Renters insurance covers a wide range of theft scenarios. The most common is burglary, where a thief breaks into your apartment or home and steals your property. It also covers theft from a locked vehicle, whether your car is parked at home or elsewhere. If your luggage is stolen while you are on vacation, that is generally covered as well. Some policies even cover “mysterious disappearance,” which applies if an item is lost under circumstances that suggest theft but you cannot prove exactly how it happened (like a lost ring). It is important to note that the policy usually requires evidence of forced entry for a home burglary claim, such as a broken window or pried door. Without signs of forced entry, the insurer may question whether the theft occurred, making a police report vital.

Understanding Sub-Limits and Special Limits for Valuables

While the answer to “does renters insurance cover theft?” is yes, there are important financial limits. Your policy has an overall personal property limit, but it also has sub-limits for specific categories of high-value items. Common sub-limits for theft include cash (often $200), jewelry (often $1,000-$1,500), watches, furs, precious metals, firearms, and business equipment. This means if $5,000 worth of jewelry is stolen, you may only be reimbursed for up to the sub-limit amount, such as $1,500. To ensure full coverage for expensive items, you must schedule them separately on your policy with a “scheduled personal property” endorsement. This provides broader coverage and an agreed-upon value. Understanding these sub-limits is a key part of evaluating your renters insurance coverage and avoiding unpleasant surprises after a loss.

The Theft Claims Process: Step-by-Step

If you are a victim of theft, taking the right steps promptly is crucial for your safety and for a successful insurance claim. Step 1: Ensure your immediate safety. Do not enter your home if you suspect the burglar might still be inside; call the police from a safe location. Step 2: Contact the police immediately to file an official theft report. Obtain a copy of the police report number, as your insurance company will require it. Step 3: Document the scene. Take photos or video of any damage or signs of forced entry and of the areas where items are missing. Do not clean up or disturb the scene until the police and your insurance adjuster have had a chance to see it. Step 4: Contact your insurance company or agent to start the claims process. Have your policy number and the police report details ready. They will assign a claims adjuster to your case.

Proving Your Loss: The Importance of a Home Inventory

The most challenging part of a theft claim is proving what you owned and its value. This is where a pre-existing home inventory becomes invaluable. A home inventory is a detailed list, with photos or video, of your possessions, including descriptions, serial numbers, and estimated values. If you have this documentation, filing your claim becomes a much faster and more accurate process. Without it, you must recreate the list from memory, which often leads to forgetting items and struggling to prove their value. The claims adjuster will ask for this list, along with any receipts, credit card statements, or owner’s manuals you have. They will use this information to determine the value of your stolen items based on your policy’s terms (ACV or RCV). Taking the time to create an inventory is the single best thing you can do to ensure you are fully compensated. For insights on how theft risk affects your policy’s pricing, see our guide on renters insurance cost.

Working with the Adjuster and Receiving Your Settlement

After you file your claim, an adjuster will contact you to investigate. They may ask for a recorded statement, request additional documentation, or, in some cases, visit your home. Be cooperative and provide all requested information honestly and promptly. The adjuster will calculate your settlement by adding up the value of all stolen items, subtracting your deductible, and applying any relevant sub-limits. If you have RCV coverage, you may receive an initial payment for the actual cash value. Once you replace the item and submit the receipt, you will receive the remaining difference up to the replacement cost. The entire process can take from a few days for simple claims to several weeks for complex ones. Keep detailed records of all communication with the adjuster.

What Renters Insurance Does Not Cover for Theft

While renters insurance covers most theft, there are important exclusions. Theft by a person who legally lives in your household is typically not covered. If your roommate steals from you, your renters insurance will not cover that loss. Furthermore, if you leave your home unlocked or invite a stranger inside who then steals from you, the insurer may deny the claim due to negligence. Business property used for a home-based business may have limited coverage unless you have a specific endorsement. Most importantly, as mentioned, high-value items like fine art, collectibles, and expensive jewelry have low sub-limits for theft unless they are separately scheduled on your policy. Always review the “exclusions” section of your policy to understand the specific limitations.

Preventing Theft and Maximizing Your Coverage

Proactive steps can reduce your risk of theft and may even lower your premium. Install deadbolt locks, window locks, and a security system. Many insurers offer a discount for these protective devices. Always lock your doors and windows, even when you are home. Do not hide spare keys in obvious places. For your vehicle, do not leave valuables in plain sight. To maximize your coverage, ensure you have an adequate personal property limit based on a home inventory. Consider upgrading to replacement cost coverage. Schedule high-value items. Finally, know that comparing policies is key; use a service like Tejribati to find the best coverage for your needs. For expert advice on theft prevention and insurance, the Insurance Information Institute is a trusted resource.

Conclusion: Essential Protection for Your Belongings

So, does renters insurance cover theft? Absolutely. It is a fundamental protection that provides financial recovery and peace of mind after a burglary or theft. The key to leveraging this coverage effectively is to understand your policy’s limits, maintain a detailed home inventory, and take immediate, documented action if a theft occurs. By choosing replacement cost coverage, scheduling valuable items, and practicing good security habits, you can ensure that you are not left to bear the full financial burden of replacing your stolen possessions. Review your policy today to confirm your theft coverage details, and take the necessary steps to protect what matters most in your rented home.

Frequently Asked Questions (FAQ)

Does renters insurance cover theft from my car?

Yes, most renters insurance policies include off-premises theft coverage, which applies to personal property stolen from your locked vehicle. However, damage to the car itself is covered by your auto insurance, not renters insurance.

What if I cannot prove I owned the stolen item?

Without proof (like a photo, receipt, or serial number), it can be difficult to get reimbursed. This is why a home inventory is so critical. In the absence of proof, the insurer may rely on your sworn statement, but the claim could be disputed or undervalued.

Will my rates go up if I file a theft claim?

Filing any claim, including a theft claim, can potentially lead to a premium increase at renewal, depending on your insurer’s policies and your overall claims history. It is one factor they consider when assessing risk.

Does renters insurance cover stolen cash?

Yes, but there is typically a very low sub-limit for stolen cash, often around $200. If you keep large amounts of cash at home, it is not well-protected by a standard renters insurance policy.

Is a police report required for a theft claim?

In almost all cases, yes. Insurance companies require a copy of the official police report to process a theft claim. This helps prevent fraud and provides an official record of the crime.

How long do I have to file a theft claim?

You should notify your insurance company as soon as possible after discovering the theft. Most policies require “prompt” or “immediate” notice. Delaying could complicate the investigation and potentially jeopardize your claim.

Are my roommate’s belongings covered under my policy?

No. Your renters insurance policy covers only you and resident relatives. Your roommate’s possessions are not covered under your policy. They would need their own separate renters insurance policy to be protected against theft.