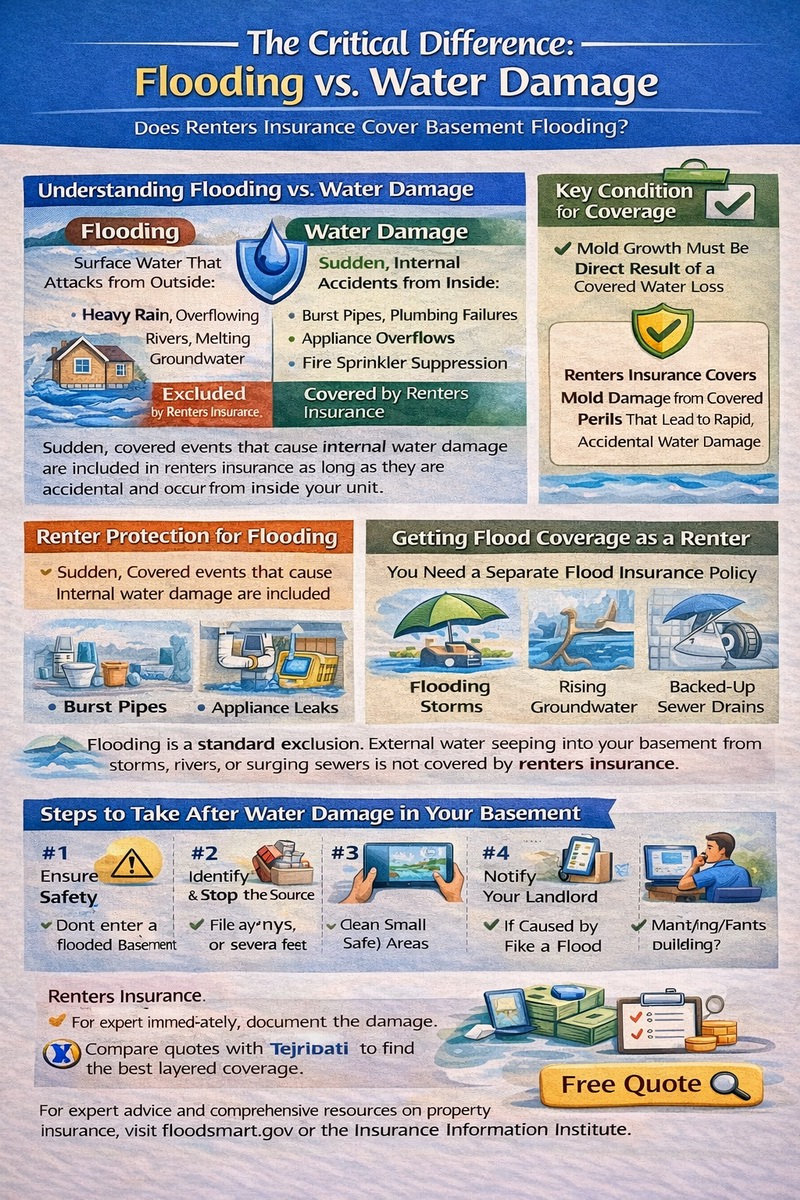

For renters with basement-level units or storage lockers, water intrusion is a common and serious concern. The critical question is: does renters insurance cover basement flooding? The answer requires a clear understanding of the fundamental difference between two types of water damage: “water damage” from internal sources, which may be covered, and “flooding” from external sources, which is almost always excluded. Standard renters insurance policies typically do not cover damage caused by water that enters your home from the ground up, such as from heavy rainfall, overflowing rivers, or storm surge. However, they may cover water damage from sudden, internal incidents like a burst pipe or an overflowing washing machine. This guide will clarify these distinctions, explain what is and is not covered, and provide essential steps to protect your belongings and secure the right insurance for your basement rental.

The Critical Difference: Flooding vs. Water Damage

To answer “does renters insurance cover basement flooding?” you must first distinguish between a flood and other water damage. In insurance terms, a flood is defined as a general and temporary condition where two or more acres of normally dry land or two or more properties are inundated by water or mudflow. This includes surface water entering your basement from outside due to heavy rain, snowmelt, rising groundwater, or overflowing bodies of water. This type of event is excluded from every standard renters insurance policy. Water damage, on the other hand, typically refers to accidental and sudden discharge or overflow of water from within your dwelling. Examples include a burst pipe, a malfunctioning water heater, or an overflowing sink. This type of damage is usually a covered peril, as it is sudden and internal. For a foundational understanding of standard protections, review what renters insurance is.

