The renters insurance cost is a key consideration for anyone leasing a home or apartment, with the national average premium providing an affordable baseline for substantial financial protection. According to recent industry analyses, the average cost of renters insurance in the United States typically ranges from **$13 to $23 per month**, or about **$151 to $170 annually**. However, your final premium is not a one-size-fits-all figure; it is a personalized calculation based on your location, the value of your belongings, your chosen deductible, and several other personal and property-related factors. This guide will break down the national and state-level averages, explain the eight most significant factors that determine your rate, and provide actionable strategies to lower your renters insurance premium without sacrificing essential coverage. By understanding what goes into the price, you can make informed decisions, shop smarter, and secure a policy that offers both value and peace of mind.

National and State Averages for Renters Insurance Cost

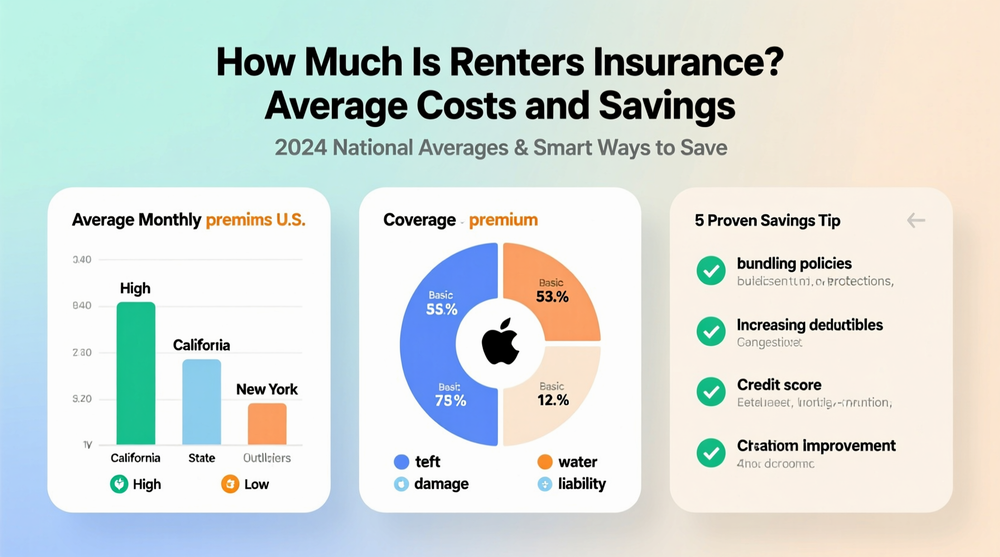

Before diving into personal factors, it’s helpful to understand the broader pricing landscape. The national average cost serves as a useful benchmark, but premiums can vary dramatically depending on where you live due to localized risks like natural disasters and crime rates.

What is the National Average Renters Insurance Cost?

Multiple reputable sources report consistent figures for the average national renters insurance cost. Data from the Insurance Information Institute (III) places the average annual premium at around $170, while analyses from NerdWallet estimate it at $151 per year for a policy with $30,000 in personal property coverage. Another major insurer cites an average of about $23 per month, or roughly $276 annually. These variations in reported averages often stem from differences in the assumed coverage levels, deductibles, and data sources used in the calculations. For a baseline estimate, renters can reasonably expect to pay **between $150 and $200 per year** for a standard policy.

State-by-State Cost Breakdown

Your state of residence is one of the most powerful determinants of your renters insurance premium. Consistently, states in the Southeast and those prone to severe weather events top the list for the most expensive average costs. Conversely, states in the Midwest with lower risk profiles often have the most affordable rates.

The table below illustrates the significant variance across states, using compiled data from recent analyses.

| Most Expensive States | Avg. Annual Premium | Least Expensive States | Avg. Annual Premium |

|---|---|---|---|

| Louisiana | $243 – $266 | North Dakota | $114 – $123 |

| Mississippi | $223 – $262 | South Dakota | $117 – $129 |

| Alabama | $203 – $222 | Wisconsin | $126 – $141 |

| Georgia | $205 – $213 | Iowa | $125 – $144 |

| Oklahoma | $179 – $221 | Minnesota | $132 – $150 |

These disparities primarily reflect localized risks. States with high costs frequently face hurricanes, tornadoes, or severe thunderstorms, leading to a greater historical frequency of claims. Similarly, areas with higher crime rates may also see elevated premiums.

8 Key Factors That Determine Your Renters Insurance Cost

Insurers calculate your premium through a process called “risk assessment,” which estimates how likely you are to file a claim. The following eight factors are the primary components of that assessment, giving you clear levers to understand and potentially influence your final rate.

1. Your Geographic Location

As seen in the state averages, location is a primary cost driver. Insurers evaluate risk at your specific ZIP code and address, considering:

– **Natural Disaster Risk:** Proximity to coastlines (hurricanes), fault lines (earthquakes), or wildfire-prone areas significantly increases premiums.

– **Local Crime Rates:** Higher rates of theft, vandalism, and burglary in your neighborhood can lead to higher costs.

– **Proximity to Emergency Services:** Living near a fire station or fire hydrant can sometimes mitigate risk and lower your rate.

2. Coverage Limits and Type

The amount and quality of coverage you choose directly impact your premium. This includes:

– **Personal Property Limit:** This is the maximum amount your policy will pay to replace your belongings. The higher the limit, the higher your premium. For example, increasing from $30,000 to $50,000 in coverage can raise the average annual cost from $151 to $192.

– **Liability Limit:** This covers you if you are found responsible for injuring someone or damaging their property. Increasing this limit, say from $100,000 to $300,000, typically adds only a small amount to your premium.

