A common and important question for tenants is: does renters insurance cover damage to property? The answer depends entirely on whose property is damaged and the circumstances of the damage. Renters insurance provides two primary types of coverage that relate to property damage: first, it covers damage to your own personal property (your belongings) from specific perils like fire, theft, or water leaks. Second, and crucially, it covers damage you accidentally cause to other people’s property under the personal liability portion of your policy. This means if you accidentally cause a fire that damages the building or a neighbor’s unit, or if you break a visitor’s expensive item, your renters insurance can help cover the costs. This guide will clarify these distinct coverages, explain key exclusions, and help you understand exactly what is protected when property is damaged.

Coverage for Damage to Your Personal Property

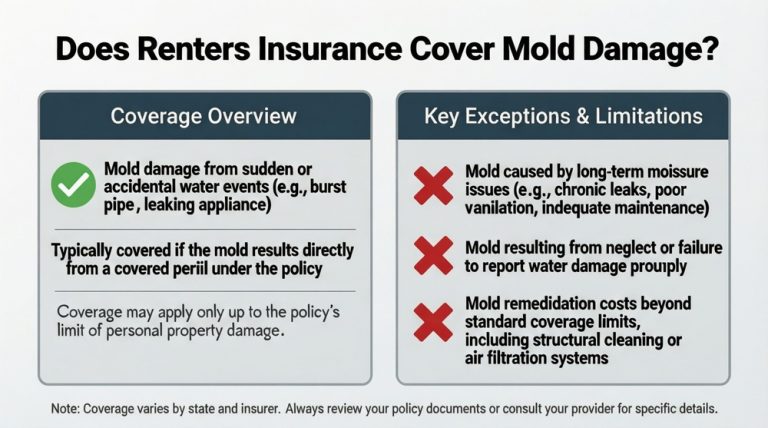

When asking “does renters insurance cover damage to property?” the most straightforward application is for your own possessions. The personal property coverage in a renters insurance policy is designed to pay to repair or replace your belongings if they are damaged or destroyed by a covered peril. Covered perils typically include events like fire, smoke, lightning, windstorm, hail, theft, vandalism, and the weight of ice or snow. It also covers certain types of water damage, such as from a burst pipe or an overflowing appliance. However, it is vital to understand what is not covered. Damage from floods and earthquakes is excluded, as is general wear and tear or damage from pests. The policy will pay up to the personal property limit you selected, minus your deductible. For a full understanding of this core protection, learn more about what renters insurance is.

Understanding Covered Perils and Settlements

Your policy is not an all-risk policy; it is a “named perils” policy, meaning it only covers the specific causes of loss listed. If your property is damaged by something not listed, it is not covered. Another critical factor is how your items are valued. Policies typically offer two types of settlements: Actual Cash Value (ACV), which pays the depreciated value of the item, or Replacement Cost Value (RCV), which pays the amount to buy a new equivalent item. RCV coverage is more comprehensive and costs slightly more. Knowing whether you have ACV or RCV coverage is essential when estimating how much you would receive to repair or replace damaged property. This coverage is the foundation of protecting your own financial investment in your belongings.

Liability Coverage for Damage You Cause to Others’ Property

The other vital way renters insurance covers damage to property is through personal liability protection. This is often the more important coverage because it protects your finances from the high costs of damaging someone else’s property. If you are found legally responsible (negligent) for damaging property that belongs to another person, your renters insurance liability coverage can pay for repairs or replacement. Common examples include: accidentally starting a kitchen fire that spreads to other units, causing damage to the building and neighbors’ belongings; overflowing a bathtub that leaks through the ceiling and damages the downstairs tenant’s furniture; or accidentally breaking a friend’s expensive electronic device while visiting their home. Your policy provides both a legal defense and pays for covered damages up to your liability limit, which is often $100,000, $300,000, or more.

Key Scenarios and the Claims Process

Imagine you are moving a bookshelf and it slips, putting a large hole in the rental’s wall. Does renters insurance cover damage to property in this case? Yes, because you damaged the landlord’s property (the wall). Your liability coverage would likely pay for the repair. The process involves notifying your insurance company, who may work directly with the landlord or their insurer to settle the claim. It is crucial to never admit fault before speaking with your insurer. They will investigate to determine if you are legally liable. This coverage is a financial safeguard, preventing you from having to pay large repair bills out of pocket. It is a core reason renters insurance is valuable, even for people who do not own many expensive items. Understanding the full scope of this protection is part of evaluating your renters insurance coverage.