What is Typically Covered: Sudden and Accidental Internal Water Events

If your basement sustains water damage from a sudden, internal source, your renters insurance personal property coverage may apply. Covered scenarios include: Burst Pipes: A frozen or broken pipe in the wall or ceiling leaks water into your basement. Appliance Malfunctions: Your washing machine, dishwasher, or water heater overflows or leaks. Plumbing Failures: A toilet overflows or a sink drain backs up (note: sewer backup may be a separate exclusion or require an endorsement). Fire Suppression: Water used by firefighters to extinguish a fire in your unit. In these cases, the policy would cover the cost to repair or replace your damaged belongings (furniture, electronics, clothing) after you pay your deductible. It may also cover the cost of water extraction and drying to prevent further damage, as part of your duty to mitigate the loss. The landlord remains responsible for repairing the source of the leak and the structure itself.

The Standard Flood Exclusion and What It Means

The flood exclusion is a universal clause in renters insurance policies. It explicitly states that damage caused by “flood, surface water, waves, tidal water, overflow of a body of water, or spray from any of these, whether or not driven by wind” is not covered. For basement renters, this means water that seeps in through foundation cracks during a heavy rainstorm, water that backs up through floor drains from overwhelmed municipal sewers (unless you have a specific endorsement), or groundwater that rises into your unit is not covered. This exclusion applies regardless of whether the flooding is a few inches or several feet deep. Understanding this exclusion is a crucial part of evaluating your renters insurance coverage and recognizing a significant gap that requires separate protection.

How to Protect Your Belongings from Basement Flooding

Since standard renters insurance does not cover basement flooding from external sources, proactive measures are essential. First, assess your risk. Are you in a designated flood zone? Check FEMA’s Flood Map Service Center. Even if you are not in a high-risk zone, flooding can occur anywhere. Second, purchase separate flood insurance. Flood insurance is available through the National Flood Insurance Program (NFIP) and some private insurers. It is a separate policy that covers both the building (the landlord’s responsibility) and your personal contents (your responsibility). As a renter, you can purchase a “contents-only” flood policy to protect your belongings. Third, take physical precautions. Store valuables and important documents in watertight containers and on high shelves. Use plastic storage bins instead of cardboard boxes. Consider installing a water alarm or a sump pump if permitted by your lease.

Understanding and Purchasing Flood Insurance

To address the gap left by renters insurance, you need a flood policy. An NFIP contents-only policy provides coverage for your personal property, up to the limit you choose, with separate deductibles. There is typically a 30-day waiting period from the date of purchase before coverage begins, so you cannot wait for a storm forecast to buy it. The cost varies based on your flood risk, the coverage amount, and your deductible. For renters in moderate-to-low risk areas, premiums can be very affordable, often less than $200 per year for significant coverage. This policy will specifically cover damage from surface water flooding, making it the definitive answer to “does renters insurance cover basement flooding?” for external water events. For insights on the cost of comprehensive protection, see our guide on renters insurance cost factors.

Sewer Backup Coverage: Another Important Endorsement

Another common basement water issue is sewer or drain backup. This occurs when water or waste backs up through floor drains, toilets, or sinks. This is often *excluded* from standard renters and flood policies. However, many insurers offer a “water backup endorsement” or “sewer backup coverage” as a low-cost add-on to your renters policy. This endorsement is highly recommended for basement and ground-floor tenants. It provides a specific limit (e.g., $5,000-$10,000) to cover damage to your belongings and the cost of cleanup from a backed-up drain or sewer line. Given that heavy rains can overwhelm municipal sewer systems, causing backups, this endorsement is a critical layer of protection that complements both your standard renters policy and a separate flood policy.

Steps to Take After Basement Water Damage Occurs

If water enters your basement, your immediate actions can minimize damage and support your insurance claim. Step 1: Ensure Safety. Do not enter a flooded basement if there is any chance of electrical hazard. Step 2: Identify and Stop the Source. If the water is from an internal leak (like a pipe), turn off the main water valve. If it is from flooding, you must wait for the water to recede. Step 3: Document Everything. Take photos and video of the water level, the damage to your belongings, and the point of entry. Step 4: Notify Your Landlord Immediately. They are responsible for stopping the source (if structural) and making repairs to the building. Step 5: Mitigate Damage. Move undamaged items to a dry area. Remove standing water if safe to do so. Step 6: Contact Your Insurance Company. Report the loss, describe the cause, and begin the claims process. Have your policy number and documentation ready.