– **Replacement Cost vs. Actual Cash Value:** Opting for “replacement cost” coverage (which pays to buy a new item) costs about 11% more on average than “actual cash value” (which pays the item’s depreciated value). For a foundational understanding of these coverage types, you can refer to our guide on renters insurance.

3. Your Deductible Amount

Your deductible is the amount you pay out-of-pocket when you file a claim before insurance coverage kicks in. There’s a direct trade-off: **choosing a higher deductible lowers your monthly or annual premium**, while a lower deductible results in a higher premium. You must select a deductible you can comfortably afford to pay in the event of a loss.

4. Personal Credit History

In most states, insurers use a credit-based insurance score to help set rates. Statistical data indicates that individuals with lower credit scores tend to file more claims. As a result, someone with poor credit could pay an average of 71% more—about $257 annually instead of $151—compared to someone with good credit. It’s important to note that the use of credit history for insurance pricing is prohibited in California, Maryland, and Massachusetts.

5. Claims History

Your personal insurance claims history signals future risk to insurers. Filing multiple claims, even for different types of insurance, can label you as a higher-risk customer and increase your renters insurance cost. For instance, having a recent theft claim on your record can increase your average annual premium from $151 to about $178.

6. Property Features and Safety

The characteristics of your rental unit itself can lead to discounts or surcharges:

– **Safety & Security Features:** Apartments with central fire alarms, burglar alarms, deadbolt locks, or sprinkler systems are less risky and often qualify for discounts.

– **Building Age & Condition:** Newer buildings with updated electrical and plumbing systems may be cheaper to insure than older buildings.

– **Building Size:** Larger apartment complexes with many units sometimes have lower average premiums than single-family rental homes.

7. Bundling with Other Policies

One of the most effective ways to save is by purchasing your renters insurance from the same company that provides your auto insurance. This “multi-policy” or bundling discount can typically save you **between 5% and 15%** on your total premiums. It’s always wise to compare the bundled price against separate policies from different providers to ensure it’s the best deal.

8. Other Personal Factors

Additional variables can influence your rate, including:

– **Dog Ownership:** Certain dog breeds perceived as high-risk may lead to higher liability premiums or even policy exclusions.

– **Payment Plan:** Some insurers offer a discount if you pay your annual premium in full upfront rather than in monthly installments.

Actionable Strategies to Lower Your Premium

While some factors like your location are fixed, you have control over several others. Implementing these strategies can help you reduce your renters insurance cost effectively.

Shop Around and Compare Quotes

This is the single most important step. Premiums can vary by hundreds of dollars for identical coverage from different companies. Experts recommend getting and comparing detailed quotes from at least three different insurers to find the best combination of price and coverage.

Optimize Your Deductible and Coverage

Review your personal property inventory honestly. If you have overestimated the value of your belongings, lowering your coverage limit can reduce your premium. Similarly, if you have a robust emergency fund, opting for a higher deductible can significantly lower your monthly cost.

Ask About Every Possible Discount

Don’t wait for discounts to be applied automatically. Inquire with your agent or insurer about:

– **Security System Discounts:** For having smoke detectors, burglar alarms, or deadbolts.

– **Claims-Free Discounts:** For maintaining a history without filed claims.

– **Autopay or Paperless Billing Discounts:** Some companies offer small incentives for these conveniences.

Improve Your Credit Score

Since a better credit-based insurance score can lead to lower rates in most states, taking steps to improve your credit—like paying bills on time and reducing debt—can have a positive long-term impact on your insurance costs.

Conclusion: Balancing Cost with Essential Protection

Understanding renters insurance cost involves looking beyond the national average and examining the personal and property-specific factors that shape your unique premium. While the price is consistently affordable—often less than a monthly streaming subscription—the value it provides in protecting your belongings, finances, and future from liability is substantial. By actively shopping around, leveraging discounts like bundling, and making informed choices about your deductible and coverage limits, you can secure a policy that fits both your budget and your need for security. Remember that coverage details, pricing, and regulations vary by state and provider, so obtaining personalized quotes is the final, crucial step in the process. For a broader perspective on protecting your rented home, explore our renters insurance resources.

Frequently Asked Questions (FAQ)

Why is my renters insurance so high?

Your premium may be higher than average due to several common factors. Living in a state prone to natural disasters (like Louisiana or Mississippi) or in a neighborhood with a high crime rate are major contributors. Personal factors such as a lower credit score (in most states) or a history of filing insurance claims can also significantly increase your rate.

Does renters insurance cost more for a house than an apartment?

Not necessarily. Since renters insurance coverage applies to your belongings and liability, not the structure, the type of building has a smaller effect. However, a single-family rental home might have different risk factors (like greater exposure) that could influence the price slightly compared to a unit in a larger, secured apartment building.

How much does a recent claim increase my renters insurance cost?

The impact varies by insurer and the type of claim. An analysis found that a recent theft claim could increase the average annual premium by about 18%, from $151 to $178. Multiple claims within a short period are viewed as a higher risk and can lead to more substantial rate increases.

Can I get renters insurance with poor credit?

Yes, you can still get renters insurance with poor credit. However, in the majority of states where it’s permitted, insurers will likely charge a higher premium. On average, renters with poor credit pay about 71% more than those with good credit. Some specialty providers may offer policies without a credit check.

What is the cheapest way to get renters insurance?

The most effective way to find an affordable policy is to compare quotes from multiple companies. Additionally, bundling your renters and auto insurance with the same provider can unlock significant discounts. Choosing a higher deductible and ensuring you only pay for the coverage you truly need are also reliable methods to lower your cost.

Is renters insurance worth the cost?

For the vast majority of renters, yes. At an average of $15 to $20 per month, it provides critical financial protection against the loss of personal belongings from theft or disaster, covers temporary living expenses if your home is damaged, and protects you from potentially devastating liability lawsuits. It is a low-cost safeguard for your financial stability.