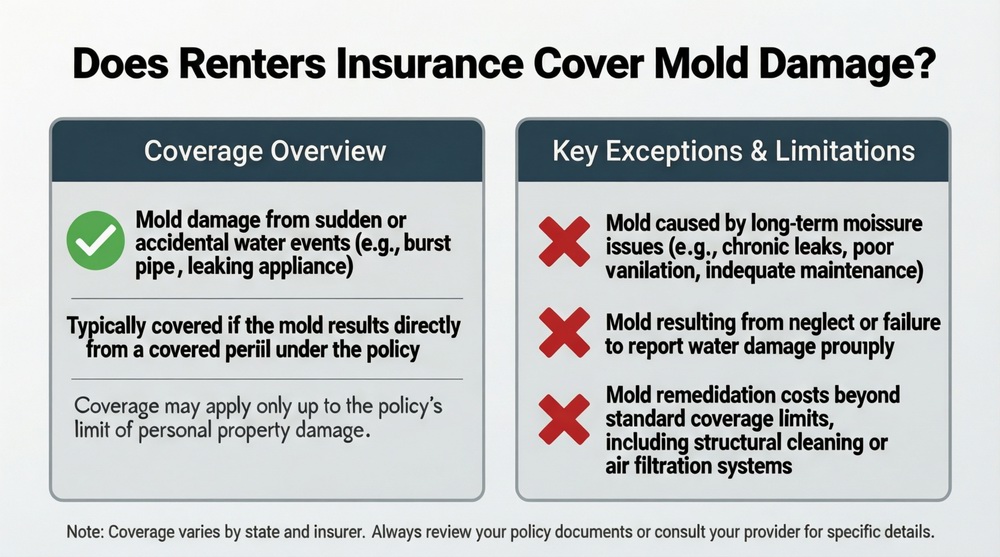

Discovering mold in your rental home can be alarming, raising immediate concerns about health, property damage, and financial responsibility. A critical question arises: does renters insurance cover mold damage? The answer is nuanced and highly dependent on the underlying cause of the mold growth. Standard renters insurance policies may provide limited coverage for mold damage, but only if it is the direct result of a covered peril listed in your policy, such as a sudden and accidental water leak from a burst pipe or a malfunctioning appliance. However, mold resulting from long-term neglect, lack of maintenance, or high humidity is almost always excluded. This guide will clarify the specific scenarios where coverage might apply, explain the common exclusions and limitations, and provide essential steps for prevention and remediation to protect your health and your finances.