Filing a Claim for Water Damage or Flooding

The claims process depends entirely on the cause. For a covered internal water leak: File a claim with your renters insurance company. An adjuster will determine if the cause is covered and assess the damage to your personal property. For external flooding: You must file a claim with your flood insurance provider (NFIP or private insurer). Your standard renters insurer will deny the claim. For sewer backup: If you have the endorsement, file with your renters insurer under that specific coverage. Be prepared to provide evidence of the cause. The insurer will need to determine if the water came from a burst pipe (covered) or from groundwater seepage (excluded). Clear documentation and a timely report from your landlord can be crucial evidence. To compare renters policies that offer strong optional endorsements, use a service like Tejribati. For expert advice, the Insurance Information Institute is a key resource.

Conclusion: Layered Protection is Essential

So, does renters insurance cover basement flooding? For flooding from external sources, the answer is a definitive no. Standard renters insurance is not a flood policy. It is designed for internal, sudden accidents. To truly protect your basement belongings, you need a layered approach: a robust renters insurance policy for internal leaks, a water backup endorsement for sewer issues, and a separate flood insurance policy for external water. Assess your risk, understand your lease responsibilities, and take proactive storage measures. By securing the right combination of coverage, you can face rainy seasons with confidence, knowing your financial interests are protected regardless of where the water comes from.

Frequently Asked Questions (FAQ)

Does renters insurance cover a flooded basement from heavy rain?

No. Water that enters your basement from the ground outside due to heavy rain, snowmelt, or rising groundwater is considered flooding and is excluded from all standard renters insurance policies. You need a separate flood insurance policy for this.

What if my basement floods from a burst pipe?

Yes, this is typically covered. A burst pipe is a sudden and accidental internal water event, which is a covered peril under the personal property section of your renters insurance policy. It would cover your damaged belongings.

Will my landlord’s insurance cover my belongings in a basement flood?

No. Your landlord’s insurance covers the building’s structure and their liability. It does not extend to your personal property under any circumstances. Protecting your belongings is solely your responsibility through your own insurance policies.

Is flood insurance expensive for renters?

Not necessarily. For renters, a contents-only flood insurance policy through the NFIP can be quite affordable, especially in moderate- to low-risk areas. Premiums can start under $150 per year for substantial coverage, making it a cost-effective essential for basement dwellers.

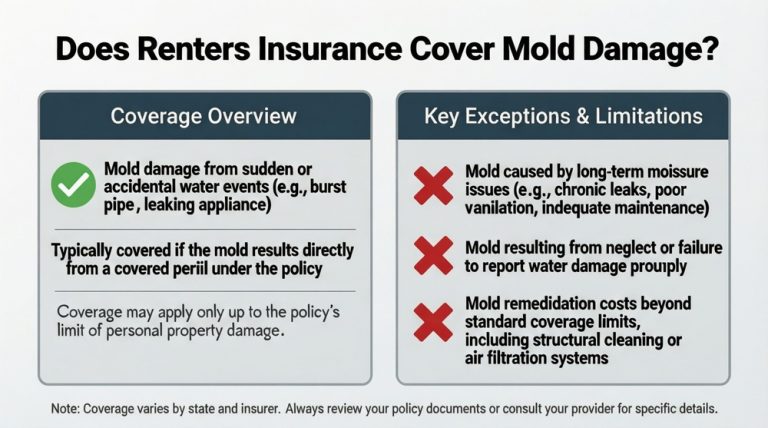

Does renters insurance cover a leaking water heater?

It depends on how it leaks. If the water heater bursts or cracks suddenly, causing a rapid release of water, the damage to your belongings is likely covered. If it has a slow, gradual leak over time that causes damage, it may be denied as a maintenance issue.

What is the difference between flood insurance and water backup coverage?

Flood insurance covers water coming from outside the home (e.g., rising river, heavy surface runoff). Water backup coverage is an endorsement that covers water that backs up through sewers or drains from within the municipal system. You may need both.

Can I get renters insurance if I live in a basement apartment?

Yes, you can and absolutely should get renters insurance for a basement apartment. However, you must disclose that it is a basement unit, as this affects your risk profile. Be sure to discuss flood and water backup endorsements with your agent given the increased risk.