If you’re asking, “do I need renters insurance?” the short, definitive answer is yes. For the vast majority of renters, it is a critical, affordable, and non-negotiable component of a responsible financial plan. A common and costly misconception is that your landlord’s insurance policy covers your personal possessions and liability—it does not. Their policy protects only the building structure itself. Renters insurance is your dedicated shield, providing three essential protections: coverage for your personal belongings against theft and disasters, liability coverage if someone is injured in your home, and funds for temporary living expenses if your rental becomes uninhabitable. This guide will thoroughly dissect the reasons why you need it, debunk persistent myths, and demonstrate how this small investment provides immense peace of mind and financial security.

The Critical Reasons Why You Need Renters Insurance

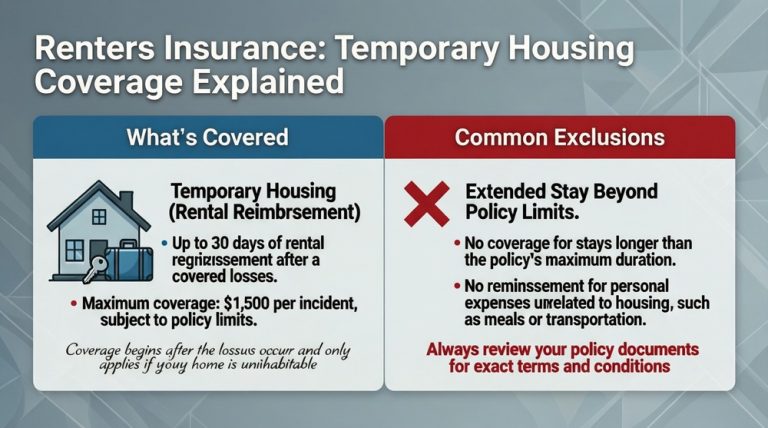

Understanding the compelling reasons behind the need for renters insurance moves it from an optional consideration to an essential purchase. First and foremost, it protects your financial investment in everything you own. Imagine replacing your clothing, furniture, electronics, kitchenware, and other belongings all at once after a fire or major theft—the cost would be staggering for most people. Renters insurance provides the funds to recover without devastating your savings. Secondly, it offers crucial liability protection. If a guest slips and falls in your apartment or your dog accidentally bites someone, you could be held legally responsible for medical bills and legal fees. Without insurance, your current assets and future wages could be at risk. Finally, it provides a safety net with loss of use coverage, paying for a hotel, meals, and other costs if you’re temporarily displaced. For a foundational breakdown, explore what renters insurance is in detail.

Your Landlord’s Insurance Does Not Cover You

The most pervasive myth that leads renters to ask “do I need renters insurance?” is the belief that the landlord’s policy extends to their unit. This is false. A landlord’s property insurance covers the physical building—the roof, walls, common areas, and possibly appliances they own. It does not cover your personal property inside the walls, nor does it provide you with any liability protection. If a pipe bursts and ruins your furniture and electronics, the landlord’s policy may pay to fix the pipe and the floor, but you are solely responsible for replacing your soaked belongings. This critical gap in coverage is precisely what renters insurance is designed to fill. Assuming you are covered under another policy is a risky gamble that can lead to significant financial loss.

Liability: The Overlooked Financial Lifesaver

While protecting belongings is important, the liability component of renters insurance is arguably its most valuable feature. We live in a litigious society, and accidents happen. If someone is injured in your home, you could be sued for medical expenses, lost wages, and “pain and suffering.” Even a simple incident can result in tens of thousands of dollars in liability. Your renters insurance policy provides a legal defense and will pay settlements or judgments up to your policy limit (often $100,000 to $500,000). This protection extends beyond your front door; it often covers you for certain incidents away from home as well. This layer of security protects your bank account, your car, and your future earnings from being garnished to pay a lawsuit—a powerful reason why you need renters insurance regardless of how many valuables you own.

Debunking Common Myths and Misconceptions

Many renters talk themselves out of a policy based on incorrect assumptions. Let’s dismantle the most common myths. Myth 1: “I don’t own enough stuff to need it.” Most people severely underestimate the total replacement cost of their possessions. Conduct a quick room-by-room mental inventory: clothing, shoes, bedding, TV, computer, game consoles, furniture, kitchen appliances, dishes, and more—it adds up quickly. Myth 2: “It’s too expensive.” Renters insurance is one of the most affordable types of insurance, averaging just $15-$30 per month. This is less than most streaming service bundles. Myth 3: “My roommate has a policy, so I’m covered.” Typically, roommates are not covered under each other’s policies unless specifically named. You need your own policy. Myth 4: “I’m a great tenant, so nothing will happen.” Disasters like fires, burglaries, and water damage are often out of your control and can affect anyone. For a clear look at the realistic renters insurance cost, see our detailed guide.