When Renters Insurance Might Cover Mold Damage

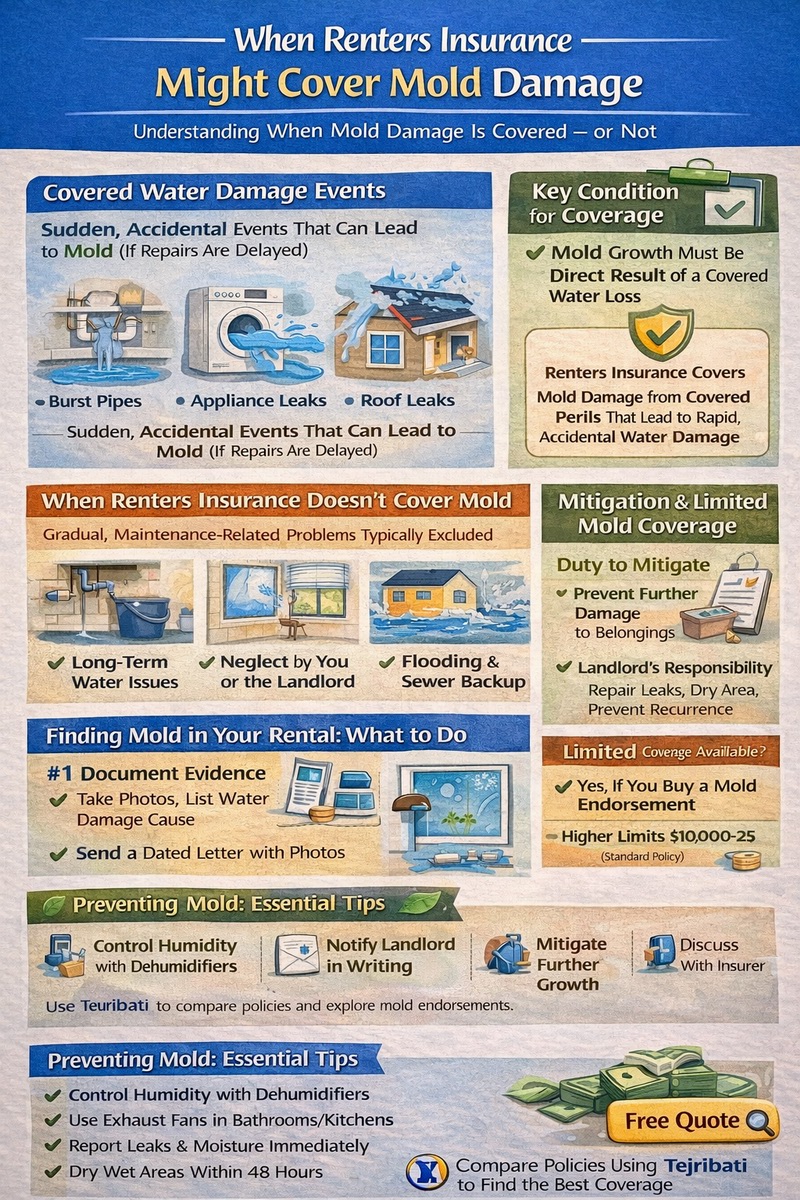

Renters insurance is designed to cover sudden and accidental events, not gradual deterioration. Therefore, the question “does renters insurance cover mold damage?” has a conditional yes, but only under strict circumstances. Coverage is typically triggered if the mold is a direct result of a covered water damage event. For example, if a washing machine supply line suddenly bursts, flooding your laundry closet, and mold subsequently grows in the damp drywall before repairs are made, your renters insurance may cover the cost to remediate the mold and replace your damaged personal property (like a nearby bookcase or clothing). The key is that the water event must be “sudden and accidental” and listed as a covered peril in your policy. In these cases, the mold is considered part of the resulting damage from the covered water loss.

Covered Perils That Can Lead to Mold

To understand potential coverage, you must know which perils are covered. Standard renters insurance policies name specific covered events. Those that can lead to sudden water damage and subsequent mold include: **Burst Pipes:** A pipe freezing and bursting in your wall. **Appliance Overflow or Leak:** A malfunctioning dishwasher, washing machine, or water heater leaking a large amount of water quickly. **Roof Leak:** If a storm damages the roof and water pours into your unit, damaging your belongings and leading to mold. **Fire Suppression:** Water damage from firefighters putting out a fire in your unit. In all these cases, you must take immediate and reasonable steps to mitigate the damage (like stopping the flow of water and reporting it to your landlord). If you fail to act quickly, the insurer may deny the mold claim, arguing you allowed the damage to worsen. For a full list of covered perils, review what renters insurance is.

The Role of Mitigation and Your Responsibilities

Your actions after a water incident are crucial. Renters insurance includes a clause called “duty to mitigate.” This means you must take reasonable steps to prevent further damage after a loss. If a pipe bursts, you must immediately shut off the water and notify your landlord. You should also move your belongings out of the water, use towels to soak up standing water, and increase ventilation. If you ignore the problem and mold grows as a result of your inaction, your insurer is likely to deny coverage for the mold remediation. Your primary responsibility is to protect the property from further harm; the landlord is typically responsible for repairing the source of the water (the broken pipe) and the structure, while your insurance handles your damaged belongings and any resulting mold on those items.

When Renters Insurance Does Not Cover Mold Damage

More often than not, the answer to “does renters insurance cover mold damage?” is no. Policies contain broad exclusions for mold, fungus, and wet rot. These exclusions are strictly enforced when the mold results from: Long-Term Moisture Issues: Persistent leaks from a slowly dripping pipe under a sink, a leaking window frame, or chronic bathroom condensation. Lack of Maintenance: Failure by you or the landlord to address known moisture problems, like a broken exhaust fan leading to high humidity. Flooding: Water that enters the home from the ground up, such as from heavy rains, overflowing rivers, or storm surge, is excluded. Flood damage requires separate flood insurance. Negligence: If mold grows because you failed to properly ventilate a bathroom or clean up a spill. Essentially, mold viewed as a maintenance issue or a result of gradual processes is not covered by your renters insurance coverage.

Common Exclusions and “Limited” Mold Endorsements

Modern renters insurance policies often have a blanket exclusion for mold or include very low sub-limits for mold remediation, such as $1,000 to $5,000, regardless of the cause. Some insurers offer an optional “mold endorsement” or “fungus coverage” for an additional premium, which may provide a higher limit (e.g., $10,000-$25,000) for mold resulting from a covered water loss. However, even these endorsements usually exclude mold from long-term humidity, construction defects, or flood water. It is essential to read your policy’s “Limitations” and “Exclusions” sections. The financial burden for excluded mold typically falls on the party responsible for the moisture source: the landlord if it is a building maintenance issue, or you, the tenant, if it was due to your negligence. For context on how these risks affect policy pricing, see our guide on renters insurance cost.

Landlord vs. Tenant Responsibility for Mold

Determining financial responsibility is key. Generally, the landlord is responsible for maintaining a habitable premises, which includes fixing structural issues that cause moisture (leaky roofs, faulty plumbing, broken ventilation). If mold grows due to such a failure, the landlord is typically liable for the cost of remediation and any damage to the structure. As a tenant, you are responsible for maintaining cleanliness, properly using ventilation systems, and promptly reporting any leaks or moisture problems. If mold grows because you did not use a bathroom fan, over-watered plants, or failed to report a small leak, you could be held financially responsible for the cleanup and any damage to the landlord’s property. Your renters insurance liability coverage might defend you if the landlord sues, but it would not pay for the mold remediation itself if the cause was your negligence.

