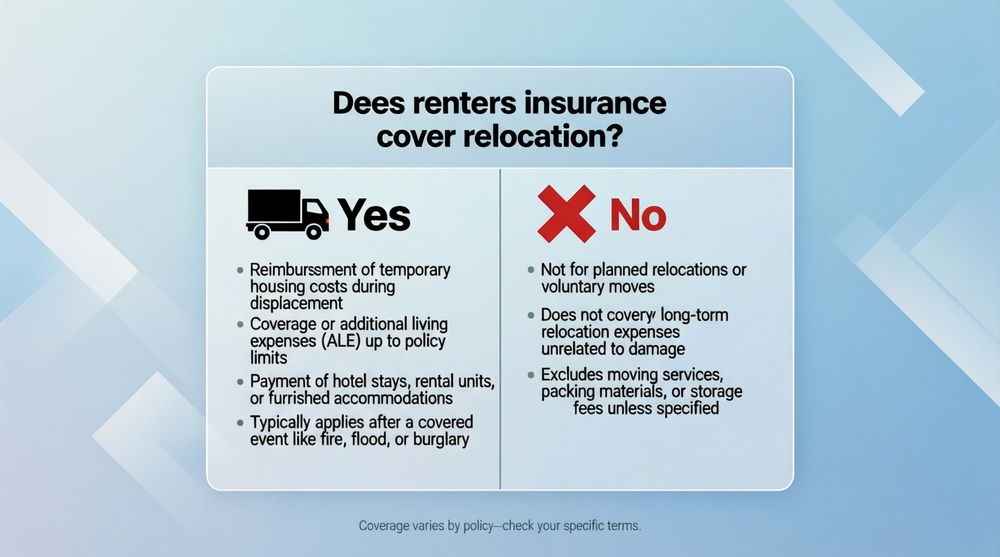

Renters insurance covers temporary relocation (like hotel stays) if your current home is uninhabitable due to a covered disaster, but it does not cover permanent relocation or moving expenses for a planned move. The coverage for temporary housing is called Additional Living Expenses (ALE) or “Loss of Use.” It pays for you to live elsewhere while your rental is being repaired after events like a fire or burst pipe. However, it will not pay for security deposits, moving trucks, utility transfers, or any costs associated with voluntarily finding and moving to a new permanent apartment. For foundational knowledge, see our guide on what renters insurance is.

Covered Relocation: Additional Living Expenses (ALE)

When people ask “does renters insurance cover relocation?” they are often thinking of ALE. This is the part of your policy that acts as a safety net when you are forcibly displaced from your home through no choice of your own.

When ALE Applies (Temporary Relocation)

ALE is triggered when two conditions are met:

1. A Covered Peril (e.g., fire, lightning, windstorm, vandalism, sudden water damage) causes damage to your rental.

2. The damage renders your home “Uninhabitable”—meaning it’s unsafe or unfit to live in (e.g., no working utilities, structural damage, severe smoke/water damage).

In this scenario, your insurer will pay for you to maintain your normal standard of living elsewhere. This is a key component of your renters insurance coverage.

What ALE Typically Covers

– Temporary Housing: Hotel, motel, or short-term furnished rental (e.g., Airbnb, extended-stay hotel).

– Increased Food Costs: Restaurant and takeout meals that exceed your normal grocery budget.

– Storage Fees: For your belongings if they need to be stored during repairs.

– Pet Boarding: If your temporary lodging doesn’t allow pets.

– Laundry & Transportation: Extra costs for laundry services and increased commuting.

ALE has limits (often 20-30% of your personal property coverage) and a time limit (e.g., up to 12 months).

What Relocation is NOT Covered: Permanent Moving Expenses

Renters insurance is not a moving insurance policy. It will not cover any costs associated with a voluntary, permanent move to a new home.

| Type of Relocation Expense | Covered by Renters Insurance? | Explanation |

|---|---|---|

| Hotel after a fire makes your apartment unlivable. | YES (ALE) | Temporary housing due to a covered loss. |

| Security deposit for a new apartment after the fire. | NO | Permanent relocation costs are not covered, even if the fire caused the need to move. |

| Moving truck/company fees for a planned move. | NO | Voluntary moving expenses are never covered. |

| Food during a mandatory evacuation for a hurricane. | YES (ALE) | Extra living costs due to a covered peril (wind) and civil authority order. |

| Breaking a lease due to uninhabitable conditions. | NO (Directly) | ALE covers your increased costs, but doesn’t pay lease break fees. Your landlord may release you if the unit is truly uninhabitable. |

| Storing belongings while you find a new permanent home after a disaster. | YES (ALE) | This is a covered additional expense during the displacement period. |

The “Gray Area”: When a Temporary Move Becomes Permanent

If your home is so badly damaged that repairs will take an exceptionally long time (e.g., over a year), your ALE coverage may be exhausted, or you and your insurer may agree that finding a new permanent residence is the best solution. In some cases, the insurer might apply some remaining ALE funds toward initial costs of establishing a new home, but this is not standard and would require explicit negotiation. They will not pay your new security deposit as a matter of course.

