Yes, renters insurance does cover temporary housing through a crucial part of your policy called Additional Living Expenses (ALE) or “Loss of Use” (Coverage D). If your rental unit becomes uninhabitable due to a covered peril like a fire, burst pipe, or severe storm damage, ALE will pay for you to maintain your normal standard of living elsewhere. This includes the cost of a hotel, short-term rental, restaurant meals (above your normal grocery spending), laundry, storage, and even pet boarding. However, it does not cover temporary housing for voluntary reasons, minor repairs, or power outages unless they result from a covered loss. For the basics, see our guide on what renters insurance is.

Understanding Additional Living Expenses (ALE) Coverage

When asking “does renters insurance cover temporary housing?” you’re focusing on one of the most valuable features of a renters policy. ALE is designed to prevent financial hardship when a covered disaster displaces you from your home. It pays for the increase in your living costs incurred to live as you normally would.

What Triggers ALE Coverage?

Two conditions must be met:

1. A Covered Peril Causes Damage: The event (fire, windstorm, vandalism, water damage from plumbing, etc.) must be listed in your policy.

2. Your Rental is “Uninhabitable”: This means it’s unsafe or unfit for living. Examples include: significant structural damage, lack of utilities (water, electricity, heat) due to the covered damage, pervasive smoke or water damage, or a civil authority (like the fire department) prohibiting entry.

Minor issues like a broken appliance or a repainting project do not make a home uninhabitable. This is a core part of your renters insurance coverage.

What Does ALE Typically Cover?

ALE reimburses reasonable extra costs above your normal expenses. This includes:

– Temporary Housing: Hotel, motel, or furnished short-term rental (e.g., Airbnb) costs.

– Food: Restaurant meals, takeout, and grocery costs that exceed what you normally spend on food at home.

– Transportation & Parking: Increased commuting costs to work or school from your temporary location. Parking fees at a hotel.

– Pet Boarding: If your temporary lodging doesn’t allow pets.

– Laundry and Storage: Laundry service costs and fees for storing salvaged belongings.

– Furniture Rental: For a longer-term displacement, renting essential furniture for your temporary apartment.

When ALE Covers Temporary Housing: Common Scenarios

The following table clarifies specific situations to answer “does renters insurance cover temporary housing?” in practical terms.

| Scenario | Does ALE Cover Temporary Housing? | Key Details & Requirements |

|---|---|---|

| Fire or major smoke damage makes your apartment unsafe. | YES | The classic ALE claim. Coverage begins immediately and lasts for the reasonable repair time. |

| A burst pipe floods your apartment, requiring floor removal. | YES | Water damage from a covered internal source triggers ALE. You cannot live in a unit with major construction/mold risk. |

| Mandatory evacuation due to a nearby wildfire. | YES (Often) | If a civil authority orders evacuation due to imminent threat from a covered peril (like fire), ALE typically applies even if your home isn’t damaged yet. |

| Minor repairs (e.g., repainting, fixing a kitchen cabinet). | NO | The home must be uninhabitable. Cosmetic or minor repairs do not qualify. |

| Power outage from a general grid failure (not storm damage). | NO | If the outage is not caused by a covered peril on your property, ALE does not apply. Check if food spoilage is covered. |

| Bed bug infestation requiring fumigation. | NO (Typically) | Insect infestation is usually excluded as a maintenance issue, not a covered peril. |

| Voluntary evacuation (you leave before an official order). | NO | ALE requires the home to be uninhabitable or for access to be prohibited by an official order. |

Understanding ALE Limits and Timeframes

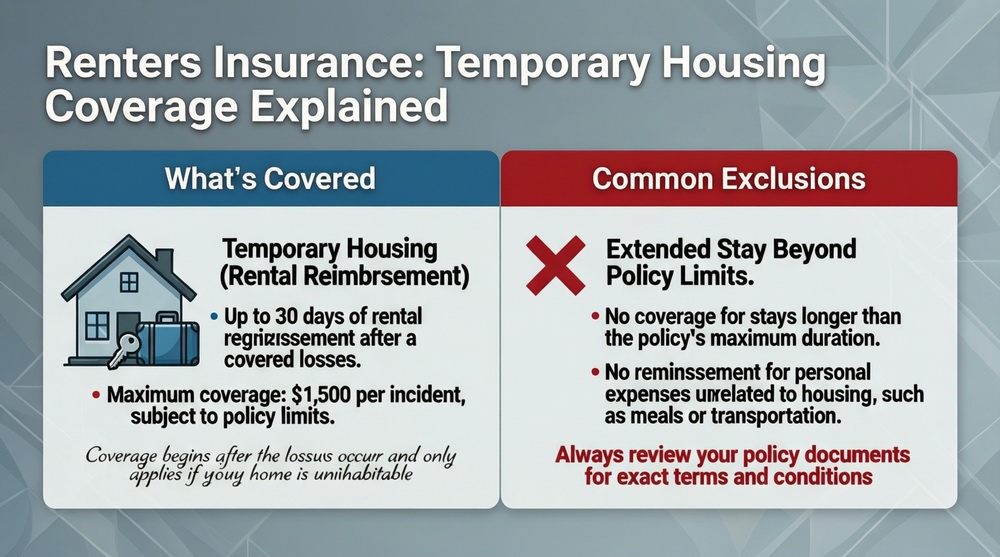

ALE coverage is not unlimited. Your policy specifies:

– Financial Limit: Often a percentage of your personal property coverage (e.g., 20-30%). If you have $30,000 in property coverage, you may have $6,000-$9,000 for ALE.

– Time Limit: Most policies cover you for the “reasonable” time required to repair your home or until you find a new permanent residence, up to a stated maximum (commonly 12-24 months).

It’s crucial to ensure your personal property limit is high enough that the corresponding ALE limit can cover extended hotel stays in your area.

How to File an ALE Claim for Temporary Housing

If you need to use your ALE coverage, follow these steps to ensure smooth reimbursement:

1. Ensure Safety & Document the Cause: Notify your landlord and insurer about the damage immediately. Take photos of the damage that makes the home uninhabitable.

2. Get Approval from Your Insurer: Before booking a long-term hotel, contact your claims adjuster. They can confirm ALE is triggered and may have preferred vendors or daily rate guidelines.

3. Keep All Receipts: This is non-negotiable. Save itemized receipts for everything: hotel bills, restaurant meals, laundry services, pet boarding, gas for extra commuting. Digital copies are fine.

4. Maintain a Log: Keep a simple diary of your additional expenses, noting what they were for and how they exceed your normal budget.

5. Submit Expenses for Reimbursement: Your adjuster will tell you how often to submit receipts—weekly or bi-weekly is common. They will review and issue payments.

6. Communicate About Timeline: Stay in touch with your adjuster and landlord about repair estimates. Your ALE coverage lasts for the reasonable repair period.

What is “Fair Rental Value” and How Does it Apply?

Some policies also include “Fair Rental Value,” which pays you the rental income you would have received if you were renting out part of your home and a covered loss makes that space unavailable to your tenant. This is less common for standard renters but may apply if you rent out a room.

Maximizing Your ALE Protection

To ensure your ALE coverage is sufficient:

– Review Your ALE Limit: When choosing your personal property limit, calculate the resulting ALE limit. Is 20% of that amount enough to cover hotel and food costs in your area for several months? If not, consider a higher base limit.

– Ask About Increased ALE Options: Some insurers offer endorsements to increase your ALE percentage limit for a small additional premium.

– Know Your Policy: Understand what perils are covered. Flood and earthquake damage are not covered by standard policies, so ALE would not apply if those events made your home uninhabitable unless you have separate policies.

Understanding these elements is part of managing your total renters insurance cost effectively. For a full review, explore all renters insurance options.

Conclusion: A Vital Financial Lifeline

In summary, does renters insurance cover temporary housing? Absolutely—it’s a cornerstone of the protection renters insurance provides. The ALE coverage is your financial lifeline, ensuring that after a devastating event like a fire, you have a safe place to stay and the means to maintain your life without draining your savings. By understanding the triggers (covered peril + uninhabitable), keeping meticulous receipts, and ensuring your policy limits are adequate, you can navigate a displacement with significantly less stress. Don’t overlook this critical coverage when reviewing your policy.

Frequently Asked Questions (FAQ)

How do I prove my normal food expenses for ALE reimbursement?

Insurers understand you have a baseline food cost. You don’t need perfect receipts from before the loss. They will often use a standard “per diem” rate for your area (e.g., $15-$25 per person per day) for meals or ask for a reasonable estimate of your weekly grocery bill. The key is to only claim the extra amount you spend eating out.

Can I stay with family or friends and still get ALE?

Yes, and you may still be reimbursed for increased expenses. ALE pays for the additional costs you incur. If staying with family increases your commuting costs or you contribute to their grocery bill, those extra expenses are reimbursable. You generally cannot claim a “lost opportunity cost” for free lodging.

Does ALE have a deductible?

No, typically not. The deductible on your renters insurance usually applies only to personal property claims, not to Additional Living Expenses. You should be reimbursed for covered ALE costs without subtracting your deductible.

What if I have a roommate? Does ALE cover us both?

This depends on the policy. If you and your roommate are both named insureds on the same policy, the ALE limit applies to the household. If you have separate policies, each of you would file under your own policy. Shared expenses should be split fairly for reimbursement.

How long will insurance pay for a hotel after a fire?

For the “reasonable” time required to repair or replace your dwelling, or until you permanently relocate, up to the policy’s stated time and financial limits. This could be weeks or many months for a severe fire. Your adjuster will work with you and the landlord’s contractor to establish a timeline.

Does renters insurance cover temporary housing during a mandatory hurricane evacuation?

Yes, typically. If a civil authority (like local government) issues a mandatory evacuation order due to an imminent threat from a covered peril (like a hurricane’s wind), your ALE coverage is usually triggered, even if your home isn’t damaged. This covers your hotel and food costs during the evacuation period.

Where can I find more information on disaster recovery?

For general guidance on recovering from a home disaster, the Insurance Information Institute’s article on unlivable homes provides a good overview of the process, including the role of ALE coverage.