“I Can’t Afford It” and Other Cost Misconceptions

The perception of high cost is a major barrier, but it’s based on a lack of information. The national average cost is remarkably low, and there are multiple ways to make it even more affordable. The most effective method is to bundle it with your auto insurance, which can save you 10-25% on both policies. Many insurers also offer discounts for safety features (smoke alarms, deadbolts), for being claim-free, or for setting up automatic payments. You can also lower your premium by choosing a higher deductible. When you weigh the minimal monthly cost against the potential of having to replace $20,000 worth of belongings out-of-pocket or facing a $50,000 liability lawsuit, the value proposition becomes undeniable. The question shifts from “do I need renters insurance?” to “can I afford *not* to have it?”

Addressing the “Nothing Will Happen to Me” Mindset

This mindset is the riskiest of all. Insurance is not for the things you expect to happen; it’s for the unexpected disasters you cannot predict or control. Consider these real-world scenarios that are not rare: a kitchen fire accidentally spreads, a burglary occurs while you’re at work, a windstorm breaks windows and ruins your furniture, or a guest trips over a rug and breaks an arm. These events are common enough that insurers price policies based on their statistical likelihood. Renters insurance is the tool that turns a potentially life-altering financial catastrophe into a manageable inconvenience. It’s the definition of being proactive rather than reactive. The comprehensive renters insurance coverage is designed specifically for these unpredictable moments.

Special Circumstances: When Renters Insurance is Non-Negotiable

While all renters benefit from a policy, certain situations make it an absolute necessity. If you live in an area prone to natural disasters like wildfires, tornadoes, or severe storms, the risk to your property is elevated. If you own high-value items like expensive electronics, musical instruments, jewelry, or collectibles, the standard sub-limits in a policy may not be enough, making scheduled personal property coverage essential. Pet owners, especially of dog breeds sometimes deemed higher risk, may find that renters insurance is crucial for providing liability coverage in case their pet injures someone. Furthermore, if your lease requires it, you have no choice—an increasing number of landlords mandate proof of renters insurance as a condition of the lease to limit their own liability and ensure tenants can recover from a loss without conflict.

Your Lease May Require It

A growing trend in property management is to include a clause in the lease agreement mandating that tenants carry a minimum amount of renters insurance liability coverage (often $100,000). Landlords do this to protect their own interests; it ensures that if you cause significant damage to the property (like a kitchen fire that damages multiple units) or if a guest is injured, your insurance will respond first. This reduces the likelihood of the landlord’s insurer suing you to recover costs (a process called subrogation). Failing to maintain the required insurance can be considered a lease violation, potentially leading to fees or even eviction. Therefore, one of the most straightforward answers to “do I need renters insurance?” is to check your lease agreement—it may already be decided for you.

Protecting High-Value Possessions and Lifestyle

For renters with valuable assets or active lifestyles, a standard policy is just the starting point. If you own a high-end bicycle, musical equipment, a valuable gaming PC, or fine jewelry, you likely need to schedule these items. A standard policy has sub-limits for categories like jewelry (e.g., $1,500 for theft), which is insufficient for an engagement ring. Scheduling an item provides broader coverage (including accidental loss) for its full appraised value. Similarly, if you freelance or run a business from home, you may need an endorsement to cover business equipment. For the most comprehensive view of your options, using a comparison service like Tejribati can help you find policies that cater to these specific needs. For expert, third-party insights, the Insurance Information Institute offers authoritative guidance.

The Bottom Line: An Investment in Peace of Mind

So, do you need renters insurance? The evidence overwhelmingly points to yes. It is a small, manageable monthly expense that provides an enormous return in financial security and personal peace of mind. It transforms “what if” from a source of anxiety into a manageable plan. For less than the cost of a daily coffee, you gain the confidence that your belongings are protected, you are shielded from catastrophic liability, and you have a plan if you’re temporarily homeless due to a disaster. It is a fundamental pillar of responsible adulting for anyone who rents. The process of getting a quote is simple and fast. Don’t wait for a disaster to reveal the gap in your coverage. Take the proactive step today to protect your present and your future.

Frequently Asked Questions (FAQ)

Is renters insurance legally required?

While no state law requires it, your landlord can legally require it as a condition of your lease. An increasing number of property management companies and landlords do exactly that, making it a practical requirement for many renters.

What if I live with roommates?

Each roommate should generally have their own separate renters insurance policy to cover their personal property and liability. Some insurers offer a shared policy, but this can be complex if one person moves out or if a claim affects how premiums are calculated.

Does renters insurance cover my car or items in my car?

No, damage to your car is covered by your auto insurance policy. However, personal items stolen from your car (like a laptop or luggage) are typically covered by your renters insurance policy, as it protects your belongings anywhere in the world.

Are floods and earthquakes covered?

No, standard renters insurance policies exclude damage from floods and earthquakes. You must purchase separate, specific policies or endorsements to be protected against these perils.

How quickly can I get a policy?

You can often get a quote and purchase a renters insurance policy online in less than 15 minutes. Coverage can frequently start the same day or the next day.

What is the difference between actual cash value and replacement cost?

Actual Cash Value (ACV) pays the value of your item minus depreciation. Replacement Cost pays the amount to buy the item new at today’s prices. Replacement cost coverage is more comprehensive and costs a bit more but is highly recommended.

Can I cancel my renters insurance if I move?

Yes, you can cancel your policy at any time, usually with a pro-rated refund for any unused premium. You will then need to purchase a new policy for your new rental address.