Steps to Take if You Discover Mold in Your Rental

If you find mold, a systematic approach protects your health, your rights, and your potential insurance claim. Step 1: **Document Everything.** Take clear photos and videos of the mold and any suspected water source. Step 2: **Notify Your Landlord in Writing.** Send a dated letter or email detailing the discovery. This creates a record of notification, which is important for liability and repair timelines. Step 3: **Mitigate Further Growth.** While waiting for repairs, clean small areas of surface mold on non-porous surfaces with a detergent solution (if safe to do so). For larger infestations, wait for professionals. Increase air circulation. Step 4: **Consult Your Insurance.** If you believe the mold stems from a sudden, covered water event (like a recent burst pipe), contact your insurer to discuss the claim process. Have your documentation ready. Step 5: **Know Your Local Laws.** Many states and cities have specific codes regarding mold and landlord responsibilities. Local health departments can be a resource.

Filing an Insurance Claim for Mold

If you proceed with a claim, be prepared for scrutiny. The insurer will send an adjuster to inspect the damage and determine the cause. They will seek to establish whether the mold resulted from a covered “sudden and accidental” event or from a long-term, excluded condition. Your documentation and the landlord’s repair history will be critical. The insurer will also check that you fulfilled your duty to mitigate. If coverage is approved, payment will be subject to your policy’s mold sub-limit and your deductible. The claim may cover cleaning or replacing your personal belongings contaminated by mold and possibly limited remediation efforts. For help finding an insurer that offers clear mold coverage terms, consider using a comparison service like Tejribati. For expert, third-party information on property damage, the Insurance Information Institute provides valuable insights.

Preventing Mold: A Proactive Strategy

The best way to deal with mold is to prevent it. As a renter, you can: **Control Humidity:** Use dehumidifiers in damp areas and ensure your HVAC system is running properly. **Ventilate:** Always use bathroom and kitchen exhaust fans during and after showering or cooking. **Promptly Report Leaks:** Inform your landlord immediately of any plumbing leaks, roof leaks, or window condensation. **Dry Wet Areas:** Clean up spills and dry wet floors, carpets, and windowsills within 24-48 hours. **Promote Airflow:** Avoid pushing furniture directly against walls and open windows when weather permits. These steps not only protect your health but also strengthen your position if a dispute arises over liability for mold damage, demonstrating you took reasonable care of the property.

Conclusion: Know Your Policy, Protect Your Home

So, does renters insurance cover mold damage? It can, but only in narrow, specific situations tied to a sudden covered water loss. For the vast majority of mold cases related to humidity and maintenance, coverage is excluded. Your first line of defense is prevention and prompt communication with your landlord. Understanding your policy’s mold exclusions and limits is essential to avoid unexpected out-of-pocket expenses. Review your policy today, consider whether a mold endorsement is worthwhile for your situation, and take proactive steps to control moisture in your rental. By knowing where your coverage ends and your responsibilities begin, you can effectively manage the risks associated with mold and maintain a safe, healthy living environment.

Frequently Asked Questions (FAQ)

Will renters insurance pay for a hotel if mold makes my apartment unlivable?

Possibly, but only if the mold is the result of a covered peril. If a covered event (like a burst pipe) causes mold that renders your unit uninhabitable, your policy’s “loss of use” coverage may pay for temporary housing. If the mold is from an excluded cause, this coverage would not apply.

Does renters insurance cover mold inspection or testing?

Typically, no. Standard policies do not cover the cost of mold inspection, testing, or air quality tests. These are considered preventative measures or costs to determine the extent of a problem, not direct damage from a covered loss.

What if my landlord’s negligence causes mold?

If mold is caused by the landlord’s failure to maintain the property (e.g., a leaky roof they won’t fix), the financial responsibility for remediation and your damaged belongings generally falls on the landlord. You may need to pursue them directly or through legal channels; your renters insurance likely would not cover it.

Is black mold treated differently by insurance?

From an insurance standpoint, the type of mold (e.g., Stachybotrys, or “black mold”) usually does not change the coverage analysis. The insurer focuses on the cause of the mold growth, not its specific species. However, certain molds may lead to more extensive and costly remediation.

Can I be evicted for having mold in my apartment?

You cannot be evicted for discovering and reporting mold. However, if you caused the mold through neglect or failure to report a problem, and it causes significant damage, it could be considered lease violation leading to eviction proceedings.

Should I buy a mold endorsement for my renters insurance?

Consider a mold endorsement if you live in a humid climate, in an older building prone to leaks, or if you want extra peace of mind. Review the cost versus the increased coverage limit and ensure you understand what causes of mold it actually covers.

How do I prove the mold was from a sudden leak and not neglect?

Evidence is key. Photos/videos of the active leak, receipts for plumber visits, dated communications with your landlord reporting the leak, and the landlord’s repair records can help establish the timeline and show the event was sudden rather than gradual.