What Renters Insurance Does Not Cover for Property Damage

While renters insurance covers many scenarios, there are significant exclusions to be aware of. First, intentional damage is never covered. If you deliberately cause damage, your policy will not pay. Second, damage from certain natural disasters like floods and earthquakes requires separate policies. Third, damage caused by your vehicle is covered by your auto insurance, not your renters policy. Fourth, damage to property related to a business you run from home is typically excluded. Fifth, normal wear and tear or damage from lack of maintenance is not covered. Finally, there are often limits on certain types of high-value personal property, like jewelry or art, unless you purchase additional scheduled coverage. Knowing these exclusions helps you avoid gaps in your protection.

Damage to the Rental Structure: Landlord vs. Tenant Responsibility

A frequent area of confusion is damage to the rental unit itself. Does renters insurance cover damage to property owned by the landlord? The landlord’s property insurance covers the building’s structure from perils like fire or storm. However, if you, the tenant, cause the damage through negligence, the landlord’s insurer may pay for the repairs initially but then may pursue you (or your insurer) to recover the costs through a process called subrogation. This is where your renters liability coverage becomes essential. It would respond to cover your legal liability for damaging the landlord’s property. If the damage is due to a normal building issue, like a roof leak from aging materials, that is the landlord’s responsibility to fix. The line between tenant negligence and landlord maintenance is where disputes often arise, and your liability coverage is your key protection. For more on costs related to these risks, see our guide on renters insurance cost.

How to File a Property Damage Claim

If property is damaged, follow these steps. For damage to your own belongings: 1. Document the damage with photos or video. 2. Prevent further damage if safe (e.g., move items out of water). 3. Contact your insurance company to start a claim under your personal property coverage. 4. Provide a list of damaged items and their value. For damage you cause to others’ property: 1. Ensure everyone’s safety. 2. Document the scene. 3. Notify the property owner (e.g., your landlord or neighbor). 4. Contact your insurance company immediately to report the incident under your liability coverage. Do not admit fault or agree to pay for anything before speaking with your insurer. They will guide you through the process, which may include an inspection by an adjuster and communication with the other party.

Maximizing Your Protection and Preventing Disputes

To ensure you are well-protected, take these steps. First, choose adequate liability limits; many experts recommend at least $300,000. Second, consider an umbrella policy for extra liability protection if you have significant assets. Third, opt for replacement cost coverage for your personal property. Fourth, create a home inventory to streamline claims for your own belongings. Fifth, understand your lease and your responsibilities for maintenance to avoid liability for negligence. Finally, communicate with your landlord promptly about any maintenance issues to prevent them from becoming bigger problems. To find the right policy with clear terms, use a comparison service like Tejribati. For expert advice on property and liability insurance, the Insurance Information Institute is a trusted resource.

Conclusion: A Dual-Layer Safety Net

So, does renters insurance cover damage to property? Yes, in two critical ways. It serves as a safety net for your own belongings when they are damaged by covered events, and it acts as a vital financial shield when you are responsible for damaging someone else’s property. Understanding the distinction between personal property coverage and liability coverage is key to using your policy effectively. By selecting appropriate coverage limits, knowing your policy’s exclusions, and taking proactive steps to document your possessions and maintain your rental, you can rent with confidence. Renters insurance transforms potential financial disasters into manageable incidents, protecting both your possessions and your financial future.

Frequently Asked Questions (FAQ)

Does renters insurance cover accidental damage to an apartment?

Yes, if you accidentally cause damage to the apartment (like putting a hole in the wall or staining the carpet), your renters insurance liability coverage can pay for the repairs, as you are liable for damage you cause to the landlord’s property.

If my TV is damaged in a power surge, is it covered?

It depends on your policy. Some standard renters policies include coverage for power surges that originate from outside your home, while others may exclude it or require a specific endorsement. Check your policy’s named perils list.

Does renters insurance cover my car if it’s damaged in the parking lot?

No. Damage to your vehicle, whether parked at home or elsewhere, is covered by your auto insurance policy, not your renters insurance. However, items stolen from your car may be covered by renters insurance.

What if a guest damages my property?

Your renters insurance personal property coverage would typically cover damage a guest accidentally causes to your belongings. If the guest intentionally causes damage, you would file a claim, but your insurer might then seek to recover the cost from the guest.

Are my roommate’s belongings covered under my policy?

Generally, no. Your renters insurance covers you and resident relatives. Your roommate’s property is not covered unless they are named on your policy. They should have their own renters insurance policy.

How much liability coverage do I need?

A common recommendation is to carry liability limits equal to your net worth. Most policies start at $100,000, but $300,000 or $500,000 is often advised for better protection at a relatively low additional cost.

Does renters insurance cover damage from pests like bed bugs?

No. Damage from insects, rodents, or other pests is considered a maintenance issue and is excluded from standard renters insurance policies. This includes the cost of extermination and replacing infested items.