Special Circumstances and Related Coverages

Does Renters Insurance Cover Moving Damage?

Maybe, during a temporary move. If you have to move your belongings into storage after a covered loss, and those items are damaged in transit or in storage, your personal property coverage typically still applies because the loss is connected to the covered event. However, damage during a voluntary, permanent move is not covered—you would need separate moving insurance or to file a claim with the moving company.

What if the Relocation is Due to a Non-Covered Event?

If you must relocate due to something not in your policy (e.g., a flood, earthquake, or bed bug infestation), ALE does not apply. You would need separate flood/earthquake insurance. For infestations, you’re generally on your own for any relocation costs.

Steps to Take if You Need to Relocate After a Covered Loss

1. Document the Cause & Uninhabitable Condition: Notify landlord and insurer. Take photos.

2. Contact Your Insurance Adjuster: Get pre-approval for temporary housing options and daily rate limits before booking long-term stays.

3. Keep All Receipts: For hotel, meals, laundry, storage—everything. This is mandatory for reimbursement.

4. Communicate About Timeline: Stay in touch with your adjuster and landlord regarding repair estimates. Your ALE coverage duration is tied to the repair time.

5. Plan for the Long Term: If repairs will take many months, discuss with your adjuster the possibility of transitioning to a more permanent solution and how ALE might apply.

Maximizing Your Protection

To ensure your ALE coverage is adequate for a potential temporary relocation:

– Choose a Sufficient Personal Property Limit: Since ALE is often a percentage of this limit, a higher personal property limit means a higher ALE limit.

– Understand Your Policy’s ALE Percentage: Know if it’s 20%, 30%, or another amount.

– Consider an Endorsement: Some insurers offer increased ALE limits for an additional premium.

Understanding these elements helps manage your overall renters insurance cost. For a full review, explore all renters insurance options.

Conclusion: A Temporary Bridge, Not a Moving Service

In summary, does renters insurance cover relocation? It provides a critical financial bridge for temporary, necessary relocation after a covered disaster, ensuring you have a roof over your head and food on the table. It is not designed to fund a permanent move, even one necessitated by a disaster. By understanding the clear distinction between ALE and moving expenses, you can set realistic expectations, ensure you have adequate ALE limits, and focus your financial planning for a permanent move on your own savings and resources.

Frequently Asked Questions (FAQ)

If my apartment is condemned after a fire, will insurance help me find and pay for a new apartment?

Your insurer will pay for temporary housing (ALE) while you look for a new place and may cover some initial costs if you find a new permanent home quickly (like overlapping rent for a short period). However, they will not pay the security deposit, first/last month’s rent, or moving truck fees to your new permanent apartment. Those are your responsibility.

Does renters insurance cover relocation due to mold?

Only if the mold is a direct result of a covered water loss (like a sudden pipe burst) and the unit is uninhabitable. Mold from long-term humidity or leaks is excluded, so relocation costs would not be covered.

Can I choose to permanently relocate and use my ALE money for the new deposit?

No. ALE is strictly for additional living expenses incurred because you cannot live in your insured home. A security deposit is a capital cost for a new asset, not a living expense. The insurer will not reimburse it. They pay for ongoing costs like rent for a temporary location, not upfront costs for a new lease.

What if I have to relocate for a job? Does renters insurance help?

No. Voluntary moves for employment, family, or personal reasons are not related to a covered insurance loss. You are 100% responsible for all associated moving and relocation costs.

How long can I stay in temporary housing with ALE?

For the “reasonable” time required to repair your home or until you find a new permanent residence, up to your policy’s stated time and financial limits. This is often 12-24 months, but the financial limit may run out first. Your adjuster must agree the timeline is reasonable.

Does ALE cover the cost of shipping my belongings across country if I decide to move after a disaster?

No. The cost to transport your belongings to a new, permanent residence you choose is considered a moving expense, not an additional living expense. ALE would only cover local storage or moving items to a temporary location during repairs.

Where can I find help with disaster recovery and housing?

For major disasters, FEMA may provide assistance. For general guidance, the Insurance Information Institute’s guide outlines steps, including working with your insurer on